Concept explainers

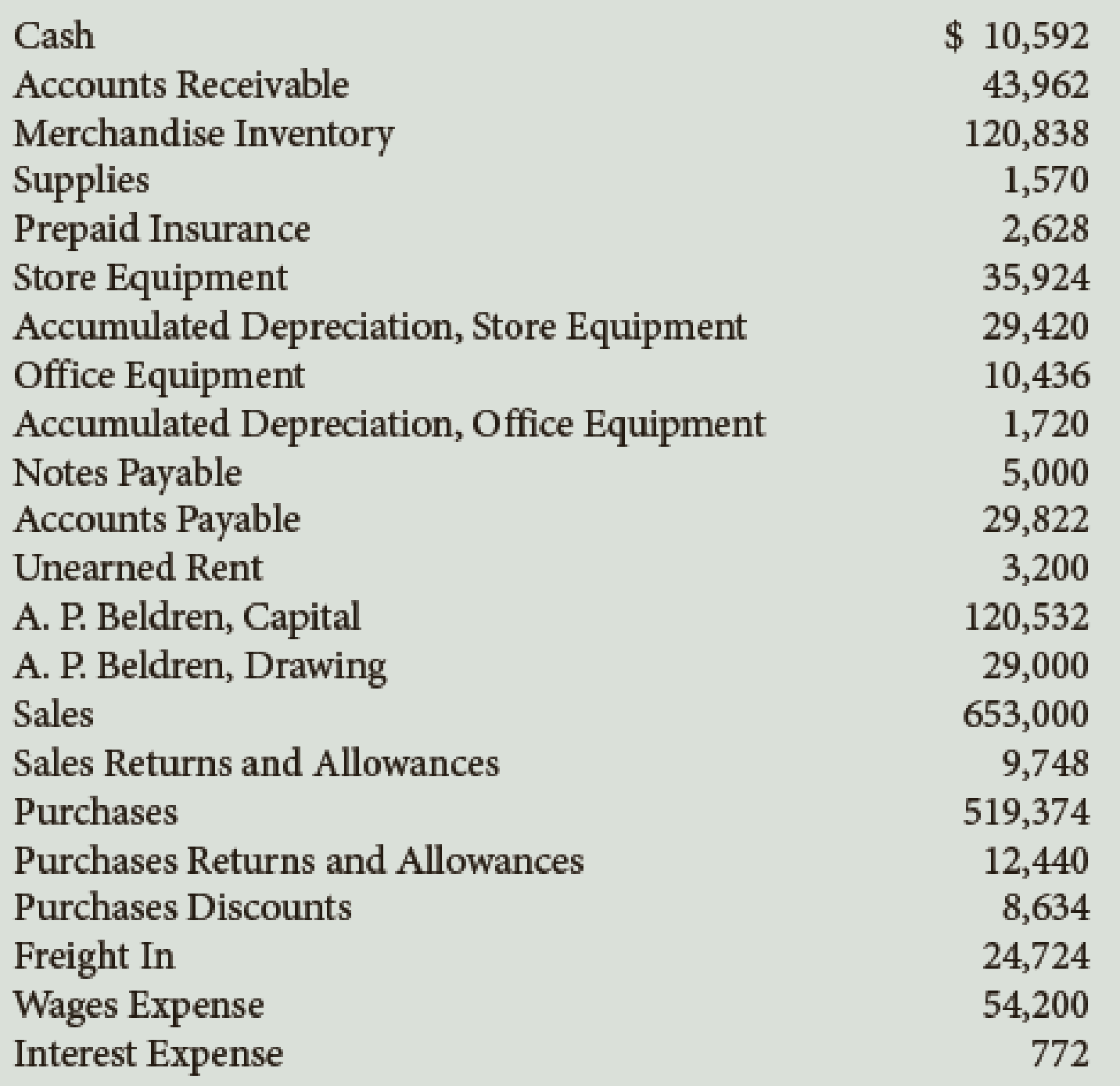

The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal year, are as follows:

Data for the adjustments are as follows:

a–b. Merchandise Inventory at December 31, $102,765.

c. Wages accrued at December 31, $1,834.

d. Supplies inventory (on hand) at December 31, $645.

e.

f. Depreciation of office equipment, $1,791.

g. Insurance expired during the year, $845.

h. Rent earned, $2,500.

Required

- 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL.

- 2. Journalize the

adjusting entries . If using manual working papers, record adjusting entries on journal page 16.

Trending nowThis is a popular solution!

Chapter 11 Solutions

COLLEGE ACCOUNTING

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Intermediate Accounting (2nd Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

- The labor quantity variance was?arrow_forwardNikka Tech Solutions reported sales revenue of $75,600 on its income statement. The accounts receivable balance decreased by $3,400 over the year. Determine the amount of cash received from customers.arrow_forwardNeed help with this financial accounting question please answerarrow_forward

- Hoy much lower would KLM s net incomearrow_forwardA local credit union negotiates the purchase of a one-year interest rate cap with a cap rate of 4.75 percent with a national bank. The option has a notional principal of 1.5million and costs 2,800. In one year, interest rates are 5.65 percent. The local credit union's net profit, ignoring commissions and taxes, was_.arrow_forwardNeed answerarrow_forward

- GG Incorporated uses LIFO. GG disclosed that if FIFO had been used, inventory at the end of 2024 would have been $16 million higher than the difference between LIFO and FIFO at the end of 2023. Assuming GG has a 25% income tax rate:arrow_forward4 POINTSarrow_forwardIgnoring commission and taxes wasarrow_forward

- Financial Accountingarrow_forwardLigher Enterprises purchased machinery on January 1, 2015. The annual depreciation expense for the machinery was $6,000. The book value of the machinery at the end of 2017 was $72,000. What is the original cost of the machinery?arrow_forwardcorrect answer pleasearrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning