Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

7th Edition

ISBN: 9781337384285

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 31E

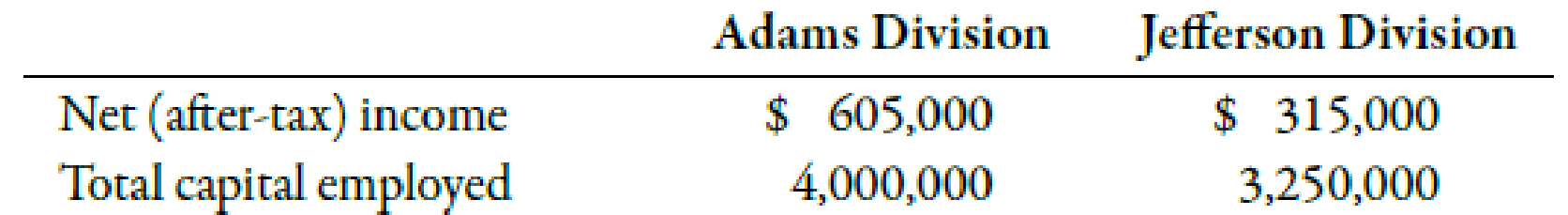

Use the following information for Exercises 11-31 and 11-32:

Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year’s results:

Washington’s actual cost of capital was 12%.

Exercise 11-31 Economic Value Added

Refer to the information for Washington Company above.

Required:

- 1. Calculate the EVA for the Adams Division.

- 2. Calculate the EVA for the Jefferson Division.

- 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth?

- 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washington’s management team could take to increase Jefferson Division’s EVA?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (Pre-2020 Form W-4)

Refer toPublication 15-T.

Need help with this accounting questions

I want to correct answer general accounting question

Chapter 11 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

Ch. 11 - Discuss the differences between centralized and...Ch. 11 - Prob. 2DQCh. 11 - Explain why firms choose to decentralize.Ch. 11 - What are margin and turnover? Explain how these...Ch. 11 - What are the three benefits of ROI? Explain how...Ch. 11 - What is residual income? What is EVA? How does EVA...Ch. 11 - Can residual income or EVA ever be negative? What...Ch. 11 - What is transfer price?Ch. 11 - Prob. 9DQCh. 11 - (Appendix 11A) What is the Balanced Scorecard?

Ch. 11 - (Appendix 11A) Describe the four perspectives of...Ch. 11 - The practice of delegating authority to...Ch. 11 - Which of the following is not a reason for...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - The key difference between residual income and EVA...Ch. 11 - It ROI for a division is 15% and the company's...Ch. 11 - Prob. 9MCQCh. 11 - Prob. 10MCQCh. 11 - (Appendix 11A) Which of the following is a...Ch. 11 - (Appendix 11A) The length of time it takes to...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 16BEACh. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 21BEBCh. 11 - Calculating Transfer Price Teslum Inc. has a...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Types of Responsibility Centers Consider each of...Ch. 11 - Margin, Turnover, Return on Investment Pelak...Ch. 11 - Margin, Turnover, Return on Investment, Average...Ch. 11 - Return on Investment, Margin, Turnover Data follow...Ch. 11 - Residual Income The Avila Division of Maldonado...Ch. 11 - Economic Value Added Falconer Company had net...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Prob. 33ECh. 11 - Use the following information for Exercises 11-33...Ch. 11 - Prob. 35ECh. 11 - (Appendix 11A) Cycle Time and Velocity Prakesh...Ch. 11 - (Appendix 11A) Cycle Time and Velocity Lasker...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - Return on Investment and Investment Decisions...Ch. 11 - Return on Investment, Margin, Turnover Ready...Ch. 11 - Return on Investment for Multiple Investments,...Ch. 11 - Return on Investment and Economic Value Added...Ch. 11 - Transfer Pricing GreenWorld Inc. is a nursery...Ch. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - (Appendix 11A) Cycle Time, Velocity, Conversion...Ch. 11 - (Appendix 11A) Balanced Scorecard The following...Ch. 11 - (Appendix 11A) Cycle Time and Velocity,...Ch. 11 - Prob. 50C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License