Concept explainers

Dexter Construction Corporation is building a student condominium complex; it started construction on January 1, Year 1. Dexter borrowed $2.5 million on January 1 specifically for the project by issuing a 10%, 5-vear, $2.5 million note, which is payable on December 31 of Year 3. Dexter also had a 12%, 5-year, $3 million note payable and a 10%, 10-year, $1.8 million note payable outstanding all year. Calculate the weighted average interest rate on the non-construction-specific debt for Year 1.

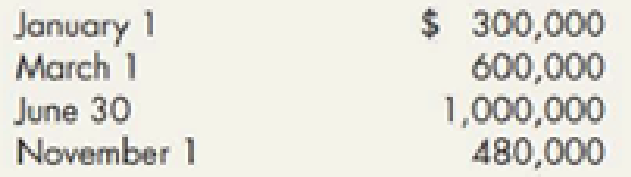

RE10-9 Refer to RE10-8. In Year 1, Dexter incurred costs as follows:

Calculate Dexter’s weighted average accumulated expenditures.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Clayton Company borrowed $7, 300 from the State Bank on April 1, Year 1. The one-year note carried a 19% rate of interest. The amount of interest expense that Clayton would report in Year 1 and Year 2, respectively would be: Multiple Choice $1, 387 and $o. $1,040 and So. So and $1,387. $1,040 and $347.arrow_forwardConcord Corporation is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6490000 on March 1, $5270000 on June 1, and $8250000 on December 31. Concord Corporation borrowed $3180000 on January 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year, $6350000 note payable and an 11%, 4-year, $11950000 note payable.What is the weighted-average interest rate used for interest capitalization purposes? 10.85% 10.50% 11.00% 10.65%arrow_forwardVipularrow_forward

- On January 1, Year 1, Brown Co. borrowed cash from First Bank by issuing a $68,500 face value, four-year term note that had an 9 percent annual interest rate. The note is to be repaid by making annual cash payments of $21,144 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $37,675 cash per year. statement of cash flowarrow_forwardBonita Industries is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6440000 on March 1, $5260000 on June 1, and $8850000 on December 31. Bonita Industries borrowed $3190000 on January 1 on a 5-year, 11% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 3-year, $6440000 note payable and an 10%, 4-year, $12650000 note payable.What are the weighted-average accumulated expenditures? $9860000 $20550000 $8435000 $11700000arrow_forwardOn July 31, 2025, Wildhorse Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction began immediately and was completed on November 1, 2025. To help finance construction, on July 31 Wildhorse issued a $284,400, 3-year, 10% note payable at Netherlands National Bank, on which interest is payable each July 31. $183,400 of the proceeds of the note was paid to Minsk on July 31. The remainder of the proceeds was temporarily invested in short-term marketable securities (trading securities) at 8% until November 1. On November 1, Wildhorse made a final $101,000 payment to Minsk. Other than the note to Netherlands, Wildhorse's only outstanding liability at December 31, 2025, is a $31,200, 6%, 6-year note payable, dated January 1, 2022, on which interest is payable each December 31. (a) Calculate weighted-average accumulated expenditures, avoidable interest, and total interest cost to be capitalized during 2025. Weighted-average accumulated…arrow_forward

- On July 31, 2025, Oriole Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction began immediately and was completed on November 1, 2025. To help finance construction, on July 31 Oriole issued a $326,400, 3-year, 12% note payable at Netherlands National Bank, on which interest is payable each July 31. $217,400 of the proceeds of the note was paid to Minsk on July 31. The remainder of the proceeds was temporarily invested in short-term marketable securities (trading securities) at 10% until November 1. On November 1, Oriole made a final $109,000 payment to Minsk. Other than the note to Netherlands, Oriole's only outstanding liability at December 31, 2025, is a $31,400, 8 %, 6-year note payable, dated January 1, 2022, on which interest is payable each December 31. (a) Calculate weighted average accumulated expenditures, avoidable interest, and total interest cost to be capitalized during 2025. Weighted-average accumulated expenditures…arrow_forwardJamaica Corporation carried out the following transactions involving note payable. During the fiscal year ended December 31, 2020. Aug 6 Borrowed $ 15,200 from Tony Stark, issuing to him a 45 da, 14% note payable. Sept. 16 Purchased office equipment from Ikea Company. The invoice amount was $18,800 and Ikea Company agreed to accept as full payment a 3-month, 15% note for the invoice amount. Sept. 20 Paid Tony Stark note plus accrued interest. Nov.1 Borrowed $ 2,35,000 from Nation Commercial Bank at an interest rate of 12% per annum; signed a 90-days note payable for $ 2,42,256, which included a $7,056 interest charge in the face amount. Dec.1 Purchased merchandise in the amount of $13,000 from Stephens & Co. Gave in settlement a 60-day note nearing interest at 15% (Perpetual inventory system is deployed). Dec. 16 The $18,800 note payable to Ikea Company matured today. Paid the interest accrued and issued new 30-days, 12% note to replace the maturing note.…arrow_forwardplease help mearrow_forward

- Sheffield Corp. is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6470000 on March 1, $5340000 on June 1, and $7950000 on December 31. Sheffield Corp. borrowed $3250000 on January 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 8%, 3-year, $6450000 note payable and an 9%, 4-year, $12350000 note payable. What is the weighted-average interest rate used for interest capitalization purposesarrow_forwardBoyd Company has a line of credit with State Bank. Boyd can borrow up to $520,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during Year 1. Boyd agreed to pay interest at an annual rate equal to 1 percent above the bank’s prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Boyd pays 6 percent (5 percent + 1 percent) annual interest on $72,000 for the month of January. Month Amount Borrowed or (Repaid) Prime Rate for the Month January $ 72,000 5% February 52,000 5 March (46,000) 6 April through October No change No change November (36,000) 6 December (22,000) 5 Boyd earned $37,000 of cash revenue during Year 1.Required Prepare an income statement, balance sheetand statement of cash…arrow_forwardJian Kang Co. is building a new hockey arena at a cost of $6,000,000. It received a down payment of $2,000,000 from local businesses to support the project and now needs to borrow $4,000,000 to complete the project. It therefore decides to issue $4,000,000 of 10.5%, 10-year bonds. These bonds were issued on January 1, 2018, and pay interest annually on each January 1. The bonds yield 10%. Instructions:a. Prepare a bond amortization schedule.b. Prepare the journal entries needed in 2018 and 2019. Assume that on July 1, 2021, Jian Kang Co. retires half of the bonds at a cost of $1,065,000 and the accrued interest. Prepare the journal entry to record this retirement.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning