INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

9th Edition

ISBN: 9781260216141

Author: SPICELAND

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 11.13E

Group

• LO11–2

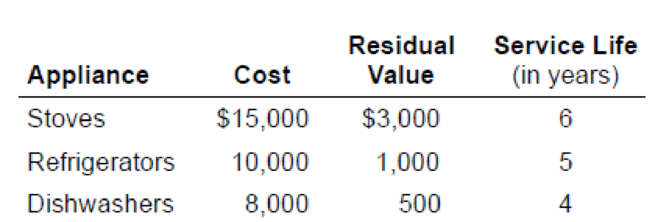

Highsmith Rental Company purchased an apartment building early in 2018. There are 20 apartments in the building and each is furnished with major kitchen appliances. The company has decided to use the group depreciation method for the appliances. The following data are available:

In 2021, three new refrigerators costing $2,700 were purchased for cash. The old refrigerators, which originally cost $1,500, were sold for $200.

Required:

1. Calculate the group depreciation rate, group life, and depreciation for 2018.

2. Prepare the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

5

Hi, I need help on this question.

Can someone help fill out the last part of this question

Chapter 11 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

Ch. 11 - Prob. 11.1QCh. 11 - Depreciation is a process of cost allocation, not...Ch. 11 - Identify and define the three characteristics of...Ch. 11 - Discuss the factors that influence the estimation...Ch. 11 - What is meant by depreciable base? How is it...Ch. 11 - Prob. 11.6QCh. 11 - Prob. 11.7QCh. 11 - Why are time-based depreciation methods used more...Ch. 11 - Prob. 11.9QCh. 11 - Prob. 11.10Q

Ch. 11 - Briefly explain the differences and similarities...Ch. 11 - Prob. 11.12QCh. 11 - Prob. 11.13QCh. 11 - What are some of the simplifying conventions a...Ch. 11 - Explain the accounting treatment required when a...Ch. 11 - Explain the accounting treatment and disclosures...Ch. 11 - Explain the steps required to correct an error in...Ch. 11 - Prob. 11.18QCh. 11 - Prob. 11.19QCh. 11 - Prob. 11.20QCh. 11 - Prob. 11.21QCh. 11 - Briefly explain the differences between U.S. GAAP...Ch. 11 - Under U.S. GAAP, litigation costs to successfully...Ch. 11 - Cost allocation At the beginning of its fiscal...Ch. 11 - Depreciation methods LO112 On January 1, 2018,...Ch. 11 - Depreciation methods; partial periods LO112 Refer...Ch. 11 - Prob. 11.4BECh. 11 - Prob. 11.5BECh. 11 - Prob. 11.6BECh. 11 - Group depreciation; disposal LO112 Mondale Winery...Ch. 11 - Prob. 11.8BECh. 11 - Prob. 11.9BECh. 11 - Prob. 11.10BECh. 11 - Change in principle; change in depreciation method...Ch. 11 - Prob. 11.12BECh. 11 - Impairment; property, plant, and equipment LO118...Ch. 11 - Prob. 11.14BECh. 11 - IFRS; impairment; property, plant, and equipment ...Ch. 11 - Prob. 11.16BECh. 11 - Prob. 11.17BECh. 11 - IFRS; impairment; goodwill LO1110 IFRS Refer to...Ch. 11 - Subsequent expenditures LO119 Demmert...Ch. 11 - Depreciation methods LO112 On January 1, 2018,...Ch. 11 - Prob. 11.2ECh. 11 - Depreciation methods; partial periods LO112 [This...Ch. 11 - Depreciation methods; asset addition; partial...Ch. 11 - Depreciation methods; solving for unknowns LO112...Ch. 11 - Depreciation methods; partial periods LO112 On...Ch. 11 - Prob. 11.7ECh. 11 - IFRS; depreciation; partial periods LO112, LO1110...Ch. 11 - IFRS; revaluation of machinery; depreciation;...Ch. 11 - Disposal of property, plant, and equipment LO112...Ch. 11 - Disposal of property, plant, and equipment;...Ch. 11 - Depreciation methods; disposal; partial periods ...Ch. 11 - Group depreciation LO112 Highsmith Rental Company...Ch. 11 - Double-declining-balance method; switch to...Ch. 11 - Prob. 11.15ECh. 11 - Prob. 11.16ECh. 11 - Cost of a natural resource; depletion and...Ch. 11 - Prob. 11.18ECh. 11 - Prob. 11.19ECh. 11 - Prob. 11.20ECh. 11 - Prob. 11.21ECh. 11 - Change in estimate; useful life and residual value...Ch. 11 - Change in principle; change in depreciation...Ch. 11 - Change in principle; change in depreciation...Ch. 11 - Prob. 11.25ECh. 11 - Impairment; property, plant, and equipment LO118...Ch. 11 - IFRS; impairment; property, plant, and equipment ...Ch. 11 - IFRS; Impairment; property, plant, and equipment ...Ch. 11 - Impairment; property, plant, and equipment LO118...Ch. 11 - Prob. 11.30ECh. 11 - IFRS; impairment; goodwill LO1110 IFRS Refer to...Ch. 11 - Prob. 11.32ECh. 11 - FASB codification research LO118 The FASB...Ch. 11 - Prob. 11.34ECh. 11 - Subsequent expenditures LO119 Belltone Company...Ch. 11 - Prob. 11.36ECh. 11 - Concept s; terminology LO111 through LO116, LO118...Ch. 11 - Retirement and replacement depreciation Appendix...Ch. 11 - Depreciation methods; change in methods LO112,...Ch. 11 - Prob. 11.2PCh. 11 - Depreciation methods; partial periods Chapters 10...Ch. 11 - Partial- year depreciation; asset addition;...Ch. 11 - Prob. 11.5PCh. 11 - Prob. 11.6PCh. 11 - Prob. 11.7PCh. 11 - Prob. 11.8PCh. 11 - Straight-line depreciation; disposal; partial...Ch. 11 - Prob. 11.10PCh. 11 - Prob. 11.11PCh. 11 - Prob. 11.12PCh. 11 - Depreciation and depletion; change in useful life;...Ch. 11 - Analysis Case 111 Depreciation, depletion, and...Ch. 11 - Communication Case 112 Depreciation LO111 At a...Ch. 11 - Judgment Case 113 Straight-line method; composite...Ch. 11 - Prob. 11.4BYPCh. 11 - Prob. 11.5BYPCh. 11 - Prob. 11.7BYPCh. 11 - Prob. 11.8BYPCh. 11 - Research Case 119 FASB codification; locate and...Ch. 11 - Ethics Case 1110 Asset impairment LO118 At the...Ch. 11 - Prob. 11.11BYPCh. 11 - Prob. 11.13BYPCh. 11 - Real World Case 1114 Disposition and depreciation;...Ch. 11 - Real World Case 1115 Depreciation and depletion...Ch. 11 - Prob. 11.16BYPCh. 11 - Target Case LO112, LO118, LO119 Target...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q#14: Keep each W&T depreciation scenario separate and do not combine facts, carefully read each problem, as facts can change. On May 1, 20X2, Whiskers & Tails, Inc. buys an airconditioned RV (i.e., a recreational vehicle AKA motor home) to use as an add on service option for clients. The motor home cost W&T $75,000 to purchase. There is high demand for the posh motor home and the company bills out the RV to clients at $125 per hour. In 20X2, at the time of purchase, the company estimated they will use the RV for 8 years and assigned it a 20% residual value. W&T initially expected to use the camper 3,000 hours in total over the eight-year estimated life but then ended up selling the RV on October 1, 20X6 before the 8 years was over. The below table summarizes the company's actual use of the RV (at customer events): 20X2 20X3 20X4 20X5 20X6 Total Actual Hours of Use Per Year 250 310 440 380 320 1,700 Cumulative 250 560 1,000 1,380 1,700 Assume W&T sells the RV on October 1, 20X6 for a…arrow_forwardPlease help me. Thankyou.arrow_forwardI could use some help with the last part of this hwarrow_forward

- Chapter 10, Question 1arrow_forward31arrow_forwardAsset Office furniture Machinery Used delivery truck* *Not considered a luxury automobile. During 2022, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2023 to increase its production capacity. These are the assets acquired during 2023: Cost $ 190,000 1,600,000 48,000 Description 2022 Assets Office furniture Machinery Used delivery truck 2023 Assets Asset Computers and information system Luxury auto* Assembly equipment Storage building *Used 100% for business purposes. Karane generated taxable income in 2023 of $1,742,500 for purposes of computing the §179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Computers and Information System Luxury Auto Assembly Equipment Storage Building Total vate Placed in Service 02/03/2022 07/22/2022 08/17/2022 Required: b. Compute the maximum 2023 depreciation…arrow_forward

- Testbank Multiple Choice Question 65 On February 1, 2020, Waterway Industries purchased a parcel of land as a factory site for $310000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2020. Costs incurred during this period are listed below: Demolition of old building $ 20700 Architect's fees 34700 Legal fees for title investigation and purchase contract 4500 Construction costs 1378000 (Salvaged materials resulting from demolition were sold for $8600.) Waterway should record the cost of the land and new building, respectively, as O $322100 and $1417200. O $322100 and $1412700. O $326600 and $1412700. O $335200 and $1404100.arrow_forwardProblem 8-33 (LO. 2) Debra acquired the following new assets during 2020: Date Asset Cost April 11 Furniture $40,000 July 28 Trucks 40,000 November 3 Computers 70,000 Debra does not elect immediate expensing under § 179. She does not claim any available additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the depreciation tables to use for this problem. c. The cost recovery deductions for the current year is: Furniture: $fill in the blank 5 Trucks: $fill in the blank 6 Computers: $fill in the blank 7 Exhibit 8.4 MACRS Accelerated Depreciation for Personal Property Assuming Mid-Quarter Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 (Partial Table) 3-Year Recovery Year First Quarter Second Quarter Third Quarter Fourth Quarter 1 58.33 41.67 25.00 8.33 2 27.78 38.89 50.00 61.11 5-Year Recovery Year First Quarter Second Quarter Third…arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY