Concept explainers

a)

The computation of magnitude of operating leverage utilising contribution margin approach of each firm.

a)

Answer to Problem 27P

the operating leverage of L Company and B Company are 1.5 times and 3 times.

Explanation of Solution

Given information:

The formula to calculate the magnitudes of operating leverage are as follows:

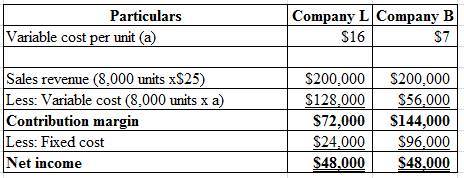

Calculate the magnitude of operating leverage of L Company and B Company:

Hence, the operating leverage of L Company and B Company are 1.5 times and 3 times.

b)

Determine the change in net income in amount and change in percentage of net income

b)

Explanation of Solution

Given information:

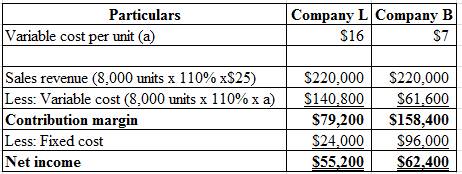

The sales increased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to calculate the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is 15% and 30%

c)

Determine the change in net income in amount and change in percentage of net income.

c)

Explanation of Solution

Given information:

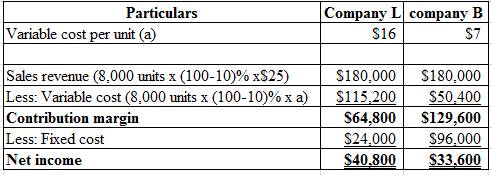

The sales decreased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to compute the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is −15% and −30%

d)

Write a memo regarding the analyses and advice by Person JD.

d)

Explanation of Solution

To,

Person A

From,

Person JD

Subject:

Analysis and recommendation regarding the investment

Date: 11/29/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person JD the operating leverage is 1.5 for Company L and 3 for Company B.

The analytical data indicates that income of Company B is more volatile than Company L.

Investment in Company B will be the better choice in a economy boom situation. Otherwise, Company L is considering better. An aggressive investor can choice Company B and a conservative investor can go for Company L.

Want to see more full solutions like this?

Chapter 11 Solutions

Survey Of Accounting

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardQuestion 9 of 12 View Policies Current Attempt in Progress Crane Manufacturing Company uses a job order cost system and keeps perpetual inventory records. June 1 Purchased raw materials for $16,400 on account. 8 Raw materials requisitioned by production: $6,560 Direct materials Indirect materials 820 Paid factory utilities, $1,722 and repairs for factory equipment, $6,560. 15 25 Incurred $108,000 of factory labor. 25 Time tickets indicated the following: Direct Labor (7,000 hrs x $12 per hr) $84,000 Indirect Labor (3,000 hrs x $8 per hr) 24,000 $108,000 - / 12.5 III 25 28 80 00 Applied manufacturing overhead to production based on a predetermined overhead rate of $7 per direct labor hour worked. Goods costing $18,200 were completed in the factory and were transferred to finished goods inventory. 30 Goods costing $15,200 were sold for $20,200 on account.arrow_forwardCould you explain the steps for solving this financial accounting question accurately?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardTotal ending inventory balance?arrow_forwardNovaTek Electronics reported net sales of $3,120,000 for the year, and cost of goods sold was $2,340,000 for its current product line. A new device is underdevelopment and must be priced below $89 per unit to stay competitive in the market. Calculate the gross profit and the gross profit ratio for the year.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning