INTERNATIONAL ACCOUNTING>CUSTOM<

5th Edition

ISBN: 9781307409376

Author: Doupnik

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 7EP

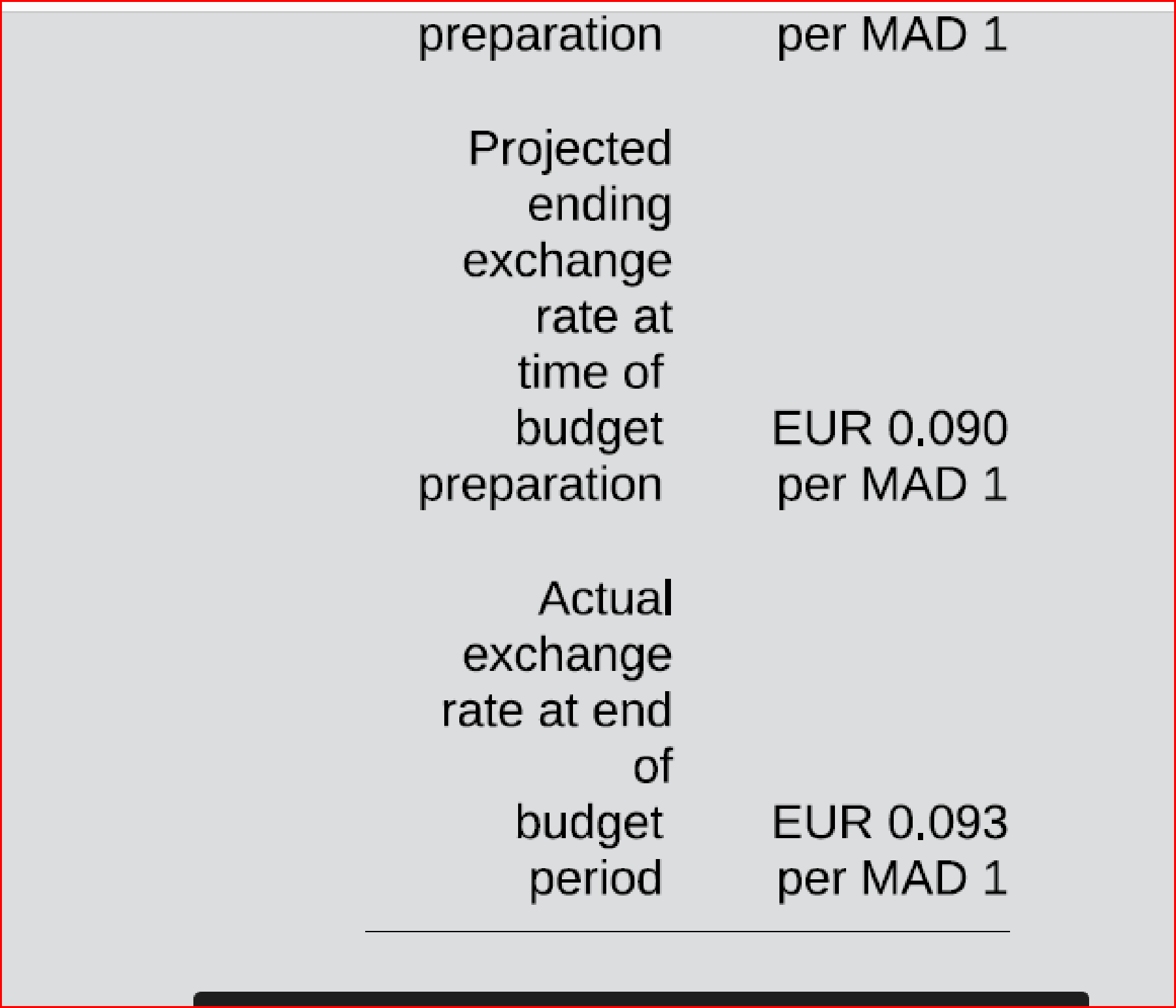

Philadelphia, Inc. (a Greek company) has a foreign subsidiary in Morocco, whose manager is evaluated on the basis of profit in euros (EUR). In the current year, the foreign subsidiary was budgeted to generate a profit of 1,000,000 Moroccan dirham (MAD), and actual profit for the year was MAD 1,050,000. Philadelphia’s corporate management has calculated an unfavorable total

Required:

- a. Identify the combination of exchange rates (see Exhibit 10.10) used by Philadelphia’s corporate management in translating budget and actual amounts that results in the total budget variance of EUR 11,650.

- b. Determine the portion of the total budget variance calculated by Philadelphia’s corporate management that is caused by a change in the exchange rate between the EUR and the MAD. (There are three possible correct responses to this requirement.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Given solution for Financial accounting question not use ai

Please provide the answer to this general accounting question using the right approach.

Can you solve this financial accounting question using valid financial methods?

Chapter 10 Solutions

INTERNATIONAL ACCOUNTING>CUSTOM<

Ch. 10 - Prob. 1QCh. 10 - What makes calculation of NPV for a foreign...Ch. 10 - How does the evaluation of a potential foreign...Ch. 10 - Prob. 4QCh. 10 - How does an ethnocentric organizational structure...Ch. 10 - Prob. 6QCh. 10 - When might it be appropriate to evaluate the...Ch. 10 - Prob. 8QCh. 10 - Prob. 9QCh. 10 - How can a local currency operating budget and...

Ch. 10 - Prob. 11QCh. 10 - What is the advantage of using a projected future...Ch. 10 - Prob. 3EPCh. 10 - Prob. 4EPCh. 10 - Imogdi Corporation (a U.S-based company) has a...Ch. 10 - Philadelphia, Inc. (a Greek company) has a foreign...Ch. 10 - Fitzwater Limited (an Irish company) has a foreign...Ch. 10 - Prob. 9EPCh. 10 - Viking Corporation (a U.S.-based company) has a...Ch. 10 - Duncan Street Company (DSC), a British company, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ainsley Corp. has retained earnings of $52,600 on August 1. Revenues for August were $10,400. Expenses for August were $3,950. In August, the company paid out a total of $1,500 in dividends to its shareholders. What is the value of retained earnings on August 31?arrow_forward3 pointsarrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- I need help with this financial accounting problem using proper accounting guidelines.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid procedures.arrow_forwardA manufacturer estimates its factory overhead costs to be $72,000 and machine hours to be 9,000 for the year. If the actual hours worked on production total 6,200 and the actual factory overhead costs are $53,500, what is the amount of the over- or under-applied factory overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Securities Markets and Transactions Pt1; Author: Larry Byerly;https://www.youtube.com/watch?v=v0ClVlaxWFY;License: Standard Youtube License