MANAGERIAL ACCOUNTING F/MGRS.

6th Edition

ISBN: 9781264100590

Author: Noreen

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.25P

Basic Transfer Pricing LO 11–3

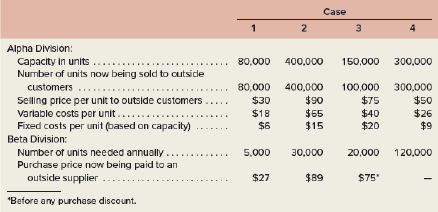

Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on their own division’sreturn on investment (

Required:

- Refer to case 1 shown above. Alpha Division can avoid $2 per unit in commissions on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Refer to case 2 shown above. A study indicates Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Would you expect any disagreement between the two divisional managers over what the exact transfer price should be? Explain.

- Assume Alpha Division offers to sell 30,000 units to Beta Division for $88 per unit and that Beta Division refuses this price. What will be the loss in potential profits for the company as a whole?

- Refer to case 3 shown above. Assume Beta Division is now receiving an 8% price discount from the outside supplier.

- What is Alpha Divisions’s lowest acceptable transfer price?

- What is Beta Division’s highest acceptable transfer price?

- What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

- Assume Beta Division offers to purchase 20,000 units from Alpha Division at $60 per unit. If Alpha Division accepts this price, would you expect its ROI to increase, decrease, or remain unchanged? Why?

- Refer to case 4 shown above. Assume Beta Division wants Alpha Division to provide it with 120,000 units of a different product from the one Alpha Division is producing now. The new product would require $21 per unit in variable costs and would require that Alpha Division cut back production of its present product by 45,000 units annually. What is Alpha Division’s lowest acceptable transfer price?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Basic Transfer Pricing

Alpha and Beta are divisions within the same company. The managers of both divisions are evaluated based on their own division’s return on investment (ROI). Assume the following information relative to the two divisions:

Managers are free to decide if they will participate in any internal transfers. All transfer prices are negotiated.

Required:

1. Refer to case 1 shown above. Alpha Division can avoid $2 per unit in commissions on any sales to Beta Division.

a. What is the lowest acceptable transfer price from the perspective of the Alpha Division?

b. What is the highest acceptable transfer price from the perspective of the Beta Division?

c. What is the range of acceptable transfer prices (if any) between the two divisions? Will the managers probably agree to a transfer? Explain.

2. Refer to case 2 shown above. A study indicates that Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division.

a. What is the lowest acceptable transfer…

H

Accounting Question

Chapter 11 Solutions

MANAGERIAL ACCOUNTING F/MGRS.

Ch. 11 - Prob. 11.1QCh. 11 - Prob. 11.2QCh. 11 - Prob. 11.3QCh. 11 - Prob. 11.4QCh. 11 - Prob. 11.5QCh. 11 - Prob. 11.6QCh. 11 - Prob. 11.7QCh. 11 - Prob. 11.8QCh. 11 - Prob. 11.9QCh. 11 - Why is using sales dollars as an allocation base...

Ch. 11 - Prob. 1AECh. 11 - Prob. 1TF15Ch. 11 - Prob. 11.1ECh. 11 - Prob. 11.2ECh. 11 - Prob. 11.3ECh. 11 - Prob. 11.4ECh. 11 - Prob. 11.5ECh. 11 - Prob. 11.6ECh. 11 - Prob. 11.7ECh. 11 - Prob. 11.8ECh. 11 - Prob. 11.9ECh. 11 - Prob. 11.10ECh. 11 - Prob. 11.11ECh. 11 - Prob. 11.12ECh. 11 - Prob. 11.13ECh. 11 - Prob. 11.14ECh. 11 - Prob. 11.15ECh. 11 - Prob. 11.16ECh. 11 - Prob. 11.17PCh. 11 - Prob. 11.18PCh. 11 - Prob. 11.19PCh. 11 - Prob. 11.20PCh. 11 - Prob. 11.21PCh. 11 - Service Department Charges LO 11–4 Sharp Motor...Ch. 11 - Prob. 11.23PCh. 11 - Prob. 11.24PCh. 11 - Basic Transfer Pricing LO 11–3 Alpha and Beta...Ch. 11 - Prob. 11.26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need correct answer for all with workingarrow_forwardVishnuarrow_forwardExercise 15-34 (Algo) Evaluate Transfer Pricing System: Negotiated Rates (LO 15-2, 3) Tops Corporation is organized into two divisions, Manufacturing and Marketing. Both divisions are considered to be profit centers and the two division managers are evaluated in large part on divisional income. The company makes a single product. It is fabricated in Manufacturing and then packaged and sold in Marketing. There is no intermediate market for the product. The monthly income statements, in thousands of dollars, for the two divisions follow. Production and sales amounted to 15,000 units. Revenues Variable costs Contribution margin Fixed costs Manufacturing $4,500 3,900 $. Marketing $15, 000 6,700 $ 8,300 600 300 800 Divisional profit $. 300 $ 7,500 Assume there is no speclal order pending. Required: a. What transfer price would you recommend for Tops Corporation? b. Using your recommended transfer price, what will be the income of the two divisions, assuming monthly production and sales of…arrow_forward

- Exercise 11-13 (Algo) Transfer Pricing Situations [LO11-3] [The following information applies to the questions displayed below.] In each of the cases below, assume Division X has a product that can be sold either to outside customers or to Division Y of the same company for use in its production process. The managers of the divisions are evaluated based on their divisional profits. Case A B Division X: Capacity in units Number of units being sold to outside customers Selling price per unit to outside customers 95,000 95,000 96,000 79,000 $ 50 $ 30 Variable costs per unit Fixed costs per unit (based on capacity) Division Y: $ 28 $ 12 $ 6 $ 4 Number of units needed for production 17,000 17,000 Purchase price per unit now being paid to an outside supplier $ 43 $ 24 Exercise 11-13 (Algo) Part 2 Required: 2. Refer to the data in case B above. In this case, there will be no savings in variable selling costs on intracompany sales. a. What is the lowest acceptable transfer price from the…arrow_forwardCalculate the lowest acceptable transfer price for the seller (Division A) ?arrow_forward5arrow_forward

- Exercise 8 (Transfer Pricing Situations) In each of the cases below, assume that Division A has 'a product that can be sold either to outside customers or to Division B of the same company for use in its production process. The managers of the divisions are evaluated based on their divisional profits. Case 1 2 Division X: Capacity in units. Number of units being sold to outside customers.. Selling price per unit to outside customers Variable costs per unit... Fixed costs per unit (based on capacity). 100,000 100,000 P50 P30 100,000 80,000 P35 P20 P 8 Division Y: Number of units needed for production... Purchase price per unit now being paid to an outside supplier.. 20,000 20,000 P47 Р34 Required: 1. Refer to the data in case A above. Assume that P2 per unit in variable selling costs can be avoided on intracompany sales. If the managers are free to negotiate and make decisions on their own, will a transfer take place? If so, within what range will the transfer price fall? Explain. 2.…arrow_forwardHi, I also need help finding the highest acceptable transfer price and the lowest acceptable transfer price. Thanksarrow_forwardExercise 11-13 (Algo) Transfer Pricing Situations [LO11-3] Skip to question [The following information applies to the questions displayed below.] In each of the cases below, assume Division X has a product that can be sold either to outside customers or to Division Y of the same company for use in its production process. The managers of the divisions are evaluated based on their divisional profits. Case A B Division X: Capacity in units 100,000 95,000 Number of units being sold to outside customers 100,000 74,000 Selling price per unit to outside customers $ 55 $ 30 Variable costs per unit $ 26 $ 14 Fixed costs per unit (based on capacity) $ 7 $ 5 Division Y: Number of units needed for production 21,000 21,000 Purchase price per unit now being paid to an outside supplier $ 50 $ 28 Exercise 11-13 (Algo) Part 1 Required: 1. Refer to the data in case A above. Assume in this case that $3 per unit in variable selling costs can be avoided on…arrow_forward

- Please help with the ones that are wrong. Thank Youarrow_forwardThe company uses the opportunity cost approach to transfer pricing. What is the minimum transfer price in Case 1?arrow_forwardCalculating Transfer Price Burt Inc. has a number of divisions, including the Indian Division, a producer of liquid pumps, and Maple Division, a manufacturer of boat engines. Indian Division produces the h20-model pump that can be used by Maple Division in the production of motors that regulate the raising and lowering of the boat engir stern drive unit. The market price of the h20-model is $724, and the full cost of the h20-model is $540. Required: 1. If Burt has a transfer pricing policy that requires transfer at full cost: What will the transfer price be? $ Do you suppose that Indian and Maple divisions will choose to transfer at that price? Maple Division Indian Division 2. If Burt has a transfer pricing policy that requires transfer at market price: What would the transfer price be? $ Do you suppose that Indian and Maple divisions would choose to transfer at that price? Maple Division Indian Division 3. Now suppose that Burt allows negotiated transfer pricing and that Indian…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License