Concept explainers

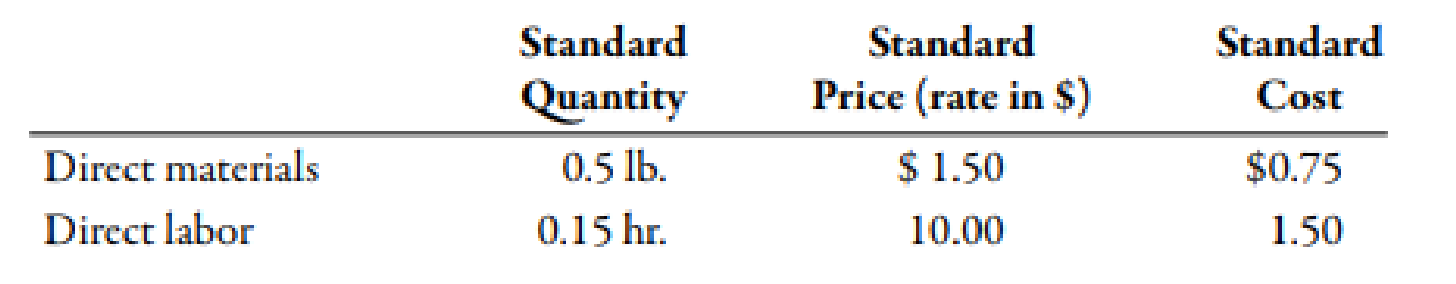

Phono Company manufactures a plastic toy cell phone. The following standards have been established for the toys materials and labor inputs:

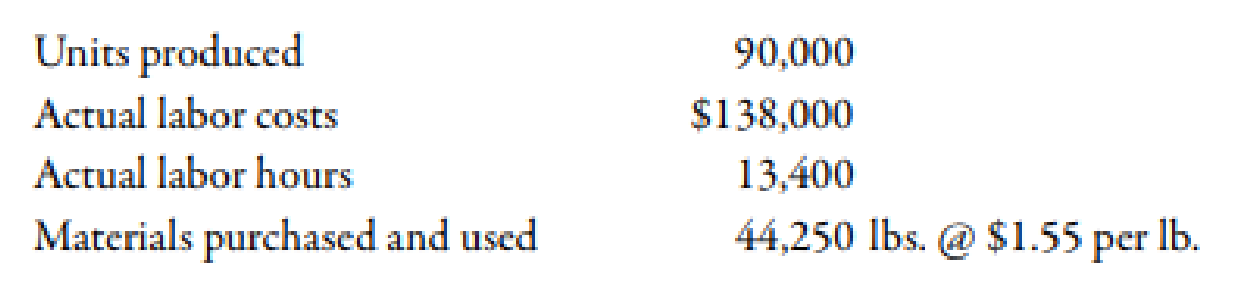

During the first week of July, the company had the following results:

The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in July. Also, a new manufacturing layout was implemented on a trial basis. The new layout required a slightly higher level of skilled labor. The higher-quality material has no effect on labor utilization. Similarly, the new manufacturing approach has no effect on material usage. (Note: Round all variances to the nearest dollar.)

Required:

- 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assuming that the materials variances are essentially attributable to the higher quality of materials, would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly.

- 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing layout, should it be continued or discontinued? Explain.

- 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new layout should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 13,200 and the labor cost was $132,000. Should the new layout be adopted? Assume the variances are attributable to the new layout. If so, what would be the projected annual savings?

1.

Calculate the value of material price variance and material usage variance. Identify whether the plant manger could continue to purchase this quality product or purchase the usual quality.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate material price variance:

Substitute $1.55 for actual price, 44,250 units for actual quantity and $1.50 for standard price in the above formula.

Therefore, the material price variance is $2,213(U).

Use the following formula to calculate material usage variance:

Substitute $1.50 for standard price, 44,250 units for actual quantity and 45,000 for standard quantity in the above formula.

Therefore, the material usage variance is $1,125(F).

The total variance is $1,088(U)

Working Note:

1. Calculation of standard quantity:

2.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the labor variances are attributable to the new manufacturing process should be continued or discontinued.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $138,000 for actual cost, 10,800 hours for actual hours and $10 for standard rate in the above formula.

Therefore, the labor rate variance is $4,000(U).

Use the following formula to calculate labor efficiency variance:

Substitute $10.00 for standard rate, 13,400 hours for actual hours and 13,500 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $1,000(F).

The total labor variance is $3,000 (U)

Working Note:

1. Calculation of standard hours:

3.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the new process should be adopted.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $132,000 for actual cost, 13,200 hours for actual hours and $10 for standard rate in the above formula.

Therefore, the labor rate variance is $0.

Use the following formula to calculate labor efficiency variance:

Substitute $10 for standard rate, 13,200 hours for actual hours and 13,500 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $3,000(F).

The total labor variance is $3,000 (F)

Working Note:

1. Calculation of standard hours:

Want to see more full solutions like this?

Chapter 10 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- need help this questionsarrow_forwardprovide correct answerarrow_forwardThe following lots of Commodity Z were available for sale during the year. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic inventory system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using the weighted average cost method? a. $620 b. $659 c. $690 d. $655arrow_forward

- Assume that three identical units of merchandise were purchased during October, as follows: Units Cost Oct. 5 Purchase 1 $ 5 12 Purchase 1 13 28 Purchase 1 15 Total 3 $33 One unit is sold on October 31 for $28. Using the table provided, determine the cost of goods sold using the weighted average cost method. a. $11 b. $17 c. $13 d. $22arrow_forwardBoxwood Company sells blankets for $39 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system.DateBlanketsUnitsCostMay 3Purchase21$1710Sale8 17Purchase36$1920Sale15 23Sale 30Purchase37$20Determine the gross profit for the sale of May 23 using the FIFO inventory costing method.a. $100b. $221c. $95d.$259arrow_forwardGeneral accounting questionarrow_forward

- Nonearrow_forwardChapter 18 Homework i Saved 15 Exercise 18-14 (Algo) Contribution margin income statement LO C2 1 points eBook Hint Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $628,000. The sales manager predicts that next year's annual sales of the company's product will be 39,800 units at a price of $198 per unit. Variable costs are predicted to increase to $138 per unit, but fixed costs will remain at $628,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement Units $ per unit 39,800 $ 198 Ask Sales Variable costs 39,800 Print Contribution margin 39,800 Fixed costs Income References Mc Graw Hill $ 7,880,400 138 5,492,400 2,388,000 628,000 $ 1,760,000 Help Save & Exit Submit Check my workarrow_forwardI want to correct answer general accountingarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning