DECISION MAKING ACROSS THE ORGANIZATION

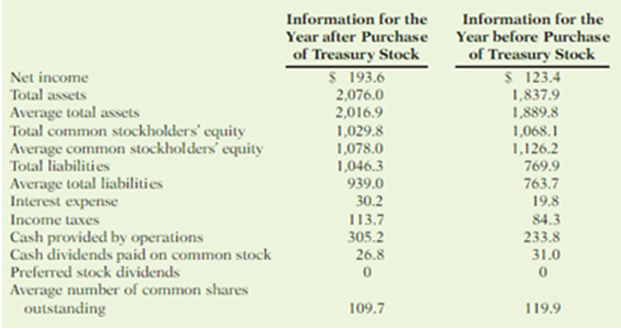

During a recent period, the fast-food drain Wendy’s International purchased many treasury shares. This caused the number of shares outstanding to fall from 124 million to 105 million. The following information was drawn from the company’s financial statements (in millions).

Instructions

Use the information provided to answer the following questions.

(a) Compute earnings per share, return on common stockholders’ equity and return on assets for both years. Discuss the change in the company’s profitability over this period.

(b) Compute the dividend payout ratio. Also compute the average cash dividend paid per share of common stock (dividends paid divided by the average number of common shares outstanding). Discuss any change in these ratios during this period and the implications for the company’s dividend policy.

(c) Compute the debt to assets ratio and limes interest earned. Discuss the change in the company’s solvency.

(d) Based on your findings in (a) and (c), discuss to what extent any change in lie return on common stockholders’ equity was tire result of increased reliance on debt.

(e) Does it appear that the purchase of

(a)

Financial Ratios: Financial ratios are the metrics used to evaluate the overall financial performance of a company during a specific period of time.

To compute: the earnings per share for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Calculate the earnings per share for W International.

For year ended after purchase of treasury stock

For year ended before purchase of treasury stock

Explanation of Solution

Earnings per share (EPS) refers to the share of earnings earned by the shareholder on each owned. The formula to calculate the earnings per share is as follows:

Therefore, the earnings per share for year ended after purchase of treasury stock is $1.76 per share and for year ended before purchase of treasury stock is $1.03 per share.

To Compute: the return on common stockholders’ equity for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the return on common stockholders’ equity for W International:

For year ended after purchase of treasury stock

For year ended before purchase of treasury stock

Explanation of Solution

Return on common stockholders’ equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on common stockholders’ equity is as follows:

Therefore, the Return on Common Stockholders’ equity for year ended after purchase of treasury stock is 18% and, for year ended before purchase of treasury stock is 11%.

To Compute: the return on assets ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the return on assets ratio:

For year ended after purchase of treasury stock.

For year ended before purchase of treasury stock.

Explanation of Solution

Return on assets is used to measure the overall earning ability of the company. Thus, it shows the relationship between the net income and the average total assets.

The formula to calculate the return on assets ratio is as follows:

Therefore, the Return on assets for year ended after purchase of treasury stock is 9.6% and, for year ended before purchase of treasury stock is 6.5%.

To discuss: the change in the company’s profitability over this period.

Explanation of Solution

The change in the company’s profitability over this period is discussed below:

- The purchase of treasury stock increased the earnings per share from $1.03 per share to $1.76 per share thereby reducing the number of outstanding shares in the for the year ended after the purchase of treasury stock.

- The return on common stockholders’ equity increased from 11% to 18% after the purchase of treasury stock due to increased return on assets from 6.5% to 9.6%. This implies that the company is able to earn more on the money invested on assets than interest paying on its borrowings.

- Thus, the above explanations imply that the purchase of treasury stock has increased the profitability of W International.

(b)

To Compute: the payout ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the payout ratio for W International:

For year ended after purchase of treasury stock

For year ended after purchase of treasury stock

Explanation of Solution

Payout Ratio: It refers to a measure that evaluates the amount of dividends paid to the shareholders out of the net income earned by a corporation. It is generally expressed as a percentage. The formula to calculate the payout ratio is as follows:

Therefore, the Payout ratio for year ended after purchase of treasury stock is 13.8% and, for year ended before purchase of treasury stock is 25.1%.

To Compute: the average cash dividend paid per share for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the average cash dividend paid per share for W International:

For year ended after purchase of treasury stock

For year ended after purchase of treasury stock

Explanation of Solution

Average cash dividend paid per share: It refers to a measure that evaluates the amount of cash dividend paid on each share owned by the common shareholders out of the total cash dividends paid by a corporation. The formula to calculate the average cash dividend paid per share as follows:

Therefore, the average cash dividend paid per share for year ended after purchase of treasury stock is $0.24 per share and, for year ended before purchase of treasury stock is $0.26 per share.

To discuss: the change in these ratios during this period and the implications for the company’s dividend policy.

Explanation of Solution

After the purchase of treasury stock, the company has paid lesser dividends to its common stockholders as compared to before the purchase of treasury stock. Thus, it implies that the company is intentionally retained its earnings for investing in operations.

(c)

To Compute: the debt to assets ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the debt to assets ratio for W International:

For year ended after purchase of treasury stock.

For year ended before purchase of treasury stock.

Explanation of Solution

Debt to assets ratio: It is the ratio that measures the ability of a company to meet its long-term obligations out of its total assets available. It shows the relationship of total liabilities and total assets.

The formula to calculate the debt to assets ratio is as follows:

Therefore, the Debt to assets ratio for year ended after purchase of treasury stock is 50.4% and, for year ended before purchase of treasury stock is 41.9%.

To Compute: the times interest earned ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Calculate the times interest earned ratio for W International:

For year ended after purchase of treasury stock.

For year ended after purchase of treasury stock.

Explanation of Solution

Times interest earned ratio: This ratio that measures a company’s ability to meet its interest payments with its available earnings.

The formula to calculate the times interest earned ratio is as follows:

Therefore, the Times interest earned ratio for year ended after purchase of treasury stock is 11.2 times and, for year ended before purchase of treasury stock is 11.5times.

To discuss: the change in company’s solvency.

Explanation of Solution

The change in company’s solvency is discussed below:

- Although the purchase of treasury stock has increased the profitability of the company but reduced its solvency.

- The company has increased the debts to assets ratio from 41.9% to 50.4% that decreased the solvency rate.

- The times interest earned ratio also slightly decreased from 11.5 times to 11.2 times due to the increase in interest expenses.

- Thus, this decrease in solvency might not much worry the investors.

(d)

To discuss: to what extent the increased reliance on debts changes in the return on common stockholders’ equity.

Explanation of Solution

As from the above calculated ratios, it is seen that there is an increase in both return on assets and return on common stockholders’ equity. Thus, it can be implied that the increased reliance and debt financing as well as the increased return on assets lead to the increase in the return on common stockholders’ equity.

(e)

To explain: whether the purchase of treasury stock and the reliance on debt financing was a wise strategic move.

Explanation of Solution

From the above calculated ratios, it is found that all the calculated ratios showed an improvement after the purchase of treasury stock. Thus, it indicates that the company has effectively used its available resources to increase its profitability significantly. However, there is seen a slight decrease in solvency rate and hence, it should not be a matter of concern for the company. It can smoothly handle its debt payments.

Therefore, it can be concluded that the purchase of treasury stock and the reliance on debt financing was a wise strategic move for W International.

Want to see more full solutions like this?

Chapter 11 Solutions

FINANCIAL ACCOUNTING>IC<

- Please give me true answer this financial accounting questionarrow_forwarda) Prepare the lease schedule for the Kaizen Limitedb) Prepare Kaizen’s journal entries for 2016 & 2017 c) If the lease agreement could be cancelled at any time without penalty. Would your answer in part a change? If yes, explain how and why.arrow_forwardHelp me with Q4, the answer CANNOT BE THE FOLLOWING, AS I TRIED AND GOT AN INCORRECT ANSWER: 1353.6, 1360.8, 1332As per question, DO NOT ROUND ANY CALCULATIONS, AND ROUND ANSWER TO 2 DECIMALarrow_forward

- Please help me with the error in Q4arrow_forwardGeneral accounting questionarrow_forwardCariman Company is a manufacturer with two production departments (Machining and Assembly) as well as two support departments (Human Resources and Information Services).For the last quarter of 2020, Cariman’s cost records indicate the following:SUPPORT PRODUCTIONHuman Resources (HR)Information Services(IS)MachiningAssemblyTotalBudgeted overhead costs before any inter-department cost allocations$400,000$2,000,000$10,912,000$14,916,000$28,228,000Support work supplied by HR (Number of employees)025%40%35%100%Support work supplied by IS (Processing costs)10%030%60%100%Required:1. Allocate the two support departments’ costs to the two operating departments using the following methods:a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.2. Compare and explain differences in the support-department costs allocated to each production department. 3. What approaches might be used to decide the sequence in which to allocate…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,