Concept explainers

Foreign Sales

Tex Hardware sells many of its producers overseas. The following are some selected transactions.

- Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753.

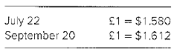

- On July 22, Tex sold copper fillings to a company in London for £30,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £30,000 at a forward rate of £ 1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow:

Required

Prepare

Introduction: Foreign exchange rate is the rate at which currency of one country is changed to currency of another country is called foreign exchange rate. Mainly there are two rate, i.e. direct exchange rate and indirect exchange rate.

Foreign exchange gain or loss: Foreign exchange gain or loss arises when there is selling or buying of any goods and services in foreign currency.

The recording of the journal entries related to the sale made by T company, use of forward contract and entries regarding the settlement.

Explanation of Solution

- Journal entries to record sale of electronic subassemblies to a firm in Denmark is as follows:

- Journal entries to record sale of copper fittings to a firm in London is as follows:

- Journal entries to record sale of storage devices to a firm in Canada is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Jun-06 | Accounts receivables | 21,000 | |

| To Sales account (Dkr120,000*0.1750$) | 21,000 | ||

| (Recording entry for the sale of electronic subassemblies by T company at exchange rate of Dkr1=$0.1750) | |||

| Jul-03 | Accounts receivable | 36 | |

| To Foreign currency transaction gain [($0.1753-$0.1750) *120,000] | 36 | ||

| (Recording entry for revaluing foreign currency receivable to U.S dollar) | |||

| Jul-03 | Foreign currency units (Dkr) | 21,036 | |

| To Accounts receivables ($0.1753*Dkr120,000) | 21,036 | ||

| (Recording entry for collection of accounts receivable in Dkr i.e. Danish kroner) |

| Date | Particulars | Debit ($) | Credit ($) |

| Jul-22 | Accounts receivable | 47,400 | |

| To sales account (£30,000*1.580) | 47,400 | ||

| (Recording entry for sale of copper fittings to a company in London) | |||

| Jul-22 | Dollars receivable from broker | 48,900 | |

| To Foreign currency payable to broker (£30,000*1.630) | |||

| (Recoding entry for entering into the 60-day forward contract @1.630) | 48,900 | ||

| Sep-20 | Accounts receivable | 960 | |

| To foreign currency transaction gain [(1.612-1.580) *£30,000] | 960 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Sep-20 | Foreign currency payable to broker | 540 | |

| To foreign currency transaction gain [(1.612-1.630) *£30,000] | 540 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Sep-20 | Foreign currency units | 48,360 | |

| To Accounts receivable (£30,000*1.612) | 48,360 | ||

| (Recording entry for receipt of British pounds from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 48,360 | |

| To foreign currency units (£30,000*1.612) | 48,360 | ||

| (Recording entry for payment of pounds to broker) | |||

| Sep-20 | Cash | 48900 | |

| To Dollars receivable from broker (£30000*1.630) | 48900 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

| Date | Particulars | Debit ($) | Credit ($) |

| Oct-11 | Accounts receivable | 51,450 | |

| To sales account (C$70,000*0.7350) | 51,450 | ||

| (Recording entry for sale of storage device to a company in Canada) | |||

| Oct-11 | Dollars receivable from broker | 51,100 | |

| To Foreign currency payable to broker (C$70,000*0.730) | 51,100 | ||

| (Recoding entry for entering into the 30-day forward contract @) | |||

| Nov-10 | Foreign currency transaction loss | 210 | |

| To Accounts receivable [(0.7350-0.7320) *C$70,000] | 210 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Nov-10 | Foreign currency transaction loss | 140 | |

| To Foreign currency payable to broker [(0.7300-0.7320) *C$70,000] | 140 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Nov-10 | Foreign currency units | 51,240 | |

| To Accounts receivable (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for receipt of Canadian dollar from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 51,240 | |

| To foreign currency units (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for payment of Canadian dollar to broker) | |||

| Sep-20 | Cash | 51,100 | |

| To Dollars receivable from broker (C$70,000*0.730) | 51,100 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

Want to see more full solutions like this?

Chapter 11 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease explain the solution to this financial accounting problem with accurate explanations.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward