CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

41st Edition

ISBN: 9781337389518

Author: William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 40P

LO.3, 11 Emily has $100,000 that she wants to invest and is considering the following two options:

- Option A: Investment in Redbird Mutual Fund, which is expected to produce interest income of $8,000 per year.

- Option B: Investment in Cardinal Limited

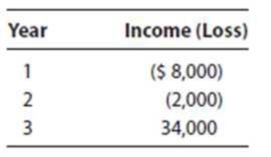

Partnership (buys, sells, and operates wine vineyards). Emily’s share of the partnership’s ordinary income and loss over the next three years would be as follows:

Emily is interested in the after-tax effects of these alternatives over a three-year horizon. Assume that Emily’s investment portfolio produces ample passive activity income to offset any passive activity losses that may be generated. Her cost of capital is 8%, and she is in the 32% tax bracket. The two investment alternatives possess equal growth potential and comparable financial risk.

- a. Based on these facts, compute the present value of these two investment alternatives and determine which option Emily should choose. Refer to Appendix H for the present value factors.

- b. Prepare your solution using spreadsheet software such as Microsoft Excel.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bramwell Industries produces joint products C and D from Material X in a single operation. 500 gallons of Material X, costing $1,200, produce 300 gallons of Product C, selling for $2.00 per gallon, and 200 gallons of Product D, selling for $4.00 per gallon. The portion of the $1,200 cost that should be allocated to Product C using the value basis of allocation is____.solve this

The net cash flows from operating activities on the statment of cash flows

Calculate the standard quantity of direct labor for one handkerchief of this general accounting question

Chapter 11 Solutions

CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

Ch. 11 - Prob. 1DQCh. 11 - List some events that increase or decrease an...Ch. 11 - Roberto invested 18,000 in a chicken production...Ch. 11 - Prob. 4DQCh. 11 - Carlos owns an interest in an activity that...Ch. 11 - Kim owns an interest in an activity that produces...Ch. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - LO.3 Bronze Corporation has 100,000 of active...Ch. 11 - LO.4 Discuss what constitutes a passive activity.

Ch. 11 - Prob. 11DQCh. 11 - LO.5 How many hours must a participant work in a...Ch. 11 - LO.5 Suzanne owns interests in a bagel shop, a...Ch. 11 - Prob. 14DQCh. 11 - Prob. 15DQCh. 11 - LO.5 Some types of work are counted in applying...Ch. 11 - LO.5 Last year Alans accountant informed him that...Ch. 11 - Prob. 18DQCh. 11 - Prob. 19DQCh. 11 - Prob. 20DQCh. 11 - What is a real estate professional? Why could...Ch. 11 - Prob. 22DQCh. 11 - LO.8 Since his college days, Charles has developed...Ch. 11 - LO.8 Brad owns a small townhouse complex that...Ch. 11 - Prob. 25DQCh. 11 - Prob. 26DQCh. 11 - LO.2 In the current year, Ed invests 30,000 in an...Ch. 11 - Prob. 28CECh. 11 - Prob. 29CECh. 11 - LO.7 Rhonda has an adjusted basis and an at-risk...Ch. 11 - Prob. 31CECh. 11 - LO.9 Rose dies with passive activity property...Ch. 11 - Prob. 33CECh. 11 - Prob. 34PCh. 11 - LO.2 In the current year, Bill Parker (54 Oak...Ch. 11 - LO.2, 11 Heather wants to invest 40,000 in a...Ch. 11 - Prob. 37PCh. 11 - Prob. 38PCh. 11 - Prob. 39PCh. 11 - LO.3, 11 Emily has 100,000 that she wants to...Ch. 11 - LO.3 Seojun acquired an activity several years...Ch. 11 - LO.3, 11 Jorge owns two passive investments,...Ch. 11 - LO.3 Sarah has investments in four passive...Ch. 11 - LO.3 Leon sells his interest in a passive activity...Ch. 11 - LO.3 Ash, Inc., a closely held personal service...Ch. 11 - Prob. 46PCh. 11 - LO.2, 3, 7, 11 Kristin Graf (123 Baskerville Mill...Ch. 11 - LO.2, 3, 7, 11 The end of the year is approaching,...Ch. 11 - Prob. 49PCh. 11 - Grace acquired an activity four years ago. The...Ch. 11 - Prob. 51PCh. 11 - Prob. 52PCh. 11 - LO.3, 8 Several years ago Benny Jackson (125 Hill...Ch. 11 - Prob. 54PCh. 11 - Prob. 55PCh. 11 - Prob. 56PCh. 11 - Prob. 57PCh. 11 - Prob. 58PCh. 11 - LO.8 Jiu has 105,000 of losses from a real estate...Ch. 11 - Prob. 60PCh. 11 - LO.9 In the current year, Abe gives an interest in...Ch. 11 - Prob. 62PCh. 11 - Prob. 63PCh. 11 - Prob. 64PCh. 11 - Carol is a successful physician who owns 100% of...Ch. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - Prob. 4RPCh. 11 - Which of the following statements regarding...Ch. 11 - Michael owns a rental house that generated a...Ch. 11 - Prob. 3CPACh. 11 - Prob. 4CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License