MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

20th Edition

ISBN: 9781259969614

Author: SPILKER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 76CP

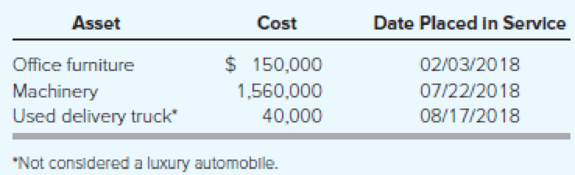

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2018. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2018:

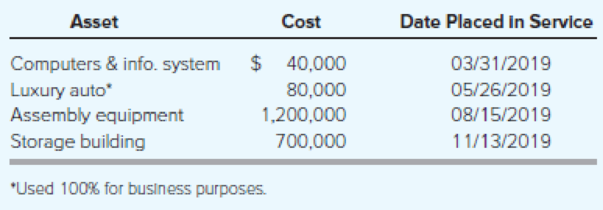

During 2018, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2019 to increase its production capacity. These are the assets acquired during 2019:

Karane generated taxable income in 2019 of $1,732,500 for purposes of computing the §179 expense limitation.

Required

- a) Compute the maximum 2018

depreciation deductions, including §179 expense (ignoring bonus depreciation). - b) Compute the maximum 2019 depreciation deductions, including §179 expense (ignoring bonus depreciation).

- c) Compute the maximum 2019 depreciation deductions, including §179 expense, but now assume that Karane would like to take bonus depreciation.

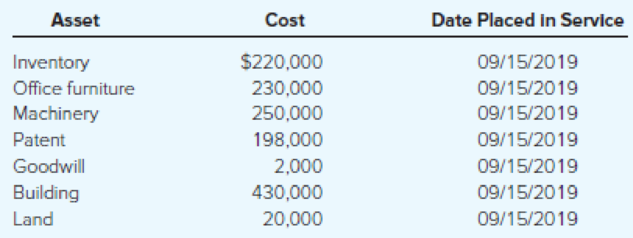

- d) Now assume that during 2019, Karane decides to buy a competitor’s assets for a purchase price of $1,350,000. Compute the maximum 2019 cost recovery, including §179 expense and bonus depreciation. Karane purchased the following assets for the lump-sum purchase price:

- e) Complete Part I of Form 4562 for part (b) (use the most current form available).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

general accounting ?

I am searching for the correct answer to this general accounting problem with proper accounting rules.

I need the correct answer to this general accounting problem using the standard accounting approach.

Chapter 10 Solutions

MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Accounting solutionarrow_forwardJoe and Ethan each own 50% of JH Corporation, a calendar year taxpayer. Distributions from JH are: $750,000 to Joe on April 1 and $250,000 to Ethan on May 1. JH’s current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Ethan’s distribution? a. $0b. $75,000c. $150,000d. $300,000e. None of the above b or c?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License