College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

12th Edition

ISBN: 9781305863385

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 4PB

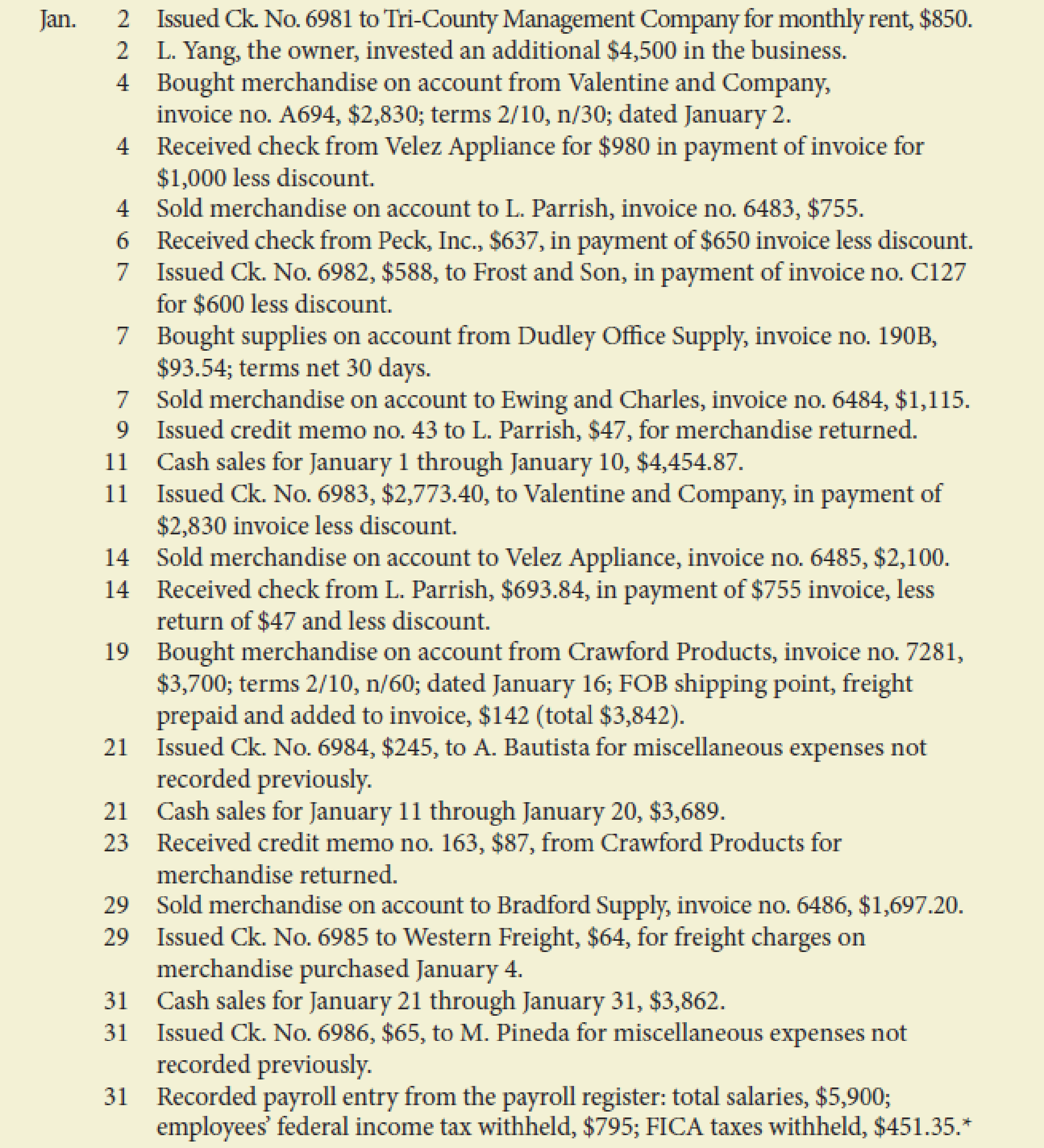

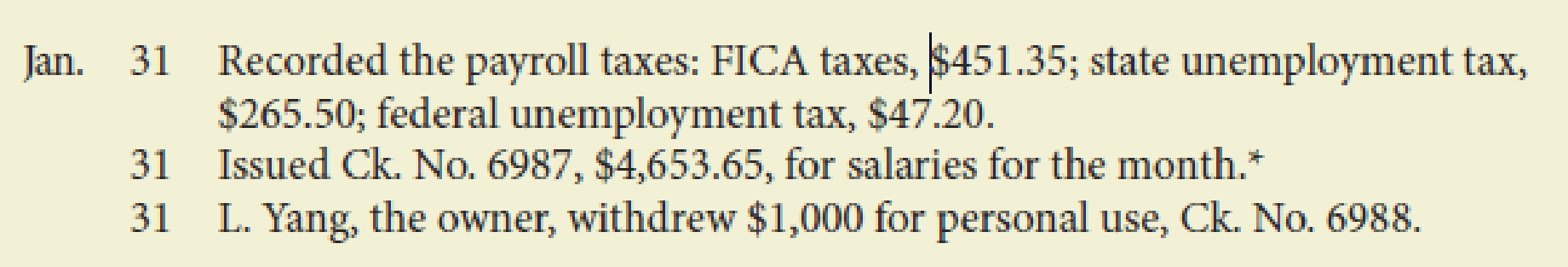

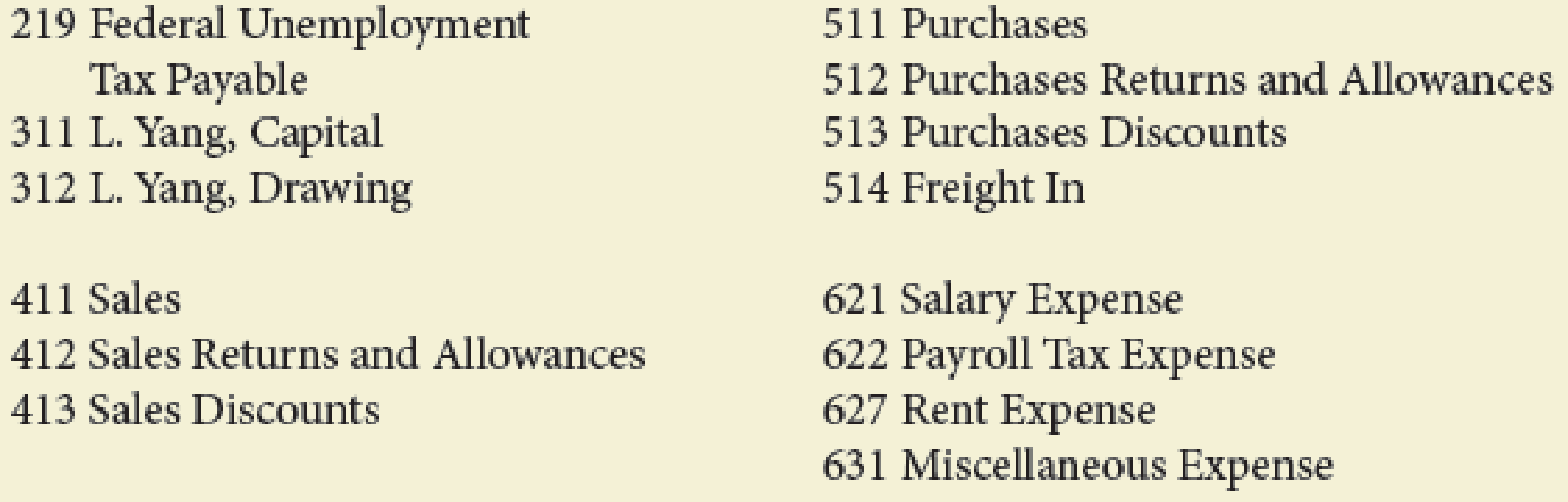

The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select “Cash Sales” as the customer for all cash sales transactions.

Required

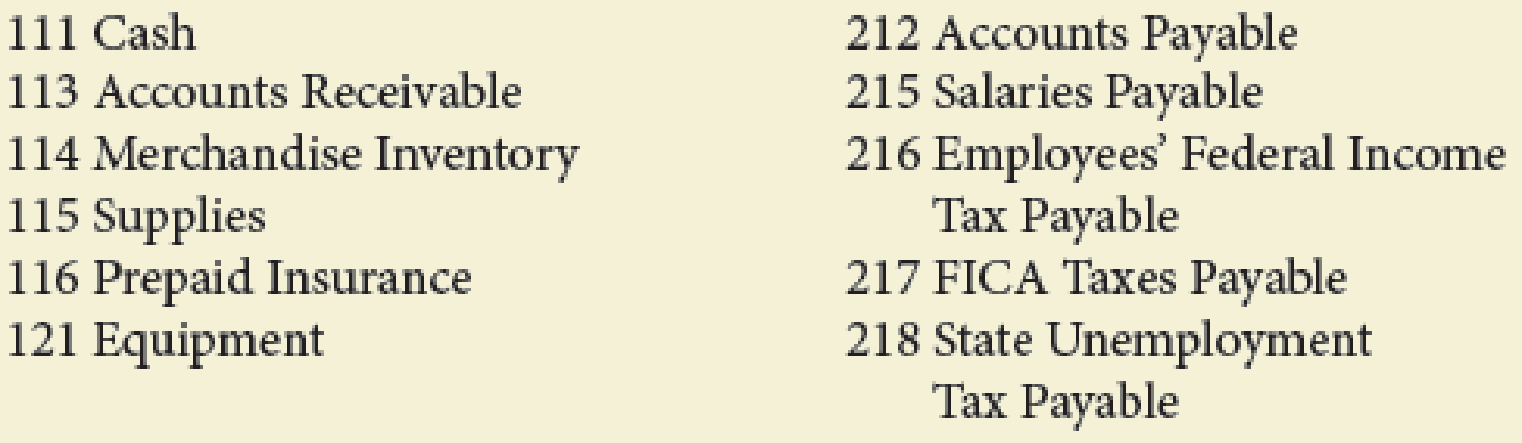

- 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used.

- 2.

Post daily all entries involving customer accounts to theaccounts receivable ledger. - 3. Post daily all entries involving creditor accounts to the accounts payable ledger.

- 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owner’s name in the Capital and Drawing accounts.

- 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper.

- 6. Post the appropriate totals of the special journals to the general ledger.

- 7. Prepare a

trial balance . - 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I need this question answer general Accounting

Subject = general Account

What was the taxable income for the year?

Chapter 10 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

Ch. 10 - What do credit terms of 2/10, n/30 mean? 210 days...Ch. 10 - What is the entry to record the cash received on a...Ch. 10 - Prob. 3QYCh. 10 - Which of the following is not an advantage of the...Ch. 10 - Prob. 5QYCh. 10 - What is the normal balance for each of the...Ch. 10 - What does an X under the total of a special...Ch. 10 - Prob. 3DQCh. 10 - In a cash receipts journal, both the Accounts...Ch. 10 - If a cash payments journal is supposed to save...

Ch. 10 - Describe the posting procedure for a cash payments...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - For the following purchases of merchandise,...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Record the following transactions in general...Ch. 10 - Prob. 5ECh. 10 - Record general journal entries to correct the...Ch. 10 - Label the blanks in the column heads as either...Ch. 10 - Describe the transaction recorded.Ch. 10 - Prob. 9ECh. 10 - Indicate the journal in which each of the...Ch. 10 - The following transactions were completed by...Ch. 10 - Preston Company sells candy wholesale, primarily...Ch. 10 - MacDonald Bookshop had the following transactions...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by Yang...Ch. 10 - C. R. McIntyre Company sells candy wholesale,...Ch. 10 - Prob. 3PBCh. 10 - The following transactions were completed by Yang...Ch. 10 - Prob. 5PBCh. 10 - Prob. 1ACh. 10 - You are the manager of the Accounts Receivable...Ch. 10 - Prob. 3ACh. 10 - Suppose we collected cash from a charge customer...Ch. 10 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY