Concept explainers

Self-Construction Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from $35,000 to $200,000. During the 5-month period from August 1, 2019, through December 31, 2019, Olson manufactured a milling machine for its own use. This machine was built as part of the regular production activities. The project required a large amount of time front planning and supervisory personnel, as well as that of some of the company’s officers, because it was a more sophisticated type of machine than the regular production models.

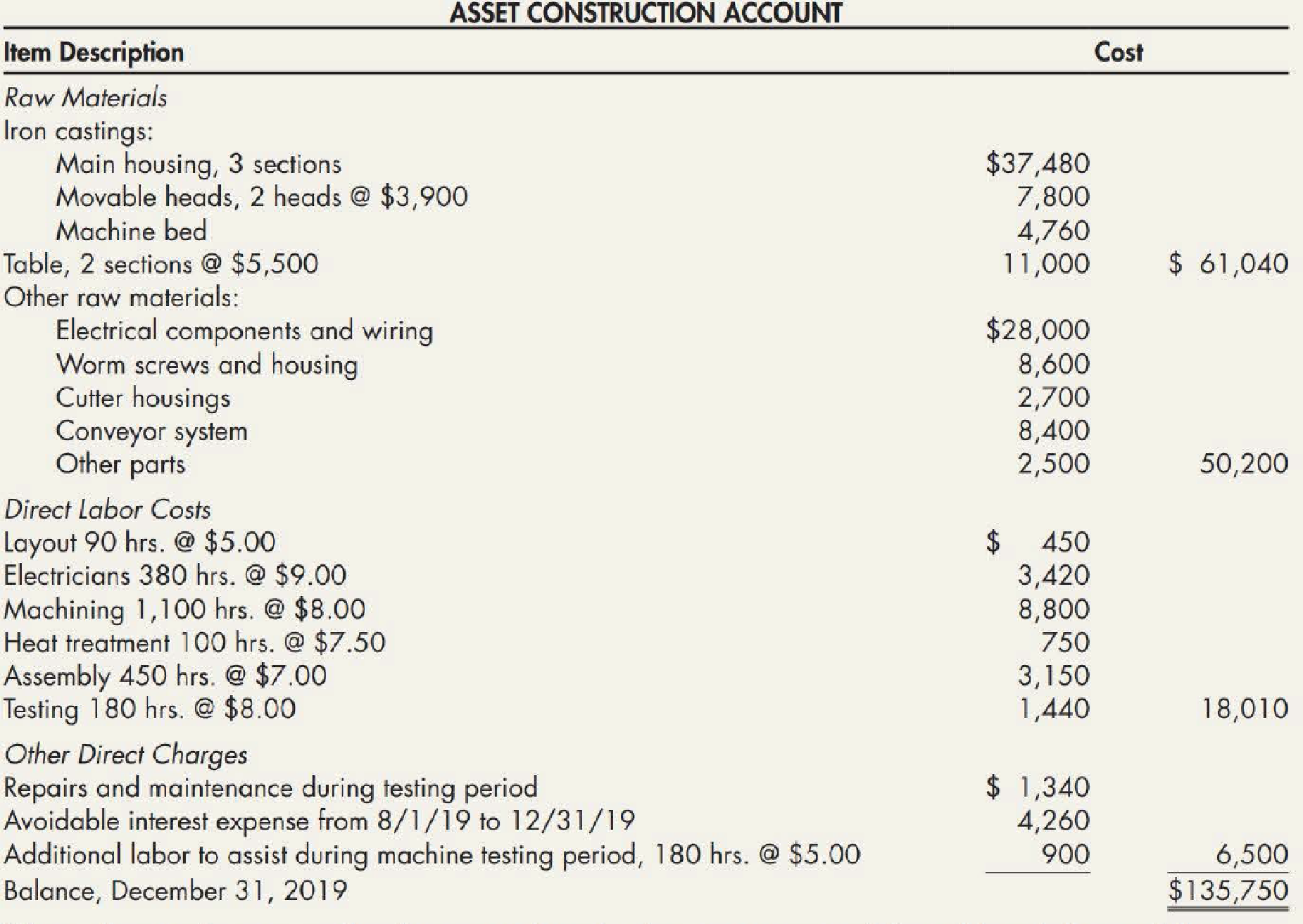

Throughout the 5-month period, Olson charged all costs directly associated with the construction of the machine to a special account entitled “Asset Construction Account.” An analysis of the charges to this account as of December 31, 2019, follows:

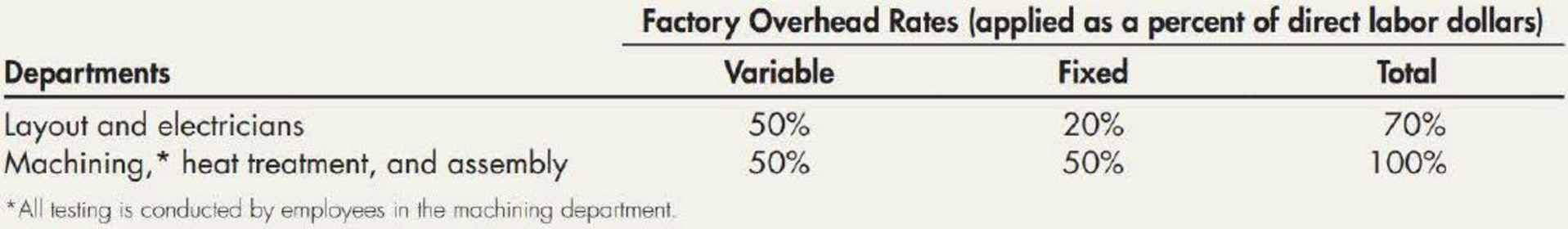

Olson allocates factory

Olson uses a flat rate of 40% of direct labor dollars to allocate general and administrative overhead.

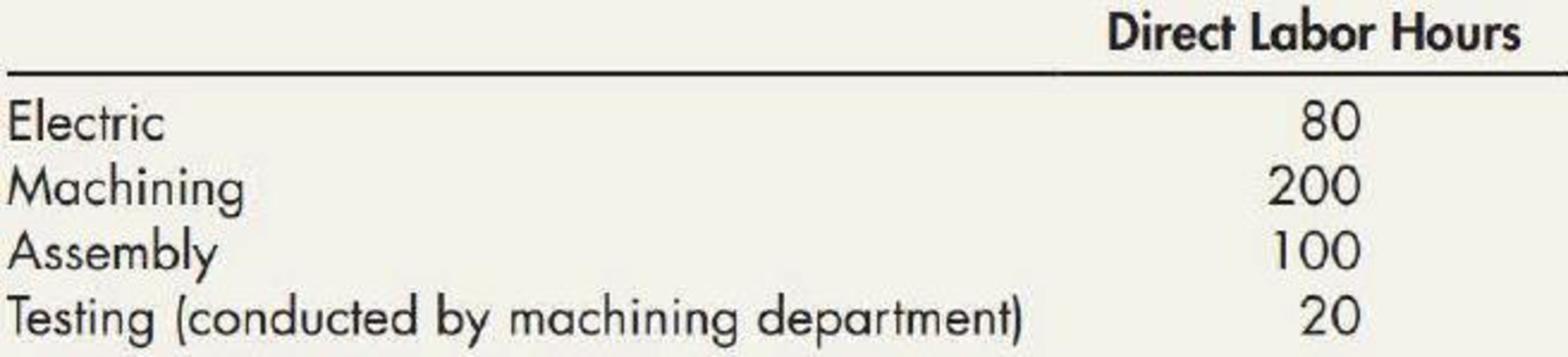

During the machine testing period, a cutter head malfunctioned and did extensive damage to the machine table and one cutter housing. This damage was not anticipated and was the result of an error in the assembly operation. Although no additional raw materials were needed to make the machine operational after the accident, the following labor for rework was required:

Olson has included all these labor charges in the asset construction account. In addition, it included in the account the repairs and maintenance charges of $1,340 that it incurred as a result of the malfunction.

Required:

- 1. Compute, consistent with GAAP and common practice, the amount that Olson should capitalize for the milling machine as of December 31, 2019, when it declares the machine operational.

- 2. Next Level Identify the costs you included in Requirement 1 for which there are acceptable alternative procedures. Describe the alternative procedure(s) in each case.

1.

Calculate the amount that Company O must capitalize for the milling machine as of December 31, 2019.

Explanation of Solution

Cost of self-constructed assets:

Company sometimes constructs an item of “property, plant and equipment” which is used in the business operations and these are known as self-constructed assets. The cost of self-constructed assets comprises of expenses that are required to build an asset and put it in operating condition.

| Particulars | Amount ($) | Amount ($) |

| Raw materials: | ||

| Iron castings | 61,040 | |

| Other raw materials. | 50,200 | $111,240 |

| Direct labor: | ||

| Layout (1) | $450 | |

| Electricians (2) | 2,700 | |

| Machinery (3) | 7,200 | |

| Heat treatment (4) | 750 | |

| Assembly (5) | 2,450 | |

| Testing (6) | 1,280 | |

| Additional testing labor (7) | 800 | 15,630 |

| Factory overhead: | ||

| Layout and electricians (8) | $2,205 | |

| Machining, heat treatment, assembly, testing (9) | ||

| 12,480 | 14,685 | |

| Interest paid | 4,260 | |

| Total amount to be capitalized | 145,815 |

Table (1)

Working notes:

(1)Calculate the amount of direct labor costs for layout:

(2)Calculate the amount of direct labor costs for electricians:

(3)Calculate the amount of direct labor costs for machinery:

(4)Calculate the amount of direct labor costs for Heat treatment:

(5)Calculate the amount of direct labor costs for assembly:

(6)Calculate the amount of direct labor costs for testing:

(7)Calculate the amount of direct labor costs for additional testing labor:

(8)Calculate the factory overhead for layout and electricians:

(9)Calculate the factory overhead for machinery, heat treatment, assembly and testing:

2.

Ascertain the costs included in requirement 1 for which there are acceptable alternative procedures and explain the alternative procedures for each case.

Explanation of Solution

“Alternate procedures are probable for two costs— factory overhead and rework costs (affects direct labor, repairs and maintenance, and factory overhead)”

- Rework costs must be taken as cost for the period in which they are nonstandard. Rework costs rising from errors that must not have incurred should be considered as losses of the period. Seemingly, this was the case in this condition since the impairment resulted from a type of error that is not expected. Accordingly, related repairs, maintenance expenses and rework costs are not capitalized in requirement 1.

- Two alternative ways are there to allocate overhead costs to self-constructed assets. The method followed in “requirement 1” is to allot a portion of all overhead costs to the self-constructed asset. The reason which justifies this particular treatment is that all productive output must absorb its proportionate share of all factory overhead costs. Additionally, this method result in a cost of the constructed asset that approximates the cost of the equivalent asset acquired.

- Capitalizing the incremental overhead, that is traceable fixed and variable overhead is the second method that increases as a result of construction. Additional costs occurred in production of the fixed asset (part of the assets’ cost) are included in this method. Traceable fixed overhead and variable overhead are occurred to build the asset and it will be advantageous in the upcoming periods therefore, these costs must be capitalized.

- If there is no relationship between the self-constructed asset and fixed overhead costs, non-traceable fixed overhead costs will be incurred so, these costs must not be capitalized.

Want to see more full solutions like this?

Chapter 10 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning