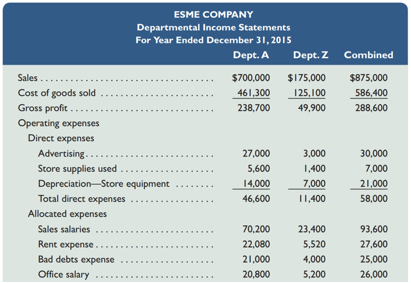

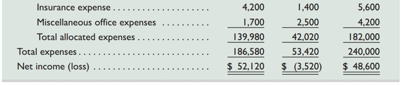

Esme Company’s management is trying to decide whether to eliminate Department Z, which has produced low

In analyzing whether to eliminate Department Z, management considers the following items:

a. The company has one office worker who earns $500 per week or $26,000 per year and four salesclerks who each earn $450 per week or $23,400 per year for each salesclerk.

b. The full salaries of three salesclerks are charged to Department A. The full salary of salesclerk is charged to Department Z.

C. Eliminating Department Z would avoid the sales salaries and the office salary currently allocated to it.

However, management prefers another plan. Two salesclerks have indicated that they will quitting soon. Management believes that their work can be done by two remaining clerks if the office worker works in sales half-time. Eliminating Department Z will this shift of duties. If this change is implemented, half the office worker’s salary would be reported as sales salaries and half would be reported as office salary.

d. The Store building is rented under a long-term lease that cannot be changed. Therefore, Department A will use the space and equipment currently used by Department Z.

e. Closing Department Z will eliminate its expenses for advertising,

Required

1. Prepare a three-column report that lists items and amounts for (a) the company’s total expenses (including cost of goods sold)--in column 1, (b) the expenses that would be eliminated by closing

Department Z—in column 2, and (c) the expenses that will continue—in column 3.

2. Prepare a

Department Z assuming that it will not affect Department A’s sales and gross profit. The statement should reflect the reassignment of the office worker to one-half time as a salesclerk.

Analysis Component

3. Reconcile the company’s combined net income with the forecasted net income assuming that

Department Z is eliminated (list both items and amounts). Analyze the reconciliation and explain why you think the department should or should not eliminated.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- ??arrow_forwardA 15-year maturity, 8% coupon bond paying coupons semiannually is callable in 7 years at a call price of $1,050. The bond currently sells at a yield to maturity of 9% per year. What is the yield to call? What is the yield to call if the call price is $1,100 and the bond can be called in 3 years instead of 7 years?arrow_forwardprovide correct answer of this General accounting questionarrow_forward

- What is the total amount of variable costs related to the units sold?arrow_forwardAt the beginning of the year, ACYFAR1 purchased 21% of the outstanding ordinary shares ofACYFAR2 Company, paying Php 8,713,514 when the carrying amount of the net assets of ACYFAR2 Company equaled to 19,987,700. The difference was attributed to equipment which had a carrying amount of 2,488, 179 and fair market value of 4,539,875 and to building which had a carrying amount of 2,051,991 and a fair market value of 3,058,391. The remaining useful life of the equipment and building was 6 and 10 year respectively. During the current year, ACYFAR2 reported net income of Php 2,106,077 and paid cash dividend of 2,366,040What amount should be reported as investment income for the year? (Correct answer: 4,223,229)What is the carrying amount of the investment in associate at the end of the year?arrow_forwardThe following information is available for the preparation of the government-wide financial statements for the city of Northern Pines for the year ended June 30, 2024: Expenses: General government $ 9,840,000 Public safety 23,400,000 Public works 12,290,000 Health and sanitation 6,250,000 Culture and recreation 4,241,000 Interest on long-term debt, governmental type 1,025,000 Water and sewer system 11,950,000 Parking system 416,000 Revenues: Charges for services, general government 1,121,000 Charges for services, public safety 1,450,000 Operating grant, public safety 702,000 Charges for services, health and sanitation 2,395,000 Operating grant, health and sanitation 1,250,000 Charges for services, culture and recreation 2,181,000 Charges for services, water and sewer 13,118,000 Charges for services, parking system 294,000 Property taxes 27,300,000 Sales taxes 21,098,000 Investment earnings, business-type 314,000 Unusual or…arrow_forward

- nonearrow_forwardA computer consulting company uses job costing system and has a pre-determined overhead rate of $24 per direct labor hour. This amount is based on an estimated overhead of $23,000 and 2,000 estimated Direct Labor hours. In addition, Selling, General, and Administrative (SG&A) costs for the period totaled $155,000. Total units produced during the period were 1,250,000. Job # 175 incurred direct material costs of $60 and three direct labor hours costing of $83 per hour. What is the total cost of Job # 175?arrow_forwardGeneral accountingarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub