Identifying Relevant Costs

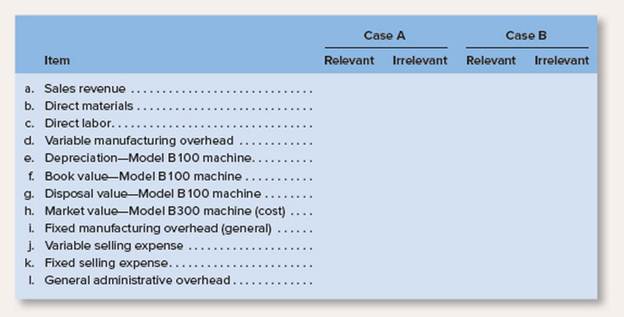

Syahn, AB, is a Swedish manufacturer of sailing yachts The company has assembled the information shown below that pertains to two independent decision-making contexts called Case A and Case B:

Case A:

The company chronically has no idle capacity and the old Model B100 machine is the company’s constraint Management is considering purchasing a Model B300 machine to use in addition to the company’s present Model B100 machine. The old Model B100 machine will continue to be used to capacity as before, with the new Model B300 machine being used to expand production. This will increase the company’s production and sales. The increase in volume will be large enough to require increases in fixed selling expenses and in general administrative

Cue B:

The old Model B100 machine is not the company’s constraint, but management is considering replacing it with a new Model B300 machine because of the potential savings in direct materials with the new machine The Model B100 machine would be sold. This change will have no effect on production or sales, other than some savings in direct materials costs due to less waste.

Required:

Copy the information below onto your answer sheet and place an x in the appropriate column to indicate whether each item is relevant or irrelevant to the decision context described in Case A and Case B.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub