Financial Accounting Plus MyLab Accounting with Pearson eText -- Access Card Package (12th Edition)

12th Edition

ISBN: 9780134833132

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 11.16AE

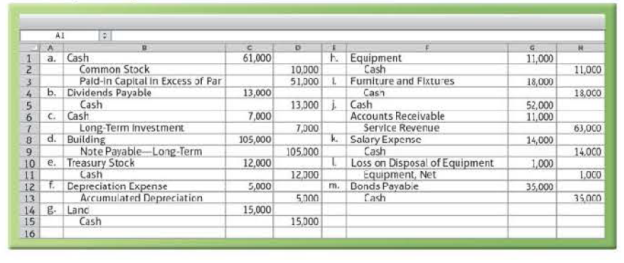

(Learning Objectives 2, 3: Distinguish among operating, investing, and financing activities for the statement of cash flows—indirect method) A company uses the indirect method to prepare the statement of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Alison Co., pays its employees every Friday for work performed through that Friday. Alison employees work Monday through Friday. They do not work on weekends. The gross payroll for Alison is $18,900 each week. Alison will pay its employees $18,900 on Friday, April 3rd. This payroll is for wages earned Monday, March 30th through Friday, April 3rd. How much of the $18,900 paid on April 3rd should be expensed in April? Right Answer

Financial Accounting MCQ

Accurate answer

Chapter 11 Solutions

Financial Accounting Plus MyLab Accounting with Pearson eText -- Access Card Package (12th Edition)

Ch. 11 - Quick Check (Answers are given here) The statement...Ch. 11 - Prob. 2QCCh. 11 - Prob. 3QCCh. 11 - Which of the three types of activities reported on...Ch. 11 - Prob. 5QCCh. 11 - On the statement of cash flows, which of the...Ch. 11 - On the statement of cash flows, which of the...Ch. 11 - Prob. 8QCCh. 11 - Prob. 9QCCh. 11 - Which of the following transactions does not...

Ch. 11 - If the indirect method is used to calculate net...Ch. 11 - In 2018, Jubilee Company repurchased its own stock...Ch. 11 - Prob. 13QCCh. 11 - Prob. 14QCCh. 11 - Prob. 11.1ECCh. 11 - LO 1 (Learning Objective 1: Explain the purposes...Ch. 11 - Prob. 11.2SCh. 11 - Prob. 11.3SCh. 11 - Prob. 11.4SCh. 11 - (Learning Objective 2: Distinguish among...Ch. 11 - Prob. 11.6SCh. 11 - (Learning Objective 3: Prepare a statement of cash...Ch. 11 - Prob. 11.8SCh. 11 - (Learning Objective 3: Calculate financing cash...Ch. 11 - Prob. 11.10SCh. 11 - (Learning Objective 4: Calculate operating cash...Ch. 11 - Prob. 11.12SCh. 11 - Prob. 11.13SCh. 11 - Prob. 11.14SCh. 11 - Prob. 11.15AECh. 11 - (Learning Objectives 2, 3: Distinguish among...Ch. 11 - Prob. 11.17AECh. 11 - Prob. 11.18AECh. 11 - Prob. 11.19AECh. 11 - Prob. 11.20AECh. 11 - Prob. 11.21AECh. 11 - Prob. 11.22AECh. 11 - Prob. 11.23AECh. 11 - (Learning Objective 4: Prepare the statement of...Ch. 11 - Prob. 11.25AECh. 11 - Prob. 11.26BECh. 11 - (Learning Objectives 2, 3: Distinguish among...Ch. 11 - Prob. 11.28BECh. 11 - Prob. 11.29BECh. 11 - Prob. 11.30BECh. 11 - Prob. 11.31BECh. 11 - Prob. 11.32BECh. 11 - Prob. 11.33BECh. 11 - Prob. 11.34BECh. 11 - Prob. 11.35BECh. 11 - Prob. 11.36BECh. 11 - Prob. 11.37QCh. 11 - Prob. 11.38QCh. 11 - Prob. 11.39QCh. 11 - Prob. 11.40QCh. 11 - Prob. 11.41QCh. 11 - Prob. 11.42QCh. 11 - Prob. 11.43QCh. 11 - Prob. 11.44QCh. 11 - Prob. 11.45QCh. 11 - Prob. 11.46QCh. 11 - Prob. 11.47QCh. 11 - Prob. 11.48QCh. 11 - Prob. 11.49QCh. 11 - Prob. 11.50QCh. 11 - The book value of equipment sold during 2018 was...Ch. 11 - Prob. 11.52QCh. 11 - Prob. 11.53QCh. 11 - Prob. 11.54QCh. 11 - Prob. 11.55QCh. 11 - Prob. 11.56QCh. 11 - Prob. 11.57APCh. 11 - Prob. 11.58APCh. 11 - (Learning Objectives 2, 3: Prepare the statement...Ch. 11 - Prob. 11.60APCh. 11 - Prob. 11.61APCh. 11 - Prob. 11.62APCh. 11 - Prob. 11.63APCh. 11 - (Learning Objectives 2, 3, 4: Prepare the...Ch. 11 - Prob. 11.65APCh. 11 - Prob. 11.66BPCh. 11 - (Learning Objectives 2, 4: Prepare an income...Ch. 11 - (Learning Objectives 2, 3: Prepare the statement...Ch. 11 - Prob. 11.69BPCh. 11 - Prob. 11.70BPCh. 11 - Prob. 11.71BPCh. 11 - Prob. 11.72BPCh. 11 - Prob. 11.73BPCh. 11 - Prob. 11.74BPCh. 11 - Prob. 11.75CEPCh. 11 - Prob. 11.76CEPCh. 11 - Prob. 11.77CEPCh. 11 - Prob. 11.78SCCh. 11 - Prob. 11.79DCCh. 11 - Prob. 11.80DCCh. 11 - Ethical Issues Georgetown Motors is having a bad...Ch. 11 - Prob. 1FFCh. 11 - Prob. 1FA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardAKA works in an accounts payable department of a major retailer. She has attempted to convince her boss to take the discount on the 3 / 25 net 90 credit terms most suppliers offer, but her boss argues that giving up the 7% discount is less costly than a short-term loan at 9%. Prove to whoever is wrong that the other is correct. (Note: Assume a 365-day year.) The cost of giving up the cash discount is _%. (round to two decimal places). Give solution to this financial accounting Problem.arrow_forward??!!arrow_forward

- Which account is considered a permanent account ?arrow_forwardAfter the accounts are adjusted and closed at the end of the year, accounts receivable have a final balance of $750,000 and an estimate of $93,000 is estimated for doubtful accounts. What is the net realizable value of accounts receivable? Answerarrow_forwardStep by step answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY