Cryogenics Inc., is a leading developer, designer, and manufacturer of tanks, moveable containers, and trailers for the most efficient storage and distribution of liquid helium and hydrogen. Cryogenics started as a private company when founded in 1960 by industrialist William Hodges. It has since gone public and has grown to support a staff 250 employees between its Tulsa, Oklahoma, and Prague, Czech Republic, operations to meet the global demand for liquid helium and hydrogen storage with the highest performance ratings in the industry. The following describes Cryogenics’ fixed asset system.

Asset acquisition begins when the department manager recognizes the need to obtain or replace an existing fixed asset. The manager prepares two copies of a purchase requisition; one is filed in the department, and one is sent to the purchasing department. The purchasing department uses the purchase requisition to prepare three copies of a purchase order. One copy of the purchase order is sent to the supplier, another copy is sent to the AP department, and the third copy is filed in the purchasing department. Vendors ship the ordered items to Cryogenics’ receiving department along with the packing slip. The receiving clerk then prepares three copies of a receiving report. One copy of the receiving report is sent to AP, one is sent to the department manager, and one is sent to the inventory department clerk who uses it to update the inventory records.

A few days later the vendor sends an invoice to the AP clerk, which the clerk reconciles with the purchase order and receiving report. The AP clerk inputs the information into the computer terminal, posts the liability, updates the purchase journal, and prints out hard copies of a journal voucher and cash disbursement voucher. The journal voucher is sent to the general ledger department, and the cash disbursement voucher and the supplier’s invoice are sent to the cash disbursements department.

The purchase order and the receiving report are filed in the AP department. Using the information from the supplier’s invoice and the cash disbursement voucher, the cash disbursements clerk prepares a hard copy check in payment of the liability, sends the check to the vendor, and posts it to the check register. Finally, the clerk sends the cash disbursement voucher to the general ledger department.

Periodically, the department manager adjusts the fixed asset inventory subsidiary account balances to reflect asset

Required

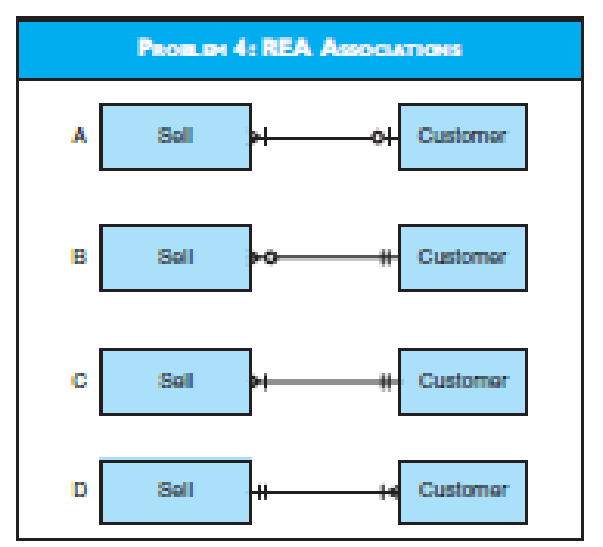

- a. Prepare the REA model to support the fixed asset procedures.

- b. Show the cardinalities for all associations.

- c. List the tables, keys, and attributes needed to implement this model in a relational database.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Accounting Information Systems

- Capstone Turbine Corporation is the world's leading provider of microturbine based MicroCHP (combined heat and power) systems for clean, continuous. distributed-generation electricity. The MicroCHP unit is a compact turbine generator that delivers electricity on-site or close to the point where it is needed. This form of distributed-generation technology, designed to operate on a variety of gaseous and liquid fuels, first debuted in 1998. The microturbine is expected to operate on-demand or continuously for up to a year between recommended maintenance (filter cleaning/replacement). The generator is cooled by air now into the gas turbine, thus eliminating the need for liquid cooling. It can make electricity from a variety of fuels-natural gas, kerosene, diesel oil, and even waste gases from landfills, sewage plants, and oil fields. Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, and hybrid electric vehicles.…arrow_forwardThe Fischer-Tropsch (F-T) process was developed in Germany in 1923 to convert synthesis gas (i.e., a mixture of hydrogen and carbon monoxide) into liquid with some gaseous hydrocarbons. Interestingly, the F-T process was used in World War II to make gasoline and other fuels. The U.S. military can save one billion gallons per year of foreign oil by blending its jet fuel with F-T products. If the government expects inflation to average 3% per year, what is the equivalent uniform annual savings in fuel? The government's MARR is 6% per year, the study period is 50 years, and one gallon of jet fuel costs $2.70.arrow_forwardH-Robotic Incorporated (HRI), a world leader in the robotics industry, produces a line of industrial robots and peripheral equipment that performs many routine assembly-line tasks. However, increased competition, particularly from Japanese firms, has caused HRI's management to be concerned about the company's growth potential in the future. HRI's research and development department have been applying the industrial robot technology to develop a line of household robots. The household robot is designed to function as a maid, mainlyperforming such tasks as vacuuming floors and carpets. This effort has nowreached the stage where a decision on whether to go forward with production must be made. The engineering department has estimated that the firm would need a new manufacturing plant with the following construction schedule: The plant would require a 35-acre site, and HRI currently has an option to purchase a suitable tract of land for $2.5 million. The building construction would begin…arrow_forward

- Extreme Inc. is a newly established enterprise. It was set up by an entrepreneur who is generally interested inthe business of providing engineering and operational support services to aircraft manufacturers. ExtremeInc., through the contacts of its owner, received a confirmed order from a well-known aircraft manufacturerto develop new designs for ducting the air conditioning of their aircraft. For this project, Extreme Inc.needed funds aggregating to $1 million. It was able to convince venture capitalists and was able to obtainfunding of $1 million from two Silicon Valley venture capitalists. The expenditures Extreme Inc. incurred inpursuance of its research and development project follow, in chronological order: • January 15, 20X5: Paid $175,000 toward salaries of the technicians (engineers and consultants) • March 31, 20X5: Incurred $250,000 toward cost of developing the duct and producing the test model • June 15, 20X5: Paid an additional $300,000 for revising the ducting process…arrow_forwardBadger Valve and Fitting Company, located in southern Wisconsin, manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearby states. Currently, the company is operating at about 70 percent capacity and is earning a satisfactory return on investment. Management has been approached by Glasgow Industries Ltd. of Scotland with an offer to buy 130,000 units of a pressure valve. Glasgow Industries manufactures a valve that is almost identical to Badger's pressure valve; however, a fire in Glasgow Industries' valve plant has shut down its manufacturing operations. Glasgow needs the 130,000 valves over the next four months to meet commitments to its regular customers. Glasgow is prepared to pay $30.40 each for the valves. Badger's total product cost, based on current attainable standards, for the pressure valve is $32.00, calculated as follows: Direct material Direct labor Manufacturing overhead Total product cost Manufacturing overhead is applied to…arrow_forwardBadger Valve and Fitting Company, located in southern Wisconsin, manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearby states. Currently, the company is operating at about 70 percent capacity and is earning a satisfactory return on investment. Management has been approached by Glasgow Industries Ltd. of Scotland with an offer to buy 130,000 units of a pressure valve. Glasgow Industries manufactures a valve that is almost identical to Badger's pressure valve; however, a fire in Glasgow Industries' valve plant has shut down its manufacturing operations. Glasgow needs the 130,000 valves over the next four months to meet commitments to its regular customers. Glasgow is prepared to pay $30.40 each for the valves. Badger's total product cost, based on current attainable standards, for the pressure valve is $32.00, calculated as follows: Direct material Direct labor Manufacturing overhead Total product cost Manufacturing overhead is applied to…arrow_forward

- In 1926 Branky scott and his wife GV started a small company in India that pioneered the use of plastics in the manufacturing of marine products. Branky Manufacturing has evolved to produce thousands of products under the Branky Trademark which are sold into the fishing, marine, outdoor, and firefighting industries worldwide. To manage production costs, Branky is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production:- Annual additional tooling costs would be $400,000- Annual inventory would decline by 80 percent from the current level of $4,000,000- Insurance, material handling, and set-up costs which currently total $1,200,000 annually, would decline by 25%- Rework would be reduced by 30 percent. Branky currently incurs $800,000 in annual rework costs.Improved product quality under JIT production would enable Branky to raise the price of its products by $8 per unit. Scotty sells 80,000 units per year.- Branky required…arrow_forwardExtreme Inc. is a newly established enterprise. It was set up by an entrepreneur who is generally interested in the business of providing engineering and operational support services to aircraft manufacturers. Extreme Inc., through the contacts of its owner, received a confirmed order from a wellknown aircraft manufacturer to develop new designs for ducting the air conditioning of their aircraft. For this project, Extreme Inc. needed funds aggregating to $1 million. It was able to convince venture capitalists and was able to obtain funding of $1 million from two Silicon Valley venture capitalists. The expenditures Extreme Inc. incurred in pursuance of its research and development project follow, in chronological order: January 15, 2015: Paid $175,000 toward salaries of the technicians (engineers and consultants) March 31, 2015: Incurred $250,000 toward cost of developing the duct and producing the test model June 15, 2015: Paid an additional $300,000 for revising the ducting process to…arrow_forwardNCO Berhad (NCO) is a manufacturer of high-quality tools for those working in the engineering industry. The mission statement of the company declares that it is dedicated to maximizing the wealth of its shareholders and, since it was formed in 2019, the company has grown rapidly. Recently, the company has developed a new type of drill and the directors of the company are now considering whether this drill should be manufactured and sold. The following information is available to help evaluate the viability of the new product: i. Costs incurred in designing and developing the new drill, which have all been paid, were RM300,000. These costs are to be written off in equal instalments against profits generated over the new product s expected life of four years. ii. Sales are expected to be 20,000 drills per year over the next four years. The selling price of each drill will be RM50 in the first three years and RM40 in the final year. iii. Variable operating costs are estimated to be RM20…arrow_forward

- ABC PLC is a highly profitable electronics company that manufactures a range of innovative products for industrial use. Its success is based to a large extent on the ability of the company’s development group to generate new ideas that result in commercially viable products. The latest of these products is just about to undergo some final tests and a decision has to be taken whether or not to proceed with an investment in the facilities required for manufacturing. You have been asked to undertake an evaluation of this investment.The company has already spent £750,000 on the development of this product. The final testing of the product will cost about £40,000. The head of the development group is very confident that the tests will be successful based on the work already undertaken. Another company has already offered Raindeer £1.10 million for the product’s patent and an exclusive right to its manufacture and sale, even though the final tests are still to be completed. This sum being…arrow_forwardBoardman Gases and Chemicals is a supplier of highly purified gases to semiconductor manufacturers. A large chip producer has asked Boardman to build a new gas production facility close to an existing semiconductor plant. Once the new gas plant is in place, Boardman will be the exclusive supplier for that semiconductor fabrication plant for the subsequent 10 years. Boardman is considering one of two plant designs. The first is Boardman's "standard" plant which will cost $38.8 million to build. The second is for a "custom" plant which will cost $53.4 million to build. The custom plant will allow Boardman to produce the highly specialized gases required for an emergency semiconductor manufacturing process. Boardman estimates that its client will order $12.8 million of product per year if the standard plant is constructed, but if the custom design is put in place, Boardman expects to sell $17.1 million worth of product annually to its client. Boardman has enough money to build…arrow_forwardComm Devices (CD) is a division of Worldwide Communications, Inc. CD produces restaurant pagers and other personal communication devices. These devices are sold to other Worldwide divisions, as well as to other communication companies. CD was recently approached by the manager of the Personal Communications Division regarding a request to make a special emergency- response pager designed to receive signals from anywhere in the world. The Personal Communications Division has requested that CD produce 12,000 units of this special pager. The following facts are available regarding the Comm Devices Division. Selling price of standard pager Variable cost of standard pager Additional variable cost of special pager For each of the following independent situations, calculate the minimum transfer price, and determine whether the Personal Communications Division should accept or reject the offer. (a) The Personal Communications Division has offered to pay the CD Division $105 per pager. The CD…arrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub