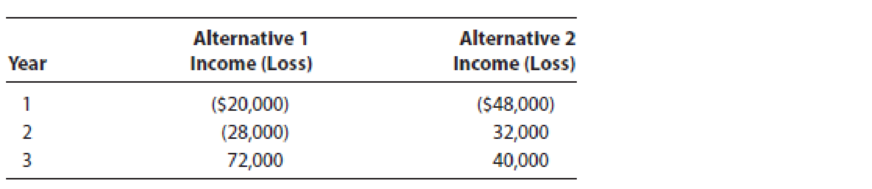

LO.2, 11 Heather wants to invest $40,000 in a relatively safe venture and has discovered two alternatives that would produce the following reportable ordinary income and loss over the next three years:

She is interested in the after-tax effects of these alternatives over a three-year horizon. Assume that Heather’s investment portfolio produces sufficient passive activity income to offset any potential passive activity loss that may arise from these alternatives, that her cost of capital is 6%, that she is in the 24% tax bracket, that each investment alternative possesses equal growth potential, and that each alternative exposes her to comparable financial risk. In addition, assume that in the loss years for each alternative, there is no cash flow from or to the investment (i.e., the loss is due to

- a. Based on these facts, compute the present value of these two investment alternatives and determine which option Heather should choose. Refer to Appendix H for the present value factors.

- b. Prepare your solution using spreadsheet software such as Microsoft Excel.

Trending nowThis is a popular solution!

Chapter 11 Solutions

South-western Federal Taxation 2018: Individual Income Taxes

- A company sold office furniture costing $12,700 with accumulated depreciation of $10,150 for $2,200 cash. The entry to record the sale would include a gain or loss of what amount?arrow_forwardLattimer enterprises reported the following information for the year please answer the general accounting questionarrow_forwardWhat will be the ending retained earning balance?arrow_forward

- What would be the effect on income from operations?arrow_forwardHello tutor answer these general accounting questionarrow_forwardAlam Store recorded the following: cash sales $52,000, credit sales $78,000, sales return $6,000, sales allowances $4,300, and early payment discount taken by customers $3,600. Calculate the net sales.arrow_forward

- What is the production cost per unit?arrow_forwardAegis Corp. has assets of $215,630 and liabilities of $97,425. Then the firm receives $30,215 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?helparrow_forwardCalculate the inventory turnover ratio of this financial accounting questionarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning