MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

20th Edition

ISBN: 9781259969614

Author: SPILKER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 46P

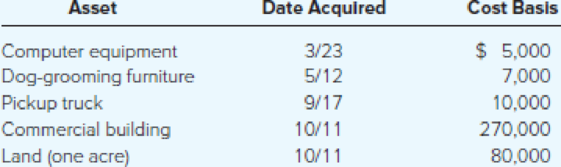

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff’s Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing and elects not to use bonus

- a) What is Poplock’s year 1 depreciation deduction for each asset?

- b) What is Poplock’s year 2 depreciation deduction for each asset?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for the correct answer to this general accounting question with appropriate explanations.

Can you explain the correct methodology to solve this general accounting problem?

Can you help me solve this general accounting problem using the correct accounting process?

Chapter 10 Solutions

MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License