Concept explainers

Problem 10-86A Stock Dividends and Stock Splits

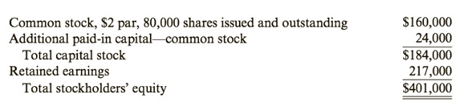

Lance Products’ balance sheet includes total assets of $587,000 and the following equity account balances at December 31, 2019:

Lance’s common stock is selling for $12 per share on December 31, 2019.

Required:

- How much would Lance Products have reported for total assets and

retained earnings on December 31, 2019, if the firm had declared and paid a $15,000 cash dividend on December 31, 2019? Prepare thejournal entry for this cash dividend. - How much would Lance have reported for total assets and retained earnings on December 31, 2019, if the firm had issued a 15% stock dividend on December 31, 2019? Prepare the journal entry for this stock dividend.

- CONCEPTUAL CONNECTION How much would Lance have reported for total assets and retained earnings on December 31, 2019, if the firm had effected a 2-for-l stock split on December 31, 2019? Is a journal entry needed to record the stock split? Why or why not?

(a)

Introduction:

Dividend is the amount that is paid to the stockholders’ periodically as a return on their investment in the company. Dividend can be made in two forms i.e. Cash Dividend and Stock Dividend.

To prepare:

Journal Entries for cash dividend and calculate value of retained earnings as well total assets.

Answer to Problem 86PSA

After paying Cash dividend,

Total Assets = $572,000

Retained Earnings = $202,000

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| December 31 | Retained Earnings Dr. Dividends Payable (Declaration of cash dividend.) |

15,000 | 15,000 |

| December 31 | Dividends Payable Dr. Cash (Payment of declared dividend.) |

15,000 | 15,000 |

Explanation of Solution

Given:

Total Assets is equal to $587,000, common stock selling at $12 as on 31st December 2019 and following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares issued and outstanding | 160,000 |

| (+) Additional Paid-in capital − common stock | 24,000 |

| Total Capital Stock | 184,000 |

| Retained Earnings | 217,000 |

| Total Stockholders’ equity | 401,000 |

There are two types of dividend i.e. Stock and Cash Dividend.

- The first effect of both the dividends (cash or stock) is on Retained Earnings of the company. The dividend payable amount reduces the balance in retained earnings.

- The second effect of the dividend (cash or stock) is on the account through which they are paid.

- If cash dividend is paid then the second effect is on cash account as cash in the company decreases.

- If stock dividend is paid then the second effect is on common stock and additional paid in capital account as new shares are issued as dividends which further increase the balance of these accounts.

Before Cash Dividend was paid,

Retained Earnings = $217,000

Total Assets = $587,000

After payment of Cash Dividend of $15,000,

Retained Earnings = $217,000 - 15,000

Retained Earnings = $202,000

Total Assets = $587,000 - 15,000

Total Assets = $572,000.

(b)

Introduction:

Dividend is the amount that is paid to the stockholders’ periodically as a return on their investment in the company. Dividend can be made in two forms i.e. Cash Dividend and Stock Dividend.

To prepare:

Journal Entry for stock dividend and calculate value of retained earnings as well total assets.

Answer to Problem 86PSA

After paying Stock dividend,

Retained Earnings = $73,000

Total Assets = $587,000

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| December 31 | Retained Earnings Dr. Common Stock Additional Paid-in Capital (Declaration of cash dividend.) |

144,000 | 24,000 120,000 |

Explanation of Solution

Given:

Total Assets is equal to $587,000, common stock selling at $12 as on 31st December 2019 and following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares issued and outstanding | 160,000 |

| (+) Additional Paid-in capital − common stock | 24,000 |

| Total Capital Stock | 184,000 |

| Retained Earnings | 217,000 |

| Total Stockholders’ equity | 401,000 |

There are two types of dividend i.e. Stock and Cash Dividend.

- The first effect of both the dividends (cash or stock) is on Retained Earnings of the company. The dividend payable amount reduces the balance in retained earnings.

- The second effect of the dividend (cash or stock) is on the account through which they are paid.

- If cash dividend is paid then the second effect is on cash account as cash in the company decreases.

- If stock dividend is paid then the second effect is on common stock and additional paid in capital account as new shares are issued as dividends which further increase the balance of these accounts.

No. of shares outstanding = 80,000

Stock Dividend = 15%

Stock Dividend = 12,000 shares

Total Par value of stock dividend =

Total Par value of stock dividend =

Total Par value of stock dividend = $24,000

Total Market value of stock dividend =

Total Market value of stock dividend =

Total Market value of stock dividend = $144,000

Additional paid in capital = $144,000 - $24,000

Additional paid in capital = $120,000

Before Cash Dividend was paid,

Retained Earnings = $217,000

Total Assets = $587,000

After payment of Cash Dividend of $15,000,

Retained Earnings = $217,000 - $144,000

Retained Earnings = $73,000

Total Assets (will remain unchanged) = $587,000.

(c)

Introduction:

In stock split, shares outstanding increases by given ratio and the price of stock decreases by the same ratio wherein the total stockholders’ equity remains unchanged.

To state:

Whether journal entry will be recorded for stock split and the value of retained earnings as well total assets.

Answer to Problem 86PSA

After Stock-split,

Retained Earnings = $217,000

Total Assets = $587,000

Stock split doesn’t affect the Total assets as well retained earnings. Thus, they remain same. It only affects no. of shares outstanding and price per share (still stockholders’ equity remains unchanged).

Since there is no actual change in stockholders’ equity or balance sheet as a whole, hence no journal entry is required for stock split.

Explanation of Solution

Given:

Total Assets is equal to $587,000, common stock selling at $12 as on 31st December 2019 and following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares issued and outstanding | 160,000 |

| (+) Additional Paid-in capital − common stock | 24,000 |

| Total Capital Stock | 184,000 |

| Retained Earnings | 217,000 |

| Total Stockholders’ equity | 401,000 |

Before stock split,

No. of shares outstanding = 80,000

Par Value = $2

After stock split,

Stock Split ratio = 2-for-1

No. of shares outstanding =

No. of shares outstanding = 160,000

Price per share =

Price per share = $1

Before Stock-split,

Retained Earnings = $217,000

Total Assets = $587,000

Shareholders’ equity =

Shareholders’ equity =

Shareholders’ equity = $160,000

After Stock-split,

Retained Earnings = $217,000

Total Assets = $587,000

Shareholders’ equity =

Shareholders’ equity =

Shareholders’ equity = $160,000.

Want to see more full solutions like this?

Chapter 10 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Which financial statement shows a company’s financial position at a specific point in time?A. Income StatementB. Balance SheetC. Statement of Cash FlowsD. Statement of Retained Earningsarrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardGeneral accountingarrow_forward

- general accountingarrow_forwardSkysong Company began operations on January 2, 2025. It employs 8 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Vacation Days Used Wage Rate by Each Employee Sick Days Used by Each Employee 2025 2026 2025 2026 2025 2026 $6 $7 0 8 4 5 Skysong Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned.arrow_forwardCan you provide the valid approach to solving this financial accounting question with suitable standards?arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning