Concept explainers

Fixed

Primara Corporation has a

Required:

- Compute the fixed portion of the predetermined overhead rate for the year.

- Compute the fixed overhead

budget variance and volume variance.

1

Fixed portion of the predetermined overhead rate of the year.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Explanation of Solution

2

Fixed overhead budget variance and volume variance.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Budgeted variances is $4,000U and volume variances is $10,000F

Explanation of Solution

Want to see more full solutions like this?

Chapter 10A Solutions

MGMR ACCT F/MANAGERS-CONNECT 180-DAY COD

- (Appendix 10A) Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported on the balance sheet at the end of the year. e. All of these.arrow_forward(Appendix) Calculating factory overhead: three variances Using the data given in E8-17, calculate the following overhead variances: a. Spending variance. b. Production-volume variance. c. Efficiency variance. d. Was the factory overhead under- or overapplied? By what amount? In all problems involving variances, use F and U to indicate favorable and unfavorable variances, respectively.arrow_forwardVariances Refer to Cornerstone Exercise 9.6. Required: 1. Calculate the variable overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to the nearest dollar.) 2. Calculate the variable overhead efficiency variance using the formula approach. 3. Calculate the variable overhead spending variance and variable overhead efficiency variance using the three-pronged graphical approach. 4. What if 26,100 direct labor hours were actually worked in February? What impact would that have had on the variable overhead spending variance? On the variable overhead efficiency variance? Standish Company manufactures consumer products and provided the following information for the month of February: Required: 1. Calculate the fixed overhead spending variance using the formula approach. 2. Calculate the volume variance using the formula approach. 3. Calculate the fixed overhead spending variance and volume variance using the three-pronged graphical approach. 4. What if 129,600 units had actually been produced in February? What impact would that have had on the fixed overhead spending variance? On the volume variance?arrow_forward

- Breakaway Companys labor information for May is as follows: A. What is the actual direct labor rate per hour? B. What is the standard direct labor rate per hour? C. What was the total standard direct labor cost for May? D. What was the direct labor rate variance for May?arrow_forwardIf variances are recorded in the accounts at the time the manufacturing costs are incurred, what does a debit balance in Direct Materials Price Variance represent?arrow_forwardTopic: Variance Analysisarrow_forward

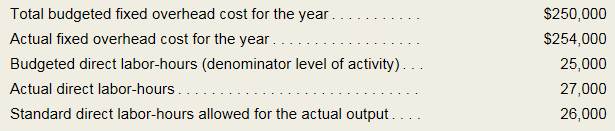

- Provide solution for this questionarrow_forwardFixed Overhead Variances Primara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. 2. Compute the fixed overhead budget variance and volume variance.arrow_forwardHi expart give correct solution for these accounting questionarrow_forward

- the Fixed overhead capacity variance is nearest to?? A. P4,710 F B. P4,710 UC. P5,110 FD. P5,110 Uarrow_forwardf. Variable manufacturing overhead efficiency variance g. Fixed manufacturing overhead spending variance h. Production-volume variancearrow_forwardAssume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours Actual direct labor-hours Standard direct labor-hours allowed for the actual output What is the fixed overhead volume variance? Multiple Choice O $20,000 U $20,000 F $9,000 U $9,000 F $ 300,000 $ 276,000 60,000 56,000 58, 200arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning