Identifying Relevant Costs

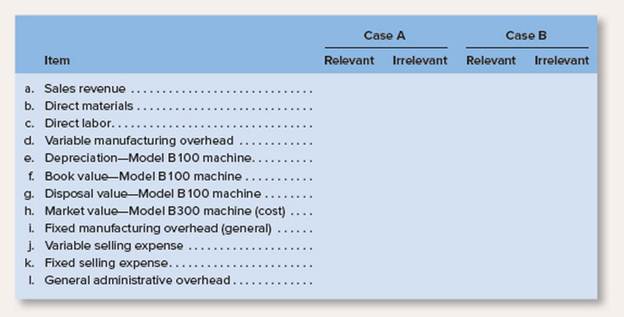

Syahn, AB, is a Swedish manufacturer of sailing yachts The company has assembled the information shown below that pertains to two independent decision-making contexts called Case A and Case B:

Case A:

The company chronically has no idle capacity and the old Model B100 machine is the company’s constraint Management is considering purchasing a Model B300 machine to use in addition to the company’s present Model B100 machine. The old Model B100 machine will continue to be used to capacity as before, with the new Model B300 machine being used to expand production. This will increase the company’s production and sales. The increase in volume will be large enough to require increases in fixed selling expenses and in general administrative

Cue B:

The old Model B100 machine is not the company’s constraint, but management is considering replacing it with a new Model B300 machine because of the potential savings in direct materials with the new machine The Model B100 machine would be sold. This change will have no effect on production or sales, other than some savings in direct materials costs due to less waste.

Required:

Copy the information below onto your answer sheet and place an x in the appropriate column to indicate whether each item is relevant or irrelevant to the decision context described in Case A and Case B.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Loose Leaf For Introduction To Managerial Accounting

- quesrion 2arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forwardQS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forward

- Question 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forwarddiscus extensivery source of bussines finances requaments not less than 4 pages font size 12 spacing 1.5 roman times references must be less thhan 5arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub