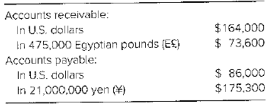

Chocolate De−lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of

The spot rates on December 31, 20X6, were

E€1 = $0.176

¥1 = $0.0081

The average exchange rates during the collection and payment period in 20X7 are

E€1 = $0.18

¥1 = $0.0078

Required

a. Prepare the adjusting entries on December 31, 20X6.

b. Record the collection of the accounts receivable in 20X7.

c. Record the payment of the accounts payable in 20X7.

d. What was the foreign currency gain or loss on the accounts receivable transaction denominated in E€ for the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

e. What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

f. What was the combined foreign currency gain or loss for both transactions? What could Chocolate De-lites have done to reduce the risk associated with the transactions denominated in foreign currencies?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ADVANCED FIN. ACCT.(LL)-W/CONNECT

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning