Concept explainers

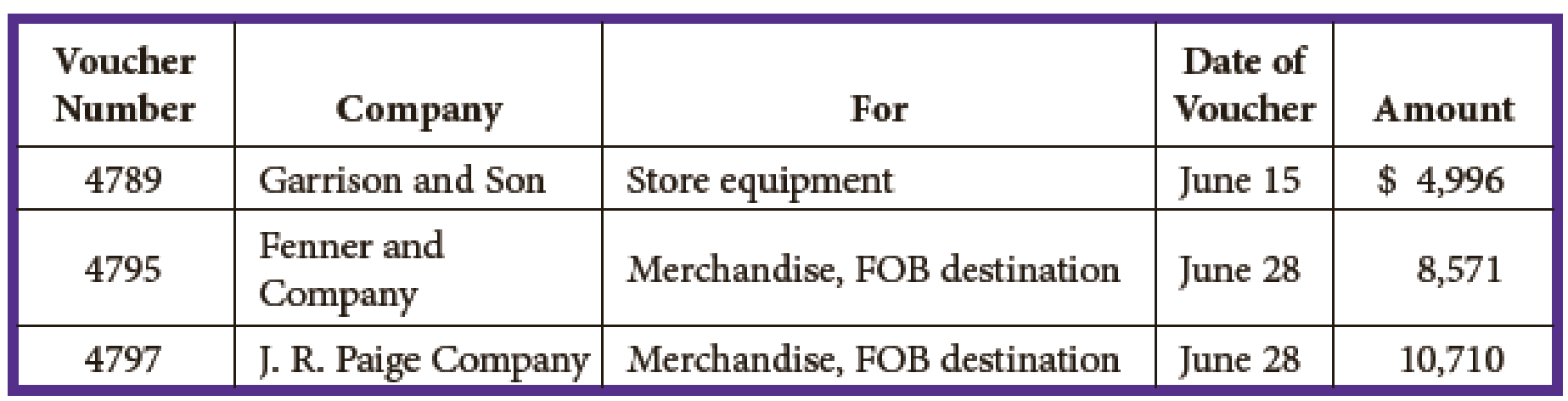

Hartman Company, which uses a voucher system, has the following unpaid vouchers on July 1. The firm follows the practice of recording vouchers at the gross amount.

The company completed the following transactions during July:

July 1 Issued voucher no. 4800 in favor of Mortenson Insurance Company for a premium on a 12-month fire insurance policy, $890.

2 Paid voucher no. 4789 by issuing Ck. No. 8219, $4,996.

2 Issued Ck. No. 8220 in payment of voucher no. 4800, $890.

3 Issued voucher no. 4801 in favor of Quinn Quick Freight for transportation charges on merchandise purchases, $223.

5 Paid voucher no. 4801 by issuing Ck. No. 8221, $223.

7 Issued Ck. No. 8222 in payment of voucher no. 4795, $8,485.29 ($8,571 less 1 percent cash discount).

8 Issued Ck. No. 8223 in payment of voucher no. 4797, $10,602.90 ($10,710 less 1 percent cash discount).

11 Established a petty cash fund of $250. Issued voucher no. 4802.

11 Paid voucher no. 4802 by issuing Ck. No. 8224, $250.

13 Issued voucher no. 4803 in favor of Mohammad Company for merchandise, $14,708; terms 2/10, n/30; FOB shipping point; freight prepaid and added to the invoice, $384 (total, $15,092).

15 Received bill for advertising in the Weekly Ads. Issued voucher no. 4804 in the amount of $410.

17 Received a credit memo for $764 from Mohammad Company for merchandise returned to it, credit memo no. 540 (pertaining to voucher no. 4803).

20 Issued voucher no. 4805 in favor of Vinson County for six months’ property tax (Prepaid Property Taxes), $2,272.

20 Paid voucher no. 4805 by issuing Ck. No. 8225, $2,272.

21 Issued Ck. No. 8226 in payment of voucher no. 4803, $14,049.12 ($14,708 less $764 return, less cash discount, plus freight).

23 Bought merchandise on account from Summers and Company, $6,039; terms 1/10, n/30; FOB destination. Issued voucher no. 4806.

27 Received a credit memo for $984 from Summers and Company for damaged merchandise, credit memo no. 437 (pertaining to voucher no. 4806).

31 Issued voucher no. 4807 to reimburse petty cash fund. The charges were:

July 31 Issued Ck. No. 8227 in payment of voucher no. 4807, $225.10.

31 Issued voucher no. 4808 for wages payable, $8,448, in favor of the payroll bank account. (Assume that the payroll entry was recorded previously in the general journal.)

31 Paid voucher no. 4808 by issuing Ck. No. 8228, payable to Payroll Bank Account.

Required

- 1. Using the voucher issue date, enter the unpaid invoices in the voucher register (page 75) beginning with voucher no. 4789. Then draw double lines across all columns to separate the vouchers of June from those of July.

- 2. Enter the transactions for July in the voucher register at the gross amount. Also record the appropriate transactions in the check register (page 86) and the general journal (page 41).

- 3. Total and rule the voucher register and the check register for the transactions recorded during July.

- 4. Prove the equality of the debits and credits on the voucher register and the check register.

Trending nowThis is a popular solution!

Chapter 10A Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Essentials of MIS (13th Edition)

Principles of Microeconomics (MindTap Course List)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Economics (MindTap Course List)

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning