Loose Leaf For Managerial Accounting for Managers

6th Edition

ISBN: 9781264445394

Author: Noreen, Eric, BREWER, Peter, Garrison, Ray

Publisher: McGraw Hill

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.25P

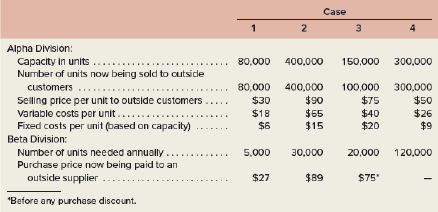

Basic Transfer Pricing LO 11–3

Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on their own division’sreturn on investment (

Required:

- Refer to case 1 shown above. Alpha Division can avoid $2 per unit in commissions on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Refer to case 2 shown above. A study indicates Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Would you expect any disagreement between the two divisional managers over what the exact transfer price should be? Explain.

- Assume Alpha Division offers to sell 30,000 units to Beta Division for $88 per unit and that Beta Division refuses this price. What will be the loss in potential profits for the company as a whole?

- Refer to case 3 shown above. Assume Beta Division is now receiving an 8% price discount from the outside supplier.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Assume Beta Division offers to purchase 20,000 units from Alpha Division at $60 per unit. If Alpha Division accepts this price, would you expect its ROI to increase, decrease, or remain unchanged? Why?

- Refer to case 4 shown above. Assume Beta Division wants Alpha Division to provide it with 120,000 units of a different product from the one Alpha Division is producing now. The new product would require $21 per unit in variable costs and would require that Alpha Division cut back production of its present product by 45,000 units annually. What is Alpha Division’s lowest acceptable transfer price?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

help me general accounting questio

ans ?? financial accounting question

Answer? Financial accounting question

Chapter 11 Solutions

Loose Leaf For Managerial Accounting for Managers

Ch. 11 - Prob. 11.1QCh. 11 - Prob. 11.2QCh. 11 - Prob. 11.3QCh. 11 - Prob. 11.4QCh. 11 - Prob. 11.5QCh. 11 - Prob. 11.6QCh. 11 - Prob. 11.7QCh. 11 - Prob. 11.8QCh. 11 - Prob. 11.9QCh. 11 - Why is using sales dollars as an allocation base...

Ch. 11 - Prob. 1AECh. 11 - Prob. 1TF15Ch. 11 - Prob. 11.1ECh. 11 - Prob. 11.2ECh. 11 - Prob. 11.3ECh. 11 - Prob. 11.4ECh. 11 - Prob. 11.5ECh. 11 - Prob. 11.6ECh. 11 - Prob. 11.7ECh. 11 - Prob. 11.8ECh. 11 - Prob. 11.9ECh. 11 - Prob. 11.10ECh. 11 - Prob. 11.11ECh. 11 - Prob. 11.12ECh. 11 - Prob. 11.13ECh. 11 - Prob. 11.14ECh. 11 - Prob. 11.15ECh. 11 - Prob. 11.16ECh. 11 - Prob. 11.17PCh. 11 - Prob. 11.18PCh. 11 - Prob. 11.19PCh. 11 - Prob. 11.20PCh. 11 - Prob. 11.21PCh. 11 - Service Department Charges LO 11–4 Sharp Motor...Ch. 11 - Prob. 11.23PCh. 11 - Prob. 11.24PCh. 11 - Basic Transfer Pricing LO 11–3 Alpha and Beta...Ch. 11 - Prob. 11.26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shumpert, Inc., entered into a contract that was to take two years to complete, with an estimated cost of $1,736,000. The contract price was $2,430,400. Costs of the contract for 2023, the first year, totaled $1,302,000. If required, round any division to two decimal places and round your final answers to the nearest dollar. a. What was the gross profit reported by the percentage of completion method for 2023? 521,508 X b. After the contract was completed at the end of 2024 at a total cost of $1,822,800, what was the gross profit reported by the percentage of completion method for 2024? -1,215,908 X Feedback Check My Work Under the percentage of completion method, a portion of the gross contract price is included in income during each period as the work progresarrow_forwardGeneral accountingarrow_forwardAnswer? ? Financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License