DECISION MAKING ACROSS THE ORGANIZATION

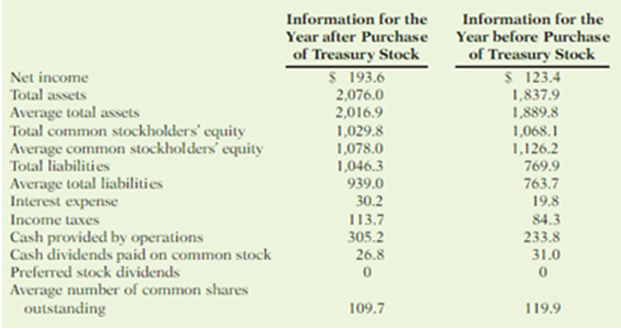

During a recent period, the fast-food drain Wendy’s International purchased many treasury shares. This caused the number of shares outstanding to fall from 124 million to 105 million. The following information was drawn from the company’s financial statements (in millions).

Instructions

Use the information provided to answer the following questions.

(a) Compute earnings per share, return on common stockholders’ equity and return on assets for both years. Discuss the change in the company’s profitability over this period.

(b) Compute the dividend payout ratio. Also compute the average cash dividend paid per share of common stock (dividends paid divided by the average number of common shares outstanding). Discuss any change in these ratios during this period and the implications for the company’s dividend policy.

(c) Compute the debt to assets ratio and limes interest earned. Discuss the change in the company’s solvency.

(d) Based on your findings in (a) and (c), discuss to what extent any change in lie return on common stockholders’ equity was tire result of increased reliance on debt.

(e) Does it appear that the purchase of

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

FINANCIAL ACCOUNTING LOOSELEAF

- Larkspur Manufacturing Company observed that, during its busiest month of 2022, maintenance costs totaled $18,500, resulting from the production of 40,000 units. During its slowest month, $13,000 in maintenance costs were incurred, resulting from the production of 25,000 units. Use the high-low method to estimate the maintenance cost that the company will incur if it produces 30,000 units. (Calculation in 2 decimal)arrow_forwardWhat is the correct option?arrow_forwardThe Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,