1.

Prepare a schedule related to payroll for Company U from the information given.

1.

Explanation of Solution

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withheld from employees’ gross pay to deduct taxes such as federal income tax, state income tax, social security tax, and Medicare tax are called payroll withholding deduction.

Payroll register: A schedule which is maintained by the company to record the earnings, earnings withholdings, and net pay of each employee is referred to as payroll register.

The purpose of payroll register is used to record the following:

- Earnings of each employee.

- Taxes (Social security tax, Medicare tax, and federal income tax) and other withholdings (health insurance, and other) of each employee.

- Net pay of each employee.

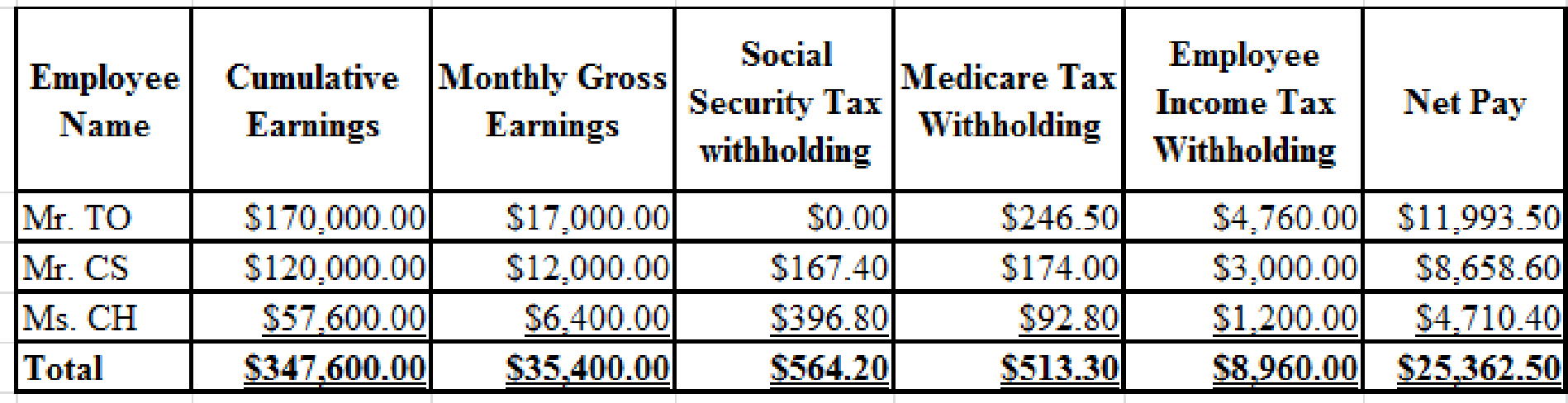

Prepare a schedule related to payroll for Company U as below:

Table (1)

Working notes:

Calculate social security tax withholding for Mr. TO.

The cumulative earnings of Mr. PP are $170,000 which already exceeds the ceiling of $122,700. Hence, the social security tax withholding will be $0.

Calculate social security tax withholding for Mr. CS.

The cumulative earnings of Mr. CW are $120,000 and the earnings ceiling of social security tax $122,700. Hence, the taxable salary of social security tax will be $2,700

Calculate social security tax withholding for Ms. CH.

Calculate Medicare tax withholding for Mr. TO.

Calculate Medicare tax withholding for Mr. CS.

Calculate Medicare tax withholding for Ms. CH.

Note:

- Net pay is calculated by using the following formula:

2.

Journalize the entry to record the payroll on November 30, 2019.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare general journal entry to record the payroll on November 30, 2019.

| General Journal | Page 24 | ||||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||||

| 2019 | Salaries Expense | 35,400.00 | |||||||

| November | 30 | Social Security Taxes Payable | 564.20 | ||||||

| Medicare Taxes Payable | 513.30 | ||||||||

| Employees Income Taxes Payable | 8,960.00 | ||||||||

| Salaries Payable | 25,362.50 | ||||||||

| (To record salaries expense and payroll withholdings) | |||||||||

Table (2)

- Salaries expense is an expense and it decreases equity value. So, debit it by $35,400.00.

- Social security taxes payable is a liability and it is increased. So, credit it by $564.20.

- Medicare taxes payable is a liability and it is increased. So, credit it by $513.30.

- Employee income taxes payable is a liability and it is increased. So, credit it by $8,960.00.

- Salaries payable is a liability and it is increased. So, credit it by $25,362.50.

3.

Journalize the entry to record the payment to employees on November 30, 2019.

3.

Explanation of Solution

Prepare general journal entry to record payment to employees on November 30, 2019.

| General Journal | Page 24 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Salaries Payable | 25,362.50 | |||||

| November | 30 | Cash | 25,362.50 | ||||

| (To record the payment to employees) | |||||||

Table (3)

- Salaries payable is a liability and it is decreased. So, debit it by $25,362.50.

- Cash is an asset and it is decreased. So, credit it by $25,362.50.

Analyze: Mr. CS reach the withholding limit for social security tax in the month of November 2019.

Want to see more full solutions like this?

Chapter 10 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning