Concept explainers

1)a.

Whether the cost of instruction is fixed or variable cost

1)a.

Explanation of Solution

The cost of instruction is fixed cost as the total cost remains constant irrespectively of number of students attends the courses

b.

Determine the profit

b.

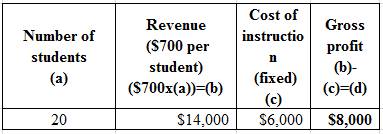

Explanation of Solution

Given information:

Number of students are 20. The salary of instructor is $6,000 per course taught. The F services offer course of instruction $700 per student to the employees of N incorporation

c.

Determine the profit with 10% of increase in enrolment and percentage of profitability.

c.

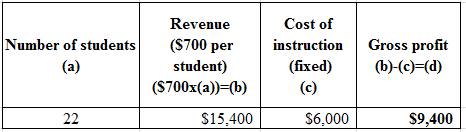

Explanation of Solution

Given information:

Number of students are 22. The salary of instructor is $6,000 per course taught. The F services offer course of instruction $700 per student to the employees of N incorporation

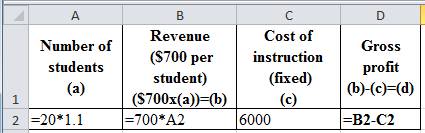

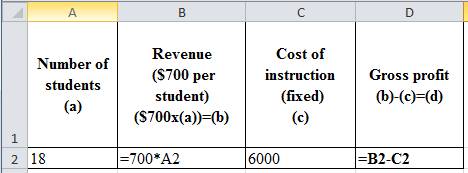

Excel spreadsheet:

Excel workings:

Percentage change in profits:

Hence, the percentage change in profitability is 17.5%.

Percentage change in revenue:

Hence, the percentage change in profitability is 10%.

d.

Determine the profit with 10% of decrease in enrolment and percentage of profitability.

d.

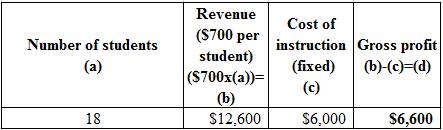

Explanation of Solution

Given information:

Number of students are 18. The salary of instructor is $6,000 per course taught. The F services offer course of instruction at $700 per student to the employees of N incorporation

Excel spreadsheet:

Excel workings:

Percentage change in revenue and profitability:

Hence, the percentage change in profitability is 17.5%.

Hence, the percentage change in profitability is 10%.

e.

The reason for 10% shift in enrollment produces more than 10% shift in profitability and the term identifies this phenomenon.

e.

Explanation of Solution

The term which identifies these phenomena is operating leverage. This causes the percentage change in profitability to higher than the percentage change in revenue.

This is because that the fixed cost remains same and covered and there is no variable cost. So each additional dollar of revenue pays directly to the profitability.

2)f.

Whether the cost of instruction is fixed or variable cost

2)f.

Explanation of Solution

Given information:

The instructor needs $300 per person attending the class. The F services offer course of instruction at $700 per student to the employees of N incorporation

The cost of instruction is variable cost as the total cost varies respectively of number of students attends the courses

g.

Determine the profit

g.

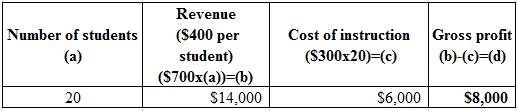

Explanation of Solution

Given information:

Number of students are 20. The instructor needs $300 per person attending the class. The F services offer course of instruction at $700 per student to the employees of N incorporation

h.

Determine the profit with 10% of increase in enrolment and percentage of profitability.

h.

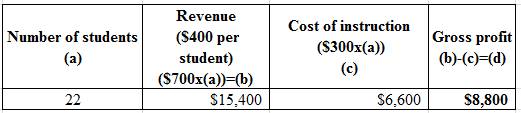

Explanation of Solution

Given information:

Number of students are 22. The instructor needs $300 per person attending the class. The F services offer course of instruction at $700 per student to the employees of N incorporation

Excel spreadsheet:

Percentage change in revenue and profitability:

Hence, the percentage change in profitability is 10%.

Hence, the percentage change in revenue is 10%.

i.

Determine the profit with 10% of decrease in enrolment and percentage of profitability.

i.

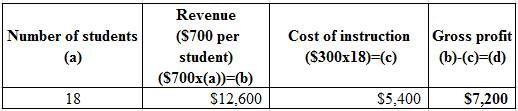

Explanation of Solution

Given information:

Number of students are 18. The instructor needs $300 per person attending the class. The F services offer course of instruction at $700 per student to the employees of N incorporation

Excel spreadsheet:

Percentage change in revenue and profit:

Hence, the percentage change in profitability is 10%.

Hence, the percentage change in revenue is 10%.

j.

The reason for 10% shift in enrollment produces relative 10% shift in profitability.

j.

Explanation of Solution

The change in profit is relative to change in revenue because the revenue as well as cost changes relatively to the change in number of students attending the course.

3)k.

The total cost and the cost per student

3)k.

Explanation of Solution

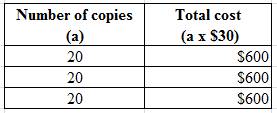

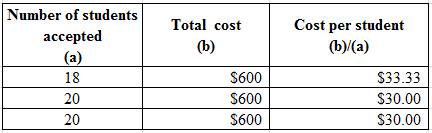

Given information:

The cost of the work book is $30 and selling price is $50. The numbers of students are 18, 20, or 22. The company printed 20 copies of books.

The formula to calculate the cost per students:

Compute the total cost:

Compute the cost per student:

l.

Whether the cost of work book is fixed or variable cost

l.

Explanation of Solution

The cost of work book is fixed cost as the cost incurred is before the sale of work book. Therefore, sales of number of work book will not affect the total cost.

Thus, it is fixed cost.

m.

The risk of holding inventory as it applies to workbooks

m.

Explanation of Solution

The risk faced by the company is that it produces very few or too many books. If the company produces too many books then the expenses will more due to wastage.

When the company produces less numbers then the will not get the opportunity to earn any additional profits.

It will also incur costs like maintenances, interest and storage.

n.

Whether just in time can reduce the cost and risk of holding inventory

n.

Explanation of Solution

JIT-Just in time produces only when there is any demand of goods. There will not be any risk on over or under production.

There will not be any stock piling of inventory as it will avoid the cost of storage, interest and maintenance

Want to see more full solutions like this?

Chapter 11 Solutions

Survey Of Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,