Two months (July and August) have passed since Ms. Valli has seen the financial statements for All About You Spa. It is time to begin their preparation. Several accounts need adjusting. These include the accounts you adjusted in Chapter 4 as well as any accounts involved with merchandising.

Adjusting Entry Information

Merchandise Inventory Adjustment (a)

A physical count of inventory was taken, and the inventory was valued at $11,310.

Supplies Adjustments (b) and (c)

A physical count has been taken of the two supplies accounts. The values of the remaining inventories of supplies are as follows:

Prepaid Insurance Adjustment (d)

A review of the insurance records determined that $233.34 in liability insurance coverage had been used during the last two months.

Estimated depreciation amounts for the two equipment accounts are as follows:

Wages Expense/Wages Payable Adjustment

There is no need for a Wages Expense/Wages Payable adjustment because the end of the fiscal period did not come in the middle of a pay period.

Required

- 1. Complete a work sheet (if required by your instructor). Ignore this step if using CLGL.

- 2. Journalize the adjusting entries in the general journal.

- If you are preparing the adjusting entries with Working Papers, enter your transactions beginning on page 16.

- 3. Post the adjusting entries to the general ledger accounts.

- Ignore this step if you are using CLGL.

- 4. Prepare an adjusted

trial balance as of August 31, 20--.

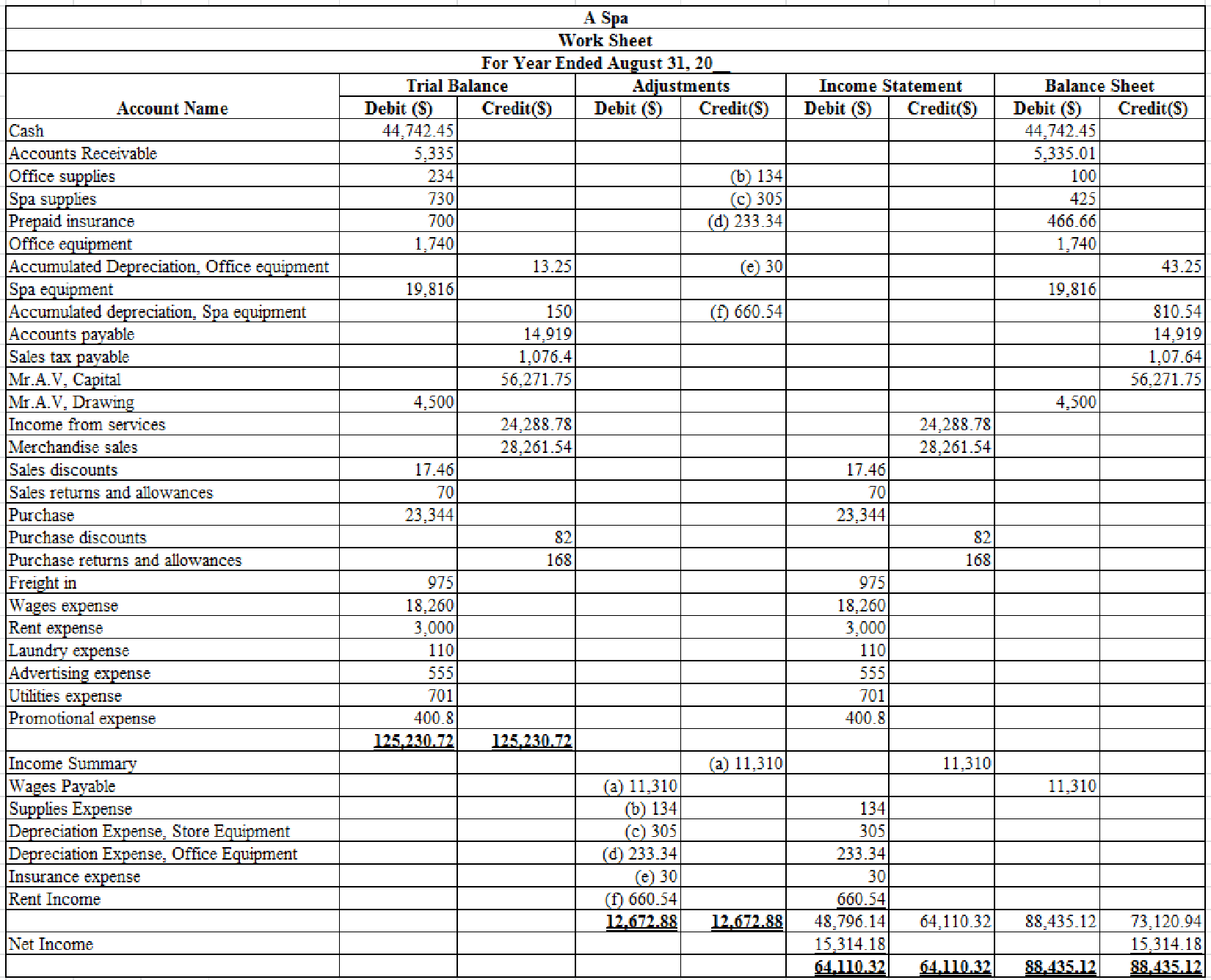

1.

Prepare worksheet for A Spa as of August.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare worksheet for A Spa.

Table (1)

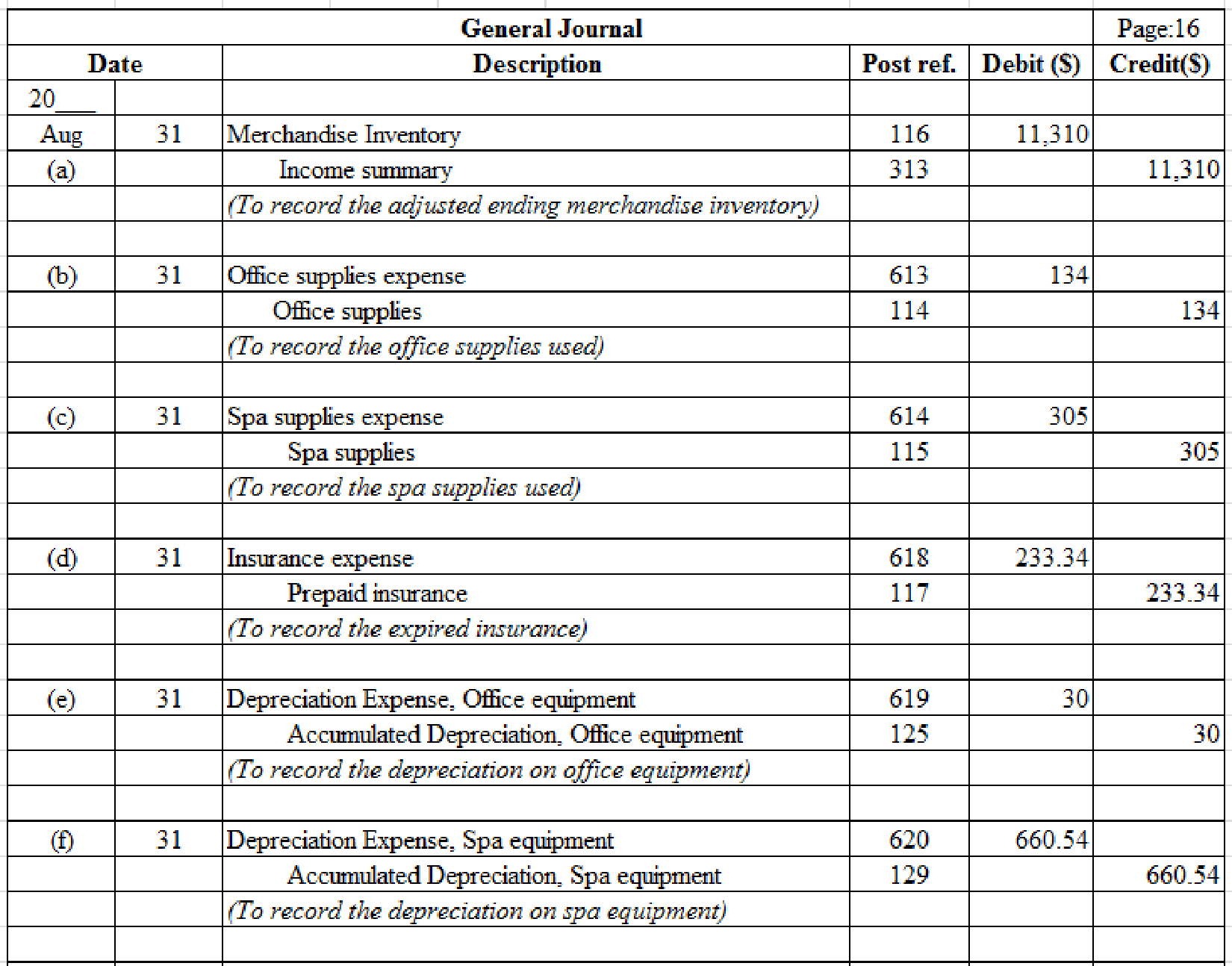

2.

Journalize the adjusting entries in the general journal

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

General journal: This is a journal used to record infrequent transactions like adjusting entries, closing entries, accounting errors, sale of assets, or bad debts expense.

Journalize the adjusting entries.

Table (2)

Description:

- a) Merchandise Inventory is an asset (current) account and it is increased. Therefore, debit the merchandise inventory. Income summary is a temporary account and it is closed. Therefore, credit the income summary.

- b) Office supplies expense is an expense account and it is increased. Therefore, debit the Office supplies expense. Office supplies are a liability account and it is increased. Therefore, credit the Office supplies.

- c) Spa supplies expense is revenue account and it is increased. Therefore, debit the Spa supplies expense. Spa supplies (on hand) are an asset (current) account and it is decreased. Therefore, credit the Spa supplies (on hand).

- d) Insurance expense is an expense (operating) account and it is increased. Therefore, debit the insurance expense. Prepaid insurance is an asset (current) account and it is decreased. Therefore, credit the prepaid insurance.

- e) Depreciation expense (on office equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on office equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

- f) Depreciation expense (on spa equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on spa equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

3.

Post the adjusting entries in general ledger.

Explanation of Solution

Posting of transaction: The process of transferring the journalized transactions into the accounts of the ledger is known as posting of transaction.

Post the prepared journals to the general ledger:

| General ledger | |||||||

| Account: Cash | Account No: 111 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 44,742.45 | ||||

| Account: Accounts receivable | Account No: 113 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 5,335.01 | ||||

| Account: Office supplies | Account No: 114 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 234 | ||||

| Adjusting | J16 | 134 | 100 | ||||

| Account: Spa supplies | Account No: 115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 730 | ||||

| Adjusting | J16 | 305 | 425 | ||||

| Account: Merchandise inventory | Account No: 116 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 11,310 | 11,310 | ||

| Account: Prepaid insurance | Account No: 117 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 700 | ||||

| Adjusting | J16 | 233.34 | 466.66 | ||||

| Account: Office equipment | Account No: 124 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 1,740 | ||||

| Account: Accumulated depreciation, Office equipment | Account No: 125 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 13.25 | ||||

| Adjusting | J11 | 30 | 43.25 | ||||

| Account: Spa equipment | Account No: 128 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 19,816 | ||||

| Account: Accumulated depreciation, Spa equipment | Account No: 129 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 150 | ||||

| Adjusting | J16 | 660.54 | 810.54 | ||||

| Account: Accounts payable | Account No: 211 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 14,919 | ||||

| Account: Wages payable | Account No: 212 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | ||||||

| Account: sales tax payable | Account No: 215 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 1,076.4 | ||||

| Account: Mr. A.V, capital | Account No: 311 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 56,271.75 | ||||

| Account: Mr. A.V, Drawing | Account No: 115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 4,500 | ||||

| Account: Income summary | Account No: 313 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 11,310 | 11,310 | ||

| Account: Income from services | Account No: 411 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 24,288.78 | ||||

| Account: Merchandise sales | Account No: 412 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 28,261.54 | ||||

| Account: Sales discount | Account No: 413 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 17.46 | ||||

| Account: Sales returns and allowances | Account No: 414 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 70 | ||||

| Account: Purchase | Account No: 511 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 23,344 | ||||

| Account: Purchase discount | Account No: 512 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 82 | ||||

| Account: Purchase returns and allowances | Account No: 513 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 168 | ||||

| Account: Freight in | Account No: 515 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 975 | ||||

| Account: Wages expense | Account No: 611 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 18,260 | ||||

| Account: Rent expense | Account No: 612 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 3,000 | ||||

| Account: Office supplies expense | Account No: 613 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 134 | 134 | ||

| Account: Spa supplies expense | Account No: 614 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 305 | 305 | ||

| Account: Laundry expense | Account No: 615 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 110 | ||||

| Account: Advertising expense | Account No: 616 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 555 | ||||

| Account: Utilities expense | Account No: 617 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 701 | ||||

| Account: Insurance expense | Account No: 618 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 233.34 | 233.34 | ||

| Account: Depreciation expense, Office equipment | Account No: 619 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 30 | 30 | ||

| Account: Depreciation expense, Spa equipment | Account No: 620 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 660.54 | 660.54 | ||

| Account: Promotional expense | Account No: 630 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 400.8 | ||||

Table (3)

4.

Prepare a trail balance for 31st August.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the ledger postings and helps preparing the final accounts.

Prepare a trial balance.

| A Spa | ||

| Trail balance (Adjusted) | ||

| August 31, 20__ | ||

| Account name | Debit ($) | Credit($) |

| Cash | 44,742.45 | |

| Accounts receivable | 5,335 | |

| Office supplies | 100 | |

| Spa supplies | 425 | |

| Merchandise inventory | 11,310 | |

| Prepaid insurance | 466.66 | |

| Office equipment | 1,740 | |

| Accumulated depreciation, office equipment | 43.25 | |

| Spa equipment | 19,816 | |

| Accumulated depreciation, spa equipment | 810.54 | |

| Accounts payable | 14,919 | |

| Sales tax payable | 1,076.4 | |

| Mr. A.V, capital | 56,271.75 | |

| Mr. A.V, drawings | 4,500 | |

| Income summary | 11,310 | |

| Income from services | 24,288.78 | |

| Merchandise sales | 28,261.54 | |

| Sales discounts | 17.46 | |

| Sales returns and allowances | 70 | |

| Purchases | 23,344 | |

| Purchases discounts | 82 | |

| Purchases returns and allowances | 168 | |

| Freight in | 975 | |

| Wages expense | 18,260 | |

| Rent expense | 3,000 | |

| Office supplies expense | 134 | |

| Spa supplies expense | 305 | |

| Laundry expense | 110 | |

| Advertising expense | 555 | |

| Utilities expense | 701 | |

| Insurance expense | 233.34 | |

| Depreciation expense, office equipment | 30 | |

| Depreciation expense, spa equipment | 660.54 | |

| Promotional expense | 400.8 | |

| 137,231.26 | 137,231.26 | |

Table (4)

Want to see more full solutions like this?

Chapter 11 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Fundamentals of Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning