Concept explainers

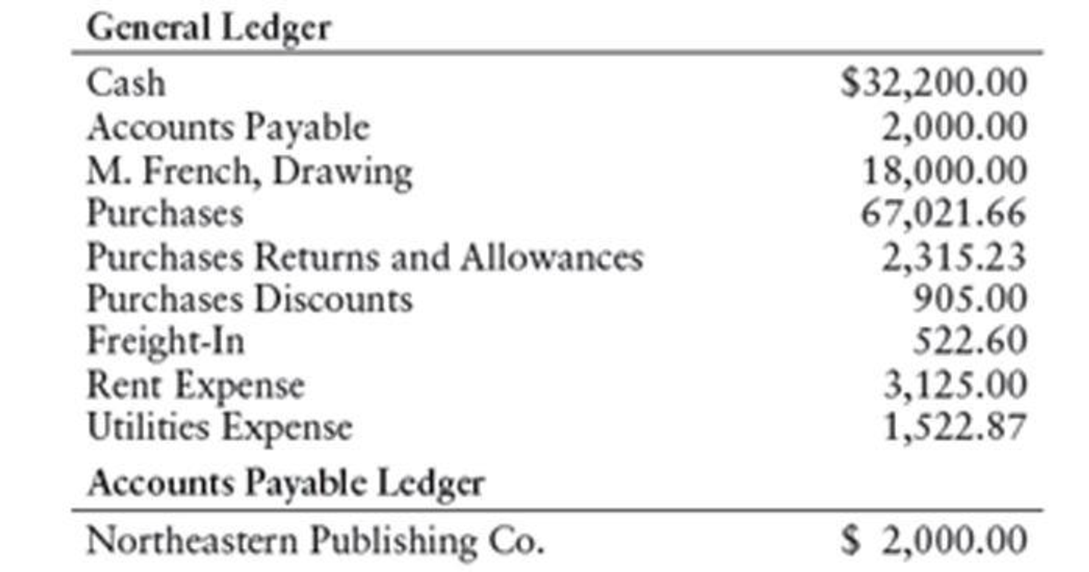

Michelle French owns and operates Books and More, a retail book store. Selected account balances on June 1 are as follows:

The following purchases and cash payments transactions took place during the month of June:

June 1 Purchased books on account from Irving Publishing Company, $2,100. Invoice No. 101, terms 2/10, n/30, FOB destination.

2 Issued Cheek No. 300 to Northeastern Publishing Co. for goods purchased on May 23, terms 2/10, n/30, $1,960 (the $2,000 invoice amount less the 2% discount).

3 Purchased books on account from Broadway Publishing, Inc., $2,880. Invoice No. 711, less a 20% trade discount, and invoice terms of 3/10, n/30, FOB shipping point.

3 Issued Cheek No. 301 to Mayday Shipping for delivery from Broadway Publishing, Inc., $250.

4 Issued Cheek No. 302 for June rent, $625.

8 Purchased books on account from Northeastern Publishing Co., $5,825. Invoice No. 268, terms 2/com, n/60, FOB destination.

10 Received a credit memo from Irving Publishing Company, $550. Books had been returned because the covers were on upside down.

13 Issued Check No. 304 to Broadway Publishing, Inc., for the purchase made on June 3. (Check No. 303 was voided because an error was made in preparing it.)

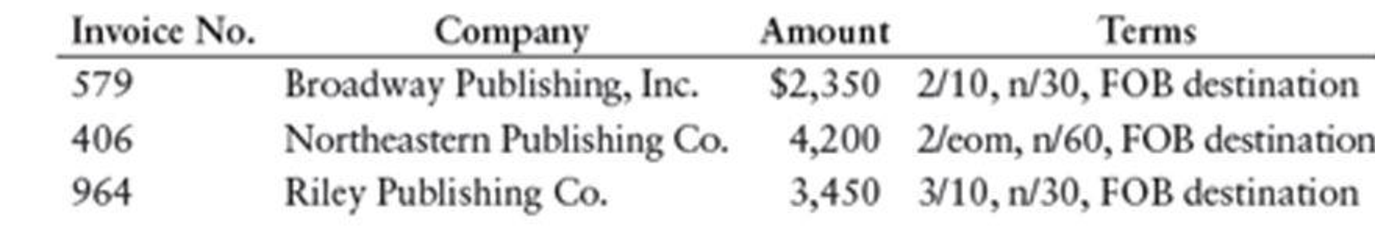

28 Made the following purchases:

30 Issued Cheek No. 305 to Taylor County Utility Co. for June utilities, $325.

30 French withdrew cash for personal use, $4,500. Issued Check No. 306.

30 Issued Cheek No. 307 to Irving Publishing Company for purchase made on June 1 less returns made on June 10.

30 Issued Check No. 308 to Northeastern Publishing Co. for purchase made on June 8.

30 Issued Check No. 309 for books purchased at an auction, $1,328.

REQUIRED

- 1. Enter the transactions in a general journal (start with page 16).

- 2. Post from the journal to the general ledger accounts and the accounts payable ledger. Use general ledger account numbers as indicated in the chapter.

- 3. Prepare a schedule of accounts payable.

- 4. If merchandise inventory was $35,523 on January 1 and $42,100 as of June 30, prepare the cost of goods sold section of the income statement for the six months ended June 30,20--.

1.

Journalize the purchases and cash payment transactions for the month of June.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- ■ Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- ■ Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the purchases and cash payment transactions for the month of June.

Transaction on June 1:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 1 | Purchases | 501 | 2,100 | ||

| Accounts Payable, Company IP | 202/✓ | 2,100 | ||||

| (Record purchases made on account) | ||||||

Table (1)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Company IP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on June 2:

| Page: 16 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 2 | Accounts Payable, Corporation NP | 202/✓ | 2,000 | ||

| Cash | 101 | 1,960 | ||||

| Purchases Discounts | 501.2 | 40 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (2)

Description:

- ■ Accounts Payable, Corporation NP is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- ■ Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 1:

Compute purchases discount value.

Working Note 2:

Compute amount of cash paid (Refer to Working Note 2 for purchase discount value).

Transaction on June 3:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 3 | Purchases | 501 | 2,304 | ||

| Accounts Payable, Incorporation BP | 202/✓ | 2,304 | ||||

| (Record purchases made on account) | ||||||

Table (3)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Incorporation BP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 3:

Compute the purchase invoice value.

Transaction on June 3:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 3 | Freight-In | 502 | 250 | ||

| Cash | 101 | 250 | ||||

| (Record payment of freight charges) | ||||||

Table (4)

Description:

- ■ Freight-In is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on June 4:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 4 | Rent Expense | 521 | 625 | ||

| Cash | 101 | 625 | ||||

| (Record payment of rent expense) | ||||||

Table (5)

Description:

- ■ Rent Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on June 8:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 8 | Purchases | 501 | 5,825 | ||

| Accounts Payable, Corporation NP | 202/✓ | 5,825 | ||||

| (Record purchases made on account) | ||||||

Table (6)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Corporation NP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on June 10:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 10 | Accounts Payable, Company IP | 202/✓ | 550 | ||

| Purchases Returns and Allowances | 501.1 | 550 | ||||

| (Record merchandise returned) | ||||||

Table (7)

Description:

- ■ Accounts Payable, Company IP is a liability account. Since inventory is returned, amount to be paid has decreased, liability account is decreased, and a decrease in liability is debited.

- ■ Purchases Returns and Allowances is a contra-cost account, and contra-cost accounts increase the equity value, and an increase in equity is credited.

Transaction on June 13:

| Page: 16 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 13 | Accounts Payable, Incorporation BP | 202/✓ | 2,304.00 | ||

| Cash | 101 | 2,234.88 | ||||

| Purchases Discounts | 501.2 | 69.12 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (8)

Description:

- ■ Accounts Payable, Incorporation BP is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- ■ Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 4:

Compute purchases discount value (Refer to Working Note 3 for value of purchases).

Working Note 5:

Compute amount of cash paid (Refer to Working Note 4 for purchase discount value).

Transaction on June 28:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 28 | Purchases | 501 | 2,350 | ||

| Accounts Payable, Incorporation BP | 202/✓ | 2,350 | ||||

| (Record purchases made on account) | ||||||

Table (9)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Incorporation BP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on June 28:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 28 | Purchases | 501 | 4,200 | ||

| Accounts Payable, Corporation NP | 202/✓ | 4,200 | ||||

| (Record purchases made on account) | ||||||

Table (10)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Corporation NP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on June 28:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 28 | Purchases | 501 | 3,450 | ||

| Accounts Payable, Corporation RP | 202/✓ | 3,450 | ||||

| (Record purchases made on account) | ||||||

Table (11)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Accounts Payable, Corporation RP is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on June 30:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Utilities Expense | 533 | 325 | ||

| Cash | 101 | 325 | ||||

| (Record payment of utilities expense) | ||||||

Table (12)

Description:

- ■ Utilities Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on June 30:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | F, Drawing | 533 | 4,500 | ||

| Cash | 101 | 4,500 | ||||

| (Record withdrawal for personal use) | ||||||

Table (13)

Description:

- ■ F, Drawings is a contra-capital account. Contra-capital accounts have a normal debit balance, hence the account is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on June 30:

| Page: 16 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Accounts Payable, Company IP | 202/✓ | 1,550 | ||

| Cash | 101 | 1,550 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (14)

Description:

- ■ Accounts Payable, Company IP is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Note 6:

Compute amount of cash paid.

Transaction on June 30:

| Page: 16 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Accounts Payable, Corporation NP | 202/✓ | 5,825.00 | ||

| Cash | 101 | 5,708.50 | ||||

| Purchases Discounts | 501.2 | 116.50 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (15)

Description:

- ■ Accounts Payable, Corporation NP is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- ■ Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 7:

Compute purchases discount value.

Working Note 8:

Compute amount of cash paid (Refer to Working Note 7 for purchase discount value).

Transaction on June 30:

| Page: 16 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Purchases | 501 | 1,328 | ||

| Cash | 101 | 1,328 | ||||

| (Record purchase of inventory) | ||||||

Table (16)

Description:

- ■ Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

2.

Post the given transactions into the accounts of the general ledger, and the suppliers account in accounts payable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the given transactions into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 32,200.00 | |||

| 2 | J16 | 1,960.00 | 30,240.00 | ||||

| 3 | J16 | 250.00 | 29,990.00 | ||||

| 4 | J16 | 625.00 | 29,365.00 | ||||

| 13 | J16 | 2,234.88 | 27,130.12 | ||||

| 30 | J16 | 325.00 | 26,805.12 | ||||

| 30 | J16 | 4,500.00 | 22,305.12 | ||||

| 30 | J16 | 1,550.00 | 20,755.12 | ||||

| 30 | J16 | 5708.50 | 15,046.62 | ||||

| 30 | J16 | 1,328.00 | 13,718.62 | ||||

Table (17)

| ACCOUNT Accounts Payable ACCOUNT NO. 202 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 2,000 | |||

| 1 | J16 | 2,100 | 4,100 | ||||

| 2 | J16 | 2,000 | 2,100 | ||||

| 3 | J16 | 2,304 | 4,404 | ||||

| 8 | J16 | 5,825 | 10,229 | ||||

| 10 | J16 | 550 | 9,679 | ||||

| 13 | J16 | 2,304 | 7,375 | ||||

| 28 | J16 | 2,350 | 9,725 | ||||

| 28 | J16 | 4,200 | 13,925 | ||||

| 28 | J16 | 3,450 | 17,375 | ||||

| 30 | J16 | 1,550 | 15,825 | ||||

| 30 | J16 | 5,825 | 10,000 | ||||

Table (18)

| ACCOUNT Purchases ACCOUNT NO. 501 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 67,021.66 | |||

| 1 | J16 | 2,100.00 | 69,121.66 | ||||

| 3 | J16 | 2,304.00 | 71,425.66 | ||||

| 8 | J16 | 5,825.00 | 77,250.66 | ||||

| 28 | J16 | 2,350.00 | 79,600.66 | ||||

| 28 | J16 | 4,200.00 | 83,800.66 | ||||

| 28 | J16 | 3,450.00 | 87,250.66 | ||||

| 30 | J16 | 1,328.00 | 88,578.66 | ||||

Table (19)

| ACCOUNT Purchases Returns and Allowances ACCOUNT NO. 501.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 2,315.23 | |||

| 10 | J16 | 550.00 | 2,865.23 | ||||

Table (20)

| ACCOUNT Purchases Discounts ACCOUNT NO. 501.2 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 905.00 | |||

| 2 | J16 | 40.00 | 945.0 | ||||

| 13 | J16 | 69.12 | 1,014.12 | ||||

| 30 | J16 | 116.50 | 1,130.62 | ||||

Table (21)

| ACCOUNT Freight-In ACCOUNT NO. 502 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 522.60 | |||

| 3 | J16 | 250.00 | 772.60 | ||||

Table (22)

| ACCOUNT Rent Expense ACCOUNT NO. 521 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 3,125.00 | |||

| 4 | J16 | 625.00 | 3,750.00 | ||||

Table (23)

| ACCOUNT Utilities Expense ACCOUNT NO. 533 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 1,522.87 | |||

| J16 | 325.00 | 1,847.87 | |||||

Table (24)

| ACCOUNT F, Drawings ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | Balance | ✓ | 18,000 | |||

| J16 | 4,500 | 22,500 | |||||

Table (25)

Post the accounts payable balances of the suppliers to the supplier accounts in the accounts payable ledger.

| NAME Incorporation BP | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| June | 3 | J16 | 2,304 | 2,304 | ||

| 13 | J16 | 2,304 | 0 | |||

| 28 | J16 | 2,350 | 2,350 | |||

Table (26)

| NAME Company IP | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| June | 1 | J16 | 2,100 | 2,100 | ||

| 10 | J16 | 550 | 1,550 | |||

| 30 | J16 | 1,550 | 0 | |||

Table (27)

| NAME Corporation NP | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| June | 1 | Balance | ✓ | 2,000 | ||

| 2 | J16 | 2,000 | 0 | |||

| 8 | J16 | 5,825 | 5,825 | |||

| 28 | J16 | 4,200 | 10,025 | |||

| 30 | J16 | 5,825 | 4,200 | |||

Table (28)

| NAME Corporation RP | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| June | 28 | J16 | 3,450 | 3,450 | ||

Table (29)

3.

Prepare accounts payable schedule for Company BM as at June 30.

Explanation of Solution

Schedule of accounts payable: This is the schedule which is prepared to verify that the total balances of all the suppliers in the accounts payable ledger, equals the balance of Accounts Payable in the general ledger.

Prepare accounts payable schedule for Company BM as at June 30 (Refer to Requirement (2) for all the values and computations of the balances of the customers).

| Company BM | |

| Schedule of Accounts Payable | |

| June 30 | |

| Incorporation BP | $2,350 |

| Corporation NP | 4,200 |

| Corporation RP | 3,450 |

| Total | $10,000 |

Table (30)

Thus, the schedule of accounts payable of Company BM shows a balance of $10,000, as of June 30.

4.

Prepare the cost of goods sold section of income statement for Company BM.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Formula to compute cost of goods sold:

| Details | Amount ($) | Amount ($) | Amount ($) |

| Merchandise inventory, January 1 | $XXX | ||

| Purchases | $XXX | ||

| Less: Purchase returns and allowances | $XXX | ||

| Less: Purchases discounts | XXX | XXX | |

| Net purchases | XXX | ||

| Add: Freight-in | XXX | ||

| Cost of goods purchased | XXX | ||

| Goods available for sale | XXX | ||

| Less: Merchandise inventory, December 31 | XXX | ||

| Cost of goods sold | $XXX |

Table (31)

Prepare the cost of goods sold section of income statement for Company BM (Refer to Requirement (2) for all the values and computations of the ledger balances).

| Details | Amount ($) | Amount ($) | Amount ($) |

| Merchandise inventory, January 1 | $35,523.00 | ||

| Purchases | $88,578.66 | ||

| Less: Purchase returns and allowances | $2,865.23 | ||

| Less: Purchases discounts | 1,130.62 | 3,995.85 | |

| Net purchases | 84,582.81 | ||

| Add: Freight-in | 772.60 | ||

| Cost of goods purchased | 85,355.41 | ||

| Goods available for sale | 120,878.41 | ||

| Less: Merchandise inventory, June 30 | 42,100.00 | ||

| Cost of goods sold | $78,778.41 |

Table (32)

Thus, the cost of goods sold of income statement for Company BM is $78,778.41.

Want to see more full solutions like this?

Chapter 11 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- prepare an income statement for delray manufacturing (a manufacturer)assume that its cost of goods manufactured is $1,247,000arrow_forwardOn 10/6/2024, company A sells goods to Customer C for €20,000 with an agreed credit of two months. On 31/12/2024, in the context of investigating the collectability of its receivables, the company estimates that it will only collect €10,000 from customer C and forms a provision for doubtful debts for the remaining amount. Finally, on 30/3/2025, company A receives from customer C the amount of: a. €9,000 b. €11,000. You are requested to comment on the impact of the above collection cases a. 9000 b. 11,000 on the income statement for fiscal year 2025, justifying your position.arrow_forwardNeed helparrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,