a.

Introduction: A contract or agreement laid between two parties for buying and selling of an asset at a specific rate and on a specific future date is known as forward contract. This is a contract or an agreement between a buyer and a seller to trade an asset at a future date whose price is set when contract is drawn and such agreements settle at the end of the contract on that specific date.

To prepare:

a.

Explanation of Solution

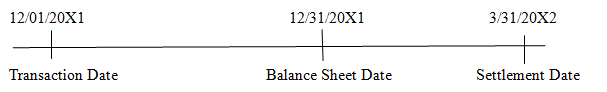

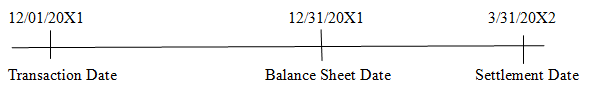

Use of forward contract to manage the foreign currency risk of exposed foreign currency position, not designated as a hedge.

-Purchase of furniture - Settle forward exchange

resulting in foreign contract and receive

currency payable 100,000 Australian

Dollars

-Sign foreign exchange - Pay foreign currency

contract to receive payable

Australian Dollars on

March 31st

Forward Rate:

A$1 = $0.609 A$1 = $0.612

Spot Rate:

A$1 = $0.600 A$1 = $0.610 A$1 = $ 0.602

| Journal entries in the books of M CompFor the year Dec 31st20X1 | |||

| Date | Particulars | Debit$ | Credit$ |

| Inventory | 60,000 | ||

| Dec 1st | Accounts Payable (1) | 60,000 | |

| 20X1 | (To record Accounts payable.) | ||

| Foreign Currency receivable from Exchange Broker (A$) | 60,900 | ||

| Dollars Payable to Exchange Broker (2) | 60,900 | ||

| (To record forward contract to manage foreign currency risk.) | |||

| Dec 31st | Foreign Currency Transaction Loss (3) | 1,000 | |

| 20X1 | Accounts Payable (A$) | 1,000 | |

| (To record foreign currency transaction loss.) | |||

| Foreign currency receivable from exchange broker (A$) (4) | 300 | ||

| Foreign currency transaction gain | 300 | ||

| (To record foreign currency transaction gain.) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| Foreign Currency Transaction Loss (5) | 1,000 | ||

| March 31st | Foreign Currency receivable from Exchange Broker (A$) | 1,000 | |

| 20X2 | (To record revalue of foreign currency receivable.) | ||

| Account Payable (A$) (6) | 800 | ||

| Foreign currency transaction gain | 800 | ||

| (To record revalue of foreign currency payable.) | |||

| Dollars payable to Exchange broker | 60,900 | ||

| Cash | 60,900 | ||

| (To record cash payment required by forward contract.) | |||

| Foreign Currency Units (A$) | 60,200 | ||

| Foreign currency receivable from exchange broker (A$) | 60,200 | ||

| Accounts Payables (A$) | 60,200 | ||

| Foreign Currency Units (A$) | 60,200 | ||

| (To record payment to creditor.) | |||

Working Notes:

1.Accounts Payable =

2.Foreign currency receivable =

6.Accounts Payable =

b.

Introduction: A contract or agreement laid between two parties for buying and selling of an asset at a specific rate and on a specific future date is known as forward contract. This is a contract or an agreement between a buyer and a seller to trade an asset at a future date whose price is set when contract is drawn and such agreements settle at the end of the contract on that specific date.

To prepare: Journal entries for forward contract as fair value of hedge of foreign currency firm commitment.

b.

Explanation of Solution

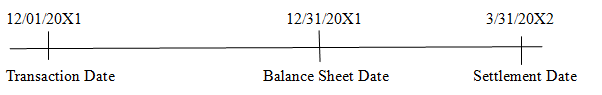

-Sign foreign exchange -Purchase of furniture - Settle forward exchange

contract to hedge foreign resulting in foreign contract and receive

currency payable firm currency payable. 100,000 Australian

commitment dollars.

-Pay foreign currency

Forward Rate:

A$1 = $0.609 A$1 = $0.612 A$1 = $0.605

Spot Rate:

A$1 = $0.600 A$1 = $0.610 A$1 = $0.608A$1 = $ 0.602

| Journal Entries in the books of M CompFor the year Dec 31st20X1 | |||

| Date | Particulars | Debit$ | Credit$ |

| Dec 1st | Foreign Currency receivable from Exchange Broker (A$) | 60,900 | |

| 20X1 | Dollars Payable to Exchange Broker (1) | 60,900 | |

| (To record forward contract to manage foreign currency risk.) | |||

| Dec 31st | Foreign currency receivable from exchange broker (A$) | 300 | |

| 20X1 | Foreign currency transaction gain (2) | 300 | |

| (To record foreign currency transaction gain.) | |||

| Foreign currency transaction loss (3) | 300 | ||

| Firm commitment | 300 | ||

| (To record the loss on the financial instrument.) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| Foreign Currency Transaction Loss (4) | 700 | ||

| Jan 30th | Foreign Currency receivable from Exchange Broker (A$) | 700 | |

| 20X2 | (To record revalue of foreign currency receivable.) | ||

| Firm commitment (5) | 700 | ||

| Foreign currency transaction gain | 700 | ||

| (To record the gain on the financialinstrument.) | |||

| Inventory (purchases) | 61,200 | ||

| Accounts payable (A$) (6) | 60,800 | ||

| Firm Commitment | 400 | ||

| (To record acquirement of furniture initially.) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| March 31st | Foreign Currency transaction loss (A$) (7) | 300 | |

| 20X2 | Foreign currency receivable from exchange broker (A$) | 300 | |

| (To record revalue of foreign currency receivable.) | |||

| Accounts Payable (A$) (8) | 600 | ||

| Foreign currency transaction gain | 600 | ||

| (To record revalue of foreign currency payable.) | |||

| Dollars payable to exchange broker (A$) | 60,900 | ||

| Cash | 60,900 | ||

| (to record the delivery of US dollars to exchange broker.) | |||

| Foreign Currency units (A$) (9) | 60,200 | ||

| Foreign currency receivable from exchange broker (A$) | 60,200 | ||

| (To record the delivery of US dollars from exchange broker.) | |||

| Accounts Payable (A$) | 60,200 | ||

| Foreign currency unit (A$) | 60,200 | ||

| (To record the payment of A$ 100,000 to foreign creditor.) | |||

Working Notes:

1. Foreign currency receivable

=

3. Foreign currency transaction loss =

6.Accounts Payable =

8.Accounts Payable =

9 Foreign Currency Units =

c.

Introduction: A contract or agreement laid between two parties for buying and selling of an asset at a specific rate and on a specific future date is known as forward contract. This is a contract or an agreement between a buyer and a seller to trade an asset at a future date whose price is set when contract is drawn and such agreements settle at the end of the contract on that specific date.

To prepare: Journal entries for forward contract as

c.

Explanation of Solution

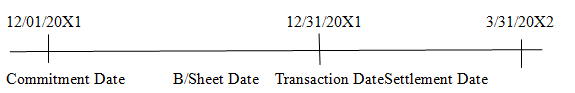

Use of forward contract as cash flow hedge of forecasted foreign currency transaction.

-Sign foreign exchange-Purchase of furniture - Settle forward exchange

Contract to hedge resulting in foreign contract and receive

Forecasted foreign Currency Payable 100,000 Australian

Currency transaction. Dollars.

- Pay foreign currency

payable.

Forward Rate:

A$1 = $0.609 A$1 = $0.612 A$1 = $0.605

Spot Rate:

A$1 = $0.600 A$1 = $0.610 A$1 = $0.608 A$1 = $ 0.602

| Journal Entries in the books of M CompFor the year Dec 31st20X1 | |||

| Date | Particulars | Debit$ | Credit$ |

| Dec 1st | Foreign currency receivable from exchange broker (A$) | 60,900 | |

| 20X1 | Dollars payable to exchange broker | 60,900 | |

| (To record forward contract to manage foreign currency risk | |||

| Dec 31st | Foreign currency receivable from exchange broker (A$) | 300 | |

| 20X1 | Other comprehensive income | 300 | |

| (To record OCI for effective portion of change in fair value) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| Other comprehensive income (OCI) | 700 | ||

| Jan 30th | Foreign currency receivable from exchange broker (A$) | 700 | |

| 20X2 | (To record revalue of foreign currency receivable and OCI) | ||

| Inventory (Purchases) | 60,800 | ||

| Account payable (A$) | 60,800 | ||

| (To record furniture acquired and value at spot rate) | |||

| March 31st | Other comprehensive income | 300 | |

| 20X2 | Foreign currency receivable from exchange broker (A$) | 300 | |

| (To record revalue of foreign currency and OCI) | |||

| Accounts Payable (A$) | 600 | ||

| Foreign currency transaction gain | 600 | ||

| (To record change in current earning as specified by FASB 52) | |||

| Foreign currency transaction loss | 600 | ||

| Other comprehensive income | 600 | ||

| (To record reclassify amount from OCI to offset foreign currency transaction gain) | |||

| Dollars payable to exchange brokers (A$) | 60900 | ||

| Cash | 60900 | ||

| (To record the delivery of US dollars to exchange broker) | |||

| Foreign currency units (A$) | 60200 | ||

| Foreign currency receivable from exchange broker (A$) | 60200 | ||

| (To receive $100,000 from broker in accordance with forward contract signed on December 1st) | |||

| Accounts payable (A$) | 60200 | ||

| Foreign currency units (A$) | 60200 | ||

| (To deliver $100,000 to foreign creditor) | |||

Working Notes:

1. Foreign currency receivable =

A$ 100,000 × 0.612 (Spot Rate) 31st Dec 20X1 − $60,900

4.Accounts Payable =

7 Foreign Currency Units =

d.

Introduction: A contract or agreement laid between two parties for buying and selling of an asset at a specific rate and on a specific future date is known as forward contract. This is a contract or an agreement between a buyer and a seller to trade an asset at a future date whose price is set when contract is drawn and such agreements settle at the end of the contract on that specific date.

To prepare: Journal entries for forward contract used for speculative purpose only.

d.

Explanation of Solution

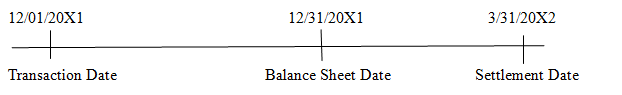

Use of forward contract for speculative purpose only

-Sign 120 day speculative - Settle forward exchange

Contract to purchasecontract and receive

100,000 Australian 100,000 Australian Dollar. Dollar.

Forward Rate:

A$1 = $0.609 A$1 = $0.612

Spot Rate:

A$1 = $0.600 A$1 = $0.610 A$1 = $ 0.602

| Journal Entries in the books of M CompFor the year Dec 31st20X1 | |||

| Date | Particulars | Debit$ | Credit$ |

| Dec 1st | Foreign currency receivable from exchange broker (A$) | 60,900 | |

| 20X1 | Dollars payable to exchange broker | 60,900 | |

| (To record 120 forward contracts for speculation) | |||

| Dec 31st | Foreign currency receivable from exchange broker (A$) | 300 | |

| 20X1 | Foreign currency transaction gain | 300 | |

| (To record foreign currency transaction gain) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| Foreign currency transaction loss | 1,000 | ||

| March 31st | Foreign currency receivable from exchange broker (A$) | 1,000 | |

| 20X2 | (To record revalue of foreign currency receivable) | ||

| Dollars payable to exchange broker | 60,900 | ||

| Cash | 60,900 | ||

| (To record delivery of US $ to forward exchange broker) | |||

| Foreign currency units (A$) | 60,200 | ||

| Foreign currency receivable from exchange broker (A$) | 60,200 | ||

| (To receive A$ 100,000 from exchange broker) | |||

Working Notes:

- Foreign currency receivable =

7 Foreign Currency Units =

e.

Introduction: A contract or agreement laid between two parties for buying and selling of an asset at a specific rate and on a specific future date is known as forward contract. This is a contract or an agreement between a buyer and a seller to trade an asset at a future date whose price is set when contract is drawn and such agreements settle at the end of the contract on that specific date.

To prepare: Journal entries for forward contract to manage the foreign currency position, considering time value of money.

e.

Explanation of Solution

Use of forward contract to manage the exposed foreign currency positionconsidering the time value of money at a 12% annual rate. Forward contract not designed as a hedge.

-Purchase of Furniture - Settle forward exchange

resulting in Foreign contract and receive

currency payable. 100,000 Australian

Dollar.

-Sign hedging foreign - Pay foreign Currency

exchange contract to Payable

receive Australian Dollars

on March 31st.

Forward Rate:

A$1 = $0.609 A$1 = $0.612

Spot Rate:

A$1 = $0.600 A$1 = $0.610 A$1 = $ 0.602

| Journal Entries in the books of M CompFor the year Dec 31st20X1 | |||

| Date | Particulars | Debit$ | Credit$ |

| Inventory (purchases) | 60,000 | ||

| Dec 1st | Accounts payable (A$) | 60,000 | |

| 20X1 | (To record foreign currency payable) | ||

| Foreign currency receivable from exchange broker (A$) | 60,900 | ||

| Dollars payable to exchange broker | 60,900 | ||

| (To record forward contract to hedge foreign currency) | |||

| Dec 31st | Foreign currency transaction loss | 1,000 | |

| 20X1 | Accounts payable (A$) | 1,000 | |

| (To record foreign currency transaction loss) | |||

| Foreign currency receivable from exchange broker (A$) | 291 | ||

| Foreign currency transaction gain | 291 | ||

| (To record revalue of foreign currency receivable) | |||

| Journal Entries in the books of M CompFor the year Dec 31st20X2 | |||

| Date | Particulars | Debit$ | Credit$ |

| Foreign currency transaction loss | 991 | ||

| March 31st | Foreign currency receivable from exchange broker (A$) | 991 | |

| 20X2 | (To record revalue of foreign currency receivable) | ||

| Account payable (A$) | 800 | ||

| Foreign currency transaction gain | 800 | ||

| (To record revalue of foreign currency payable) | |||

| Dollars payable to exchange broker | 60,900 | ||

| Cash | 60,900 | ||

| (To record cash payment required by forward contract) | |||

| Foreign currency units (A$) | 60,200 | ||

| Foreign currency receivable from exchange broker (A$) | 60,200 | ||

| (to receive $100,000 from exchange broker as per forward contract) | |||

| Accounts payables (A$) | 60,200 | ||

| Foreign currency units (A$) | 60,200 | ||

| (To record payment to creditor) | |||

Working Notes:

1.Accounts Payable =

2. Foreign currency receivable =

3.Foreign currency transaction loss =

4.Foreign currency transaction Gain = Foreign currency receivable Dec 31st (forward rate) − foreign currency receivable Dec 1st (forward rate)

5 Foreign Currency Transaction Loss

6. Accounts Payable =

7 Foreign Currency Units =

Want to see more full solutions like this?

Chapter 11 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardSocrates Manufacturing's budget for the coming year includes $840,000 for manufacturing overhead, 95,000 hours of direct labor, and 600,000 hours of machine time. If Socrates applies overhead using a predetermined rate based on machine hours, what amount of overhead will be assigned to a unit of output which requires 0.80 machine hours and 0.30 labor hours to complete?arrow_forward

- 1. How does an accounting system provide accurate calculations to prevent errors? 2. What are potential concerns related to data security? 3. How does an accounting system save time?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardWhat is the correct answer with accounting questionarrow_forward