a.1

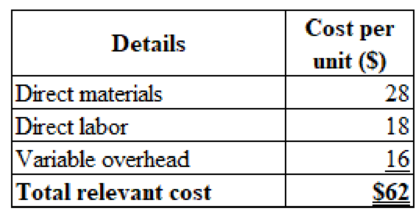

Calculate the relevant cost per unit to make the product internally.

a.1

Explanation of Solution

Calculate the relevant cost per unit to make the product internally:

Figure (1)

Therefore, the relevant cost per unit is $62.

a.2

Calculate the estimated increase or decrease in short-term operating profit of producing the product versus purchasing the product from a supplier.

a.2

Explanation of Solution

Calculate the estimated increase or decrease in short-term operating profit of producing the product versus purchasing the product from a supplier:

Therefore, decrease in short-term operating profit is $(4,000).

a.3

State the strategy considerations for make-vs.-buy decision.

a.3

Explanation of Solution

State the strategy considerations for make-vs.-buy decision:

- How does the quality of item contrast and the quality of the item delivered internally?

- Dependability (i.e., on-time conveyance implementation)?

- Financial condition of the supplier? (Will the supplier continue to do business?)

- Are there alternative (i.e., better) uses of available capacity?

- Will outsourcing permit "data spillage" with respect to the item (a negative if in the end in the possession of your rivals)?

- Will outsourcing cause an expansion in joblessness, with specialist cost (Increase payroll taxes, negative

goodwill , and so on.).

b.

Explain the action taken by the company if assets are disposed (include financial and strategic considerations).

b.

Explanation of Solution

Explain the action taken by the company if assets are disposed (include financial and strategic considerations):

Calculate the difference of assets:

| Particulars | Re-machine |

| Incremental revenues from further processing: | |

| Estimated sales value of re-machined parts | $30,000 |

| Less: Current disposal value of parts | 2,500 |

| Incremental revenues from re-machining | 27,500 |

| Less: Incremental costs (re-machining) | 25,000 |

| Difference in favor of re-machining the parts | $2,500 |

Table (1)

The Difference (in favor of re-machining the parts) is $2,500

Strategic Considerations are given below:

- Better use of the capacity devoted to this task?

- Will consumer’s care that re-machined parts make their way into the market?

- Quality of re-machined parts (in the minds of the consumer)?

c.

Explain the action taken by the company if assets are replaced (include financial and strategic considerations).

c.

Explanation of Solution

Explain the action taken by the company if assets are replaced (include financial and strategic considerations):

Calculate the difference of assets:

| Particulars | Re-machine |

| Cost to buy a replacement boat | 92,000 |

| Total cost of buildings: | |

| Out-of-pocket cost | 75,000 |

| Add: Opportunity cost | 9,000 |

| Difference in favor of re-building | $8,000 |

Table (2)

The Difference (in favor of re-building) is $8,000

Strategic Considerations are given below:

- Personal preference for new vs. rebuilt asset?

- Safety/reliability of rebuilt boat vs. new boat

- Disposal values of each option, at the end of useful life?

- Income tax consequences (e.g., casualty loss deduction), if any?

d.1.

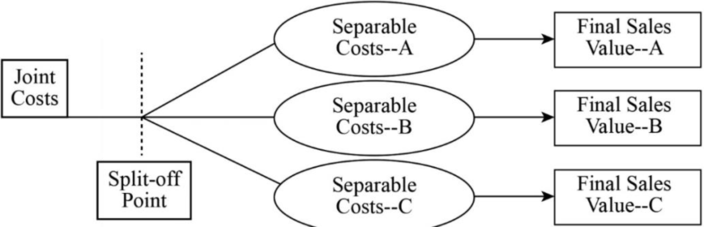

Define the term of joint production process, joint production costs, separable processing costs and split-off point.

d.1.

Explanation of Solution

Define the term of joint production process, joint production costs, separable processing costs and split-off point:

- Joint production process: It is process in which more than one output appears from a common resource input. For example: barrel of crude oil

- Joint costs: In a joint production process, these are the cost which is incurred before the split-off point; which means these costs are joint or common to the outputs. Since these costs are non-traceable, and it must be allocated to outputs.

- Separable

processing costs: In a joint production process these are the cost which is incurred after the split-off point and these costs are traceable to individual products and incremental to the decision to process products beyond the split-off point. - Split-off point: In a joint production process where products with individual identities arise; cost incurred prior to the split-off point are called as joint costs, whereas those cost are incurred after the split-off point are called as separable processing costs.

The situation for D Corporation is illustrated in the diagram as follows:

Figure (2)

d.2.

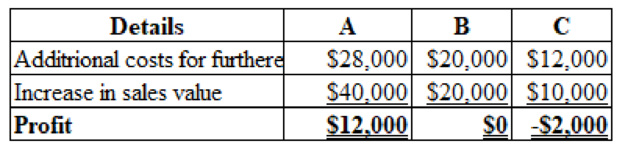

Explain the impact on short-term operating income of processing each of the three products (A, B, and C) beyond the split-off point.

d.2.

Explanation of Solution

Explain the impact on short-term operating income of processing each of the three products (A, B, and C) beyond the split-off point:

Figure (3)

Working notes:

Calculate the increase in sale value for A:

Calculate the increase in sale value for B:

Calculate the increase in sale value for C:

There would be a positive benefit for further processing of A ($12,000) and a loss from further processing of C ($2,000).

d.3.

Explain the reason for why accountant allocate joint/common costs to individual products in a joint manufacturing process.

d.3.

Explanation of Solution

Explain the reason for why accountant allocate joint/common costs to individual products in a joint manufacturing process:

Accountants need to value inventory on a "full cost" basis because of financial reporting and tax purposes.

Therefore, in the preparation of income-statement purposes and for preparing the end-of-period

There are alternative ways to allocate joint production costs to outputs. Irrespective of how these costs are controlled for financial reporting and tax purposes, they are irrelevant to the sell-or-process-further decision.

e.1

Identify the more attractive alternative to E Company and determine the amount.

e.1

Explanation of Solution

Identify the more attractive alternative to E Company and determine the amount:

Therefore, the relevant cost per unit is $87 which is less than the cost to buy $90 ($3.00 per unit is saved to make a product).

e.2

Indicate the strategic factor bear upon the ultimate decision.

e.2

Explanation of Solution

Following are the strategic factor might be relevant to the decision:

- Are alternative better uses for the available capacity?

- Quality of the supplier's product: how does it compare to the quality of internal production?

- Reliability-on-time delivery performance of the supplier?

- Future price trends: is the supplier’s price likely to be lower (or greater) in the long run?

- Will outsourcing the product allows information about the design of the product to leak out to competitors?

- Employment-related considerations: if we outsource, what happens to our labor force and costs such as

unemployment insurance, goodwill, etc.?

f.1

State the meaning and importance of “Flash or Clash are processed through the same production department.

f.1

Explanation of Solution

The term "Flash and Clash are processed through the same production departments" can be taken to mean the fixed

f.2

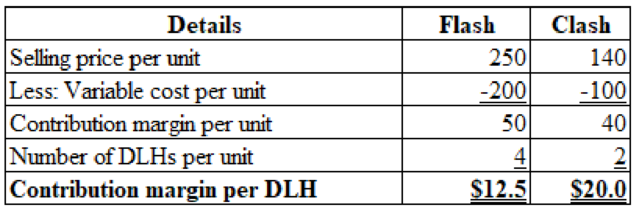

Identify which two products are produced and explain.

f.2

Explanation of Solution

Selection of the more profitable product:

Figure (4)

Working notes:

Calculate the variable cost per unit for Flash:

Calculate the variable cost per unit for Clash:

From the above table it is clear that Flash has the higher contribution margin per unit, and Clash has the higher contribution per direct labor hour (DLH). Thus, Flash would be the more profitable product without a labor constraint, while Clash is the more profitable product with the labor constraint.

g.1

Calculate the incremental profit or loss per bus-tour meal and explain whether the bus tour offer is accepted by B or not.

g.1

Explanation of Solution

Calculate the incremental profit or loss per bus-tour meal and explain whether the bus tour offer is accepted by B or not:

Therefore, the incremental profit or loss per bus-tour meal is $1.50.

Hence, the offer given by tour operators is a good one for B. If there is space for the additional meals, and since daily fixed costs are unaffected by the additional patrons, any price above $2.00 should be acceptable.

g.2

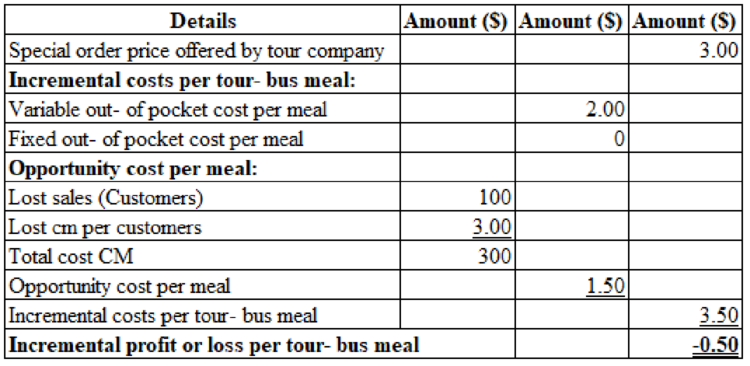

Calculate the incremental profit or loss for each meal if Tour Company guarantees 200 patrons at least once a month for $3.00 per meal.

g.2

Explanation of Solution

Calculate the incremental profit or loss for each meal if Tour Company guarantees 200 patrons at least once a month for $3.00 per meal:

Figure (5)

Therefore, the current four-busload offer would not be attractive from a short-term financial perspective.

Want to see more full solutions like this?

Chapter 11 Solutions

Cost Management: A Strategic Emphasis

- I need assistance with this general accounting question using appropriate principles.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Try to give coarrow_forwardThe stockholders' equity accounts of Grouper Corp. on January 1, 2025, were as follows. Preferred Stock (7%, $100 par noncumulative, 8,500 shares authorized) $510,000 Common Stock ($4 stated value, 510,000 shares authorized) 1,700,000 Paid-in Capital in Excess of Par-Preferred Stock 25,500 Paid-in Capital in Excess of Stated Value-Common Stock 816,000 Retained Earnings 1,169,600 Treasury Stock (8,500 common shares) 68,000 During 2025, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 8,500 shares of common stock for $51,000. Mar. 20 Purchased 1,700 additional shares of common treasury stock at $7 per share. Oct. 1 Nov. 1 Dec. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Paid the dividend declared on October 1. Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2 Dec. 31 Determined that net income for the year was $477,000. Paid the dividend…arrow_forwardFinancial accounting questionarrow_forward

- General accountingarrow_forwardThe stockholders' equity accounts of Grouper Corp. on January 1, 2025, were as follows. Preferred Stock (7%, $100 par noncumulative, 8,500 shares authorized) $510,000 Common Stock ($4 stated value, 510,000 shares authorized) 1,700,000 Paid-in Capital in Excess of Par-Preferred Stock 25,500 Paid-in Capital in Excess of Stated Value-Common Stock 816,000 Retained Earnings 1,169,600 Treasury Stock (8,500 common shares) 68,000 During 2025, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 8,500 shares of common stock for $51,000. Mar. 20 Purchased 1,700 additional shares of common treasury stock at $7 per share. Oct. 1 Nov. 1 Dec. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Paid the dividend declared on October 1. Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2 Dec. 31 Determined that net income for the year was $477,000. Paid the dividend…arrow_forwardI am trying to find correct solarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education