Concept explainers

The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer.

Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $775.

2 J. Hammond, the owner, invested an additional $3,500 in the business.

4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,930; terms 2/10, n/30; dated January 2.

4 Received check from Vega Appliance for $980 in payment of $1,000 invoice less discount.

4 Sold merchandise on account to L. Paul, invoice no. 6483, $850.

6 Received check from Petty, Inc., $637, in payment of $650 invoice less discount.

7 Issued Ck. No. 6982, $588, to Fischer and Son, in payment of invoice no. C1272 for $600 less discount.

7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days.

7 Sold merchandise on account to Ellison and Clay, invoice no. 6484, $787.

9 Issued credit memo no. 43 to L. Paul, $54, for merchandise returned.

11 Cash sales for January 1 through January 10, $4,863.20.

11 Issued Ck. No. 6983, $2,871.40, to Valencia and Company, in payment of $2,930 invoice less discount.

14 Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,050.

Jan. 18 Bought merchandise on account from Costa Products, invoice no. 7281D, $4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $147 (total $5,001).

21 Issued Ck. No. 6984, $194, to M. Miller for miscellaneous expenses not recorded previously.

21 Cash sales for January 11 through January 20, $4,591.

23 Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4.

23 Received credit memo no. 163, $376, from Costa Products for merchandise returned.

29 Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,835.

31 Cash sales for January 21 through January 31, $4,428.

31 Issued Ck. No. 6986, $53, to M. Miller for miscellaneous expenses not recorded previously.

31 Recorded payroll entry from the payroll register: total salaries, $6,200; employees’ federal income tax withheld, $872; FICA Social Security tax withheld, $384.40, FICA Medicare tax withheld, $89.90.

31 Recorded the payroll taxes: Social Security tax, $384.40, FICA Medicare tax, $89.90; state

31 Issued Ck. No. 6987, $4,853.70, for salaries for the month.

31 J. Hammond, the owner, withdrew $1,000 for personal use, Ck. No. 6988.

Required

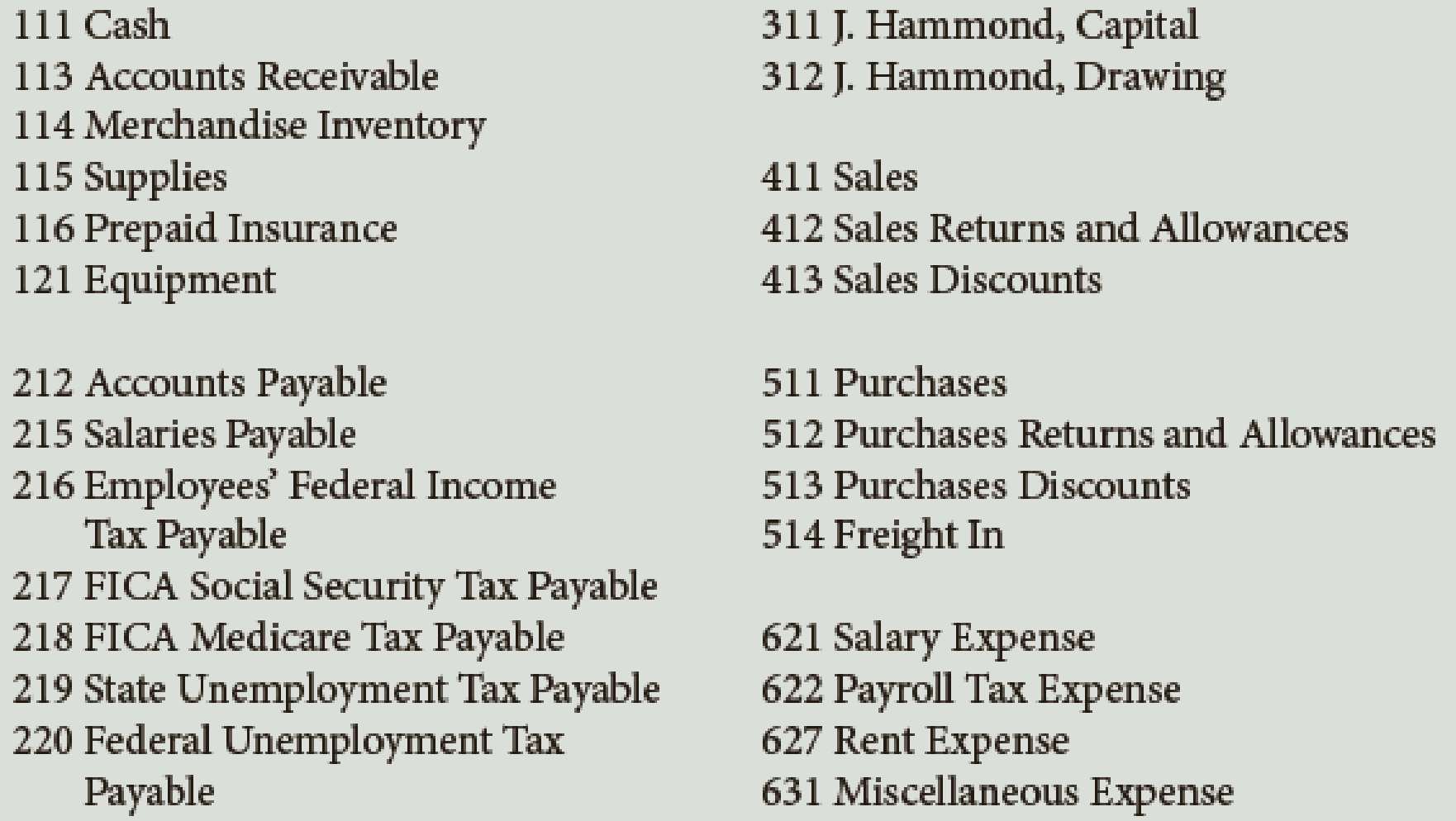

- 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used.

- 2.

Post daily all entries involving customer accounts to theaccounts receivable ledger. - 3. Post daily all entries involving creditor accounts to the accounts payable ledger.

- 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owner’s name in the Capital and Drawing accounts.

- 5. Add the columns of the special journals and prove the equality of the debit and credit totals.

- 6. Post the appropriate totals of the special journals to the general ledger.

- 7. Prepare a

trial balance . - 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

Trending nowThis is a popular solution!

Chapter 10 Solutions

EBK COLLEGE ACCOUNTING: A CAREER APPROA

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Macroeconomics

Intermediate Accounting (2nd Edition)

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Accounting (12th Edition)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning