1 to 7.

Prepare payroll register for CP Movie Theaters from the information given.

1 to 7.

Explanation of Solution

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withheld from employees’ gross pay to deduct taxes such as federal income tax, state income tax, social security tax, and Medicare tax are called payroll withholding deduction.

Payroll register: A schedule which is maintained by the company to record the earnings, earnings withholdings, and net pay of each employee is referred to as payroll register.

The purpose of payroll register is used to record the following:

- Earnings of each employee.

- Taxes (Social security tax, Medicare tax, and federal income tax) and other withholdings (health insurance, and other) of each employee.

- Net pay of each employee.

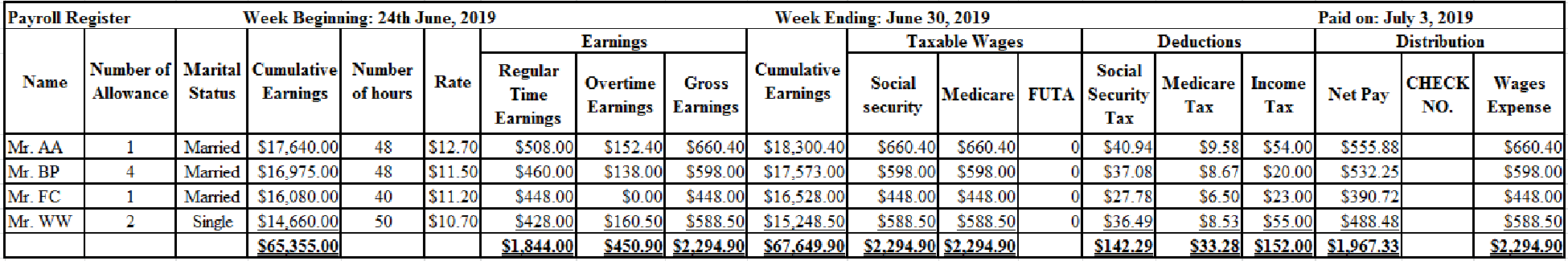

Prepare payroll register for CP Movie Theaters as below:

Table (1)

Working notes:

Calculate regular time earnings for Mr. AA.

Calculate regular time earnings for Mr. BP.

Calculate regular time earnings for Mr. FC.

Calculate regular time earnings for Mr. WW.

Calculate overtime earnings for Mr. AA.

Calculate overtime earnings for Mr. BP.

Calculate overtime earnings for Mr. WW.

Calculate social security tax for Mr. AA.

Calculate social security tax for Mr. BP.

Calculate social security tax for Mr. FC.

Calculate social security tax for Mr. WW.

Calculate Medicare tax for Mr. AA.

Calculate Medicare tax for Mr. BP.

Calculate Medicare tax for Mr. FC.

Calculate Medicare tax for Mr. WW.

Calculate the amount of Federal income tax for Mr. AA.

Mr. AA is married, claims one withholding allowances, and earned weekly salary of $660.40. Hence, by using withholding table (Refer figure 10.2B) his Federal income tax amount would be $54.

Calculate the amount of Federal income tax for Mr. BP.

Mr. BP is married, claims four withholding allowances, and earned weekly salary of $598. Hence, by using withholding table (Refer figure 10.2B) his Federal income tax amount would be $20.

Calculate the amount of Federal income tax for Mr. FC.

Mr. FC is married, claims one withholding allowances, and earned weekly salary of $448. Hence, by using withholding table (Refer figure 10.2B) his Federal income tax amount would be $23.

Calculate the amount of Federal income tax for Mr. WW.

Mr. WW is single, claims two withholding allowances, and earned weekly salary of $588.50. Hence, by using withholding table (Refer figure 10.2A) his Federal income tax amount would be $55.

Notes:

- Gross earnings are calculated by using the following formula:

- Net pay is calculated by using the following formula:

8.

Journalize the entry to record the payroll on June 30, 2019.

8.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare general journal entry to record the payroll on June 30, 2019.

| General Journal | Page 15 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Wages Expense | 2,294.90 | |||||

| June | 30 | Social Security Taxes Payable | 142.29 | ||||

| Medicare Taxes Payable | 33.28 | ||||||

| Employees Income Taxes Payable | 152.00 | ||||||

| Wages Payable | 1,967.33 | ||||||

| (To record wages expense and payroll withholdings) | |||||||

Table (2)

- Wages expense is an expense and it decreases equity value. So, debit it by $2,294.90.

- Social security taxes payable is a liability and it is increased. So, credit it by $142.29.

- Medicare taxes payable is a liability and it is increased. So, credit it by $33.28.

- Employee income taxes payable is a liability and it is increased. So, credit it by $152.00.

- Wages payable is a liability and it is increased. So, credit it by $1,967.33.

9.

Journalize the entry to record the payment of weekly payroll on July 3, 2019.

9.

Explanation of Solution

Prepare general journal entry to record payment of weekly payroll on July 3, 2019.

| General Journal | Page 15 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Wages Payable | 1,967.33 | |||||

| July | 3 | Cash | 1,967.33 | ||||

| (To record the payment of weekly payroll) | |||||||

Table (3)

- Wages payable is a liability and it is decreased. So, debit it by $1,967.33.

- Cash is an asset and it is decreased. So, credit it by $1,967.33.

Analyze: The cumulative earnings of Mr. AA on June 30, 2019 are $18,300.40.

Want to see more full solutions like this?

Chapter 10 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- Sterling Fabrication Ltd. operates at a normal capacity of30,000 direct labor hours. The company’s variable manufacturing overhead is $39,000, and its fixed overhead is $21,000 when operating at normal capacity. What is its standard manufacturing overhead rate per unit(per direct labor hour)?arrow_forwardIf the liabilities of a company increased RM75,000 during a period of time and the owner's equity in the company increased RM15,000 during the same period, the assets of the company must have: A. Decreased RM90,000 B. Increased RM60,000 C. Increased RM90,000 D. Decreased RM60,000arrow_forwardThe best estimate of the total variable cost per unit isarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning