Intermediate Accounting: Reporting and Analysis, 2017 Update

2nd Edition

ISBN: 9781337116619

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 4P

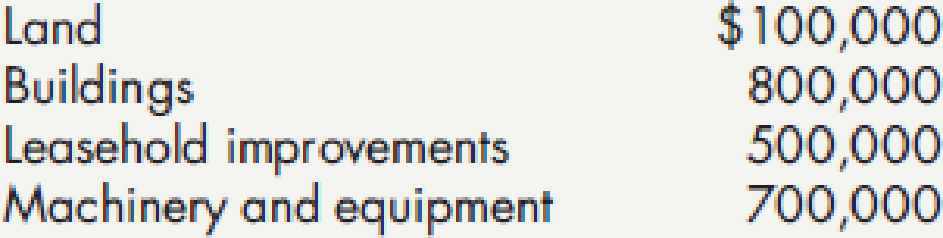

At December 31, 2015, certain accounts included in the property, plant, and equipment section of Townsand Company’s

During 2016, the following transactions occurred:

- 1. Land site number 621 was acquired for $1,000,000. Additionally, to acquire the land, Townsand paid a $60,000 commission to a real estate agent. Costs of $15,000 were incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for $5,000.

- 2. A second tract of land (site number 622) with a building was acquired for $300,000. The closing statement indicated that the land value was $200,000 and the building value was $100,000. Shortly after acquisition, the building was demolished at a cost of $30,000. A new building was constructed for $150,000 plus the following costs:

The building was completed and occupied on September 29, 2016.

- 3. A third tract of land (site number 623) was acquired for $600,000 and was put on the market for resale.

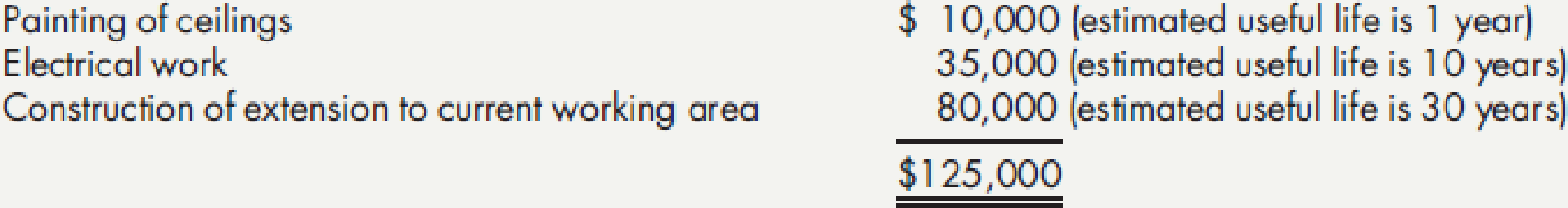

- 4. Extensive work was done to a building occupied by Townsand under a lease agreement that expires on December 31, 2025. The total cost of the work was $125,000, which consisted of the following:

The lessor, Steinbeck Company, paid one-half of the costs incurred in connection with the extension to the current working area.

- 5. During December 2016, costs of $65,000 were incurred to improve leased office space. The related lease will terminate on December 31, 2018, and is not expected to be renewed.

- 6. A group of new machines was purchased under a royalty agreement that provides for payment of royalties based on units of production for the machines. The invoice price of the machines was $75,000, freight costs were $2,000, unloading charges were $1,500, and royalty payments for 2016 were $13,000.

Required:

- 1. Prepare a detailed analysis of the changes in the balance sheet accounts—Land, Buildings, Leasehold Improvements, and Machinery and Equipment—for 2016. Disregard the related

accumulated depreciation accounts. - 2. List the items in the fact situation that were not used to determine the answer to Requirement 1, and indicate where, or if these items should be included in Townsand’s financial statements.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Chapter 15 Homework

13

Saved

Help

Save & Exit Submit

Part 1 of 2

0.83

points

eBook

Ask

Required information

Use the following information to answer questions. (Algo)

[The following information applies to the questions displayed below.]

Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $100,800 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

Job 202

Total direct materials

Indirect materials

Total materials used

$ 49,000

24,400

73,400

9,420

$ 82,820

c. Time tickets show the following labor used for the month.

Print

References

Job 201

$ 40,000

Job 202

13,400

Total direct labor

53,400

25,000

$ 78,400

Indirect labor

Total labor used

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $166,160 on credit.

g. Incurred the following actual other…

quesrion 2

Anti-Pandemic Pharma Co. Ltd. reports the following information in

its income statement:

Sales = $5,250,000;

Costs = $2, 173,000;

Other expenses = $187,400;

Depreciation expense = $79,000;

Interest expense= $53,555;

Taxes $76,000;

Dividends $69,000.

$136,700 worth of new shares were also issued during the year and

long-term debt worth $65,300 was redeemed.

a) Compute the cash flow from assets

b) Compute the net change in working capital

(325 marks)

Chapter 10 Solutions

Intermediate Accounting: Reporting and Analysis, 2017 Update

Ch. 10 - Prob. 1GICh. 10 - Prob. 2GICh. 10 - What is the relationship between the book value...Ch. 10 - Prob. 4GICh. 10 - Prob. 5GICh. 10 - Prob. 6GICh. 10 - What are asset retirement obligations? How should...Ch. 10 - Prob. 8GICh. 10 - Prob. 9GICh. 10 - Prob. 10GI

Ch. 10 - At what amount does a company record the cost of a...Ch. 10 - Prob. 12GICh. 10 - Prob. 13GICh. 10 - Prob. 14GICh. 10 - Prob. 15GICh. 10 - Prob. 16GICh. 10 - Prob. 17GICh. 10 - What is the distinction between a capital and an...Ch. 10 - Distinguish between additions and...Ch. 10 - Distinguish between ordinary repairs and...Ch. 10 - Prob. 21GICh. 10 - Hickory Company made a lump-sum purchase of three...Ch. 10 - Prob. 2MCCh. 10 - Electro Corporation bought a new machine and...Ch. 10 - Prob. 4MCCh. 10 - Lyle Inc. purchased certain plant assets under a...Ch. 10 - Ashton Company exchanged a nonmonetary asset with...Ch. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Prob. 10MCCh. 10 - On January 1, Duane Company purchases land at a...Ch. 10 - Prob. 2RECh. 10 - Utica Corporation paid 360,000 to purchase land...Ch. 10 - Prob. 4RECh. 10 - Prob. 5RECh. 10 - Prob. 6RECh. 10 - Nabokov Company exchanges assets with Faulkner...Ch. 10 - Prob. 8RECh. 10 - Dexter Construction Corporation is building a...Ch. 10 - Prob. 10RECh. 10 - Prob. 11RECh. 10 - Ricks Towing Company owns three tow trucks. During...Ch. 10 - Inclusion in Property, Plant, and Equipment...Ch. 10 - Prob. 2ECh. 10 - Acquisition Costs Voiture Company manufactures...Ch. 10 - Prob. 4ECh. 10 - Asset Retirement Obligation Big Cat Exploration...Ch. 10 - Prob. 6ECh. 10 - Prob. 7ECh. 10 - Prob. 8ECh. 10 - Exchange of Assets Two independent companies,...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 11ECh. 10 - Exchange of Assets Goodman Company acquired a...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 14ECh. 10 - Self-Construction Harshman Company constructed a...Ch. 10 - Matrix Inc. borrowed 1,000,000 at 8% to finance...Ch. 10 - Prob. 17ECh. 10 - Prob. 18ECh. 10 - Prob. 19ECh. 10 - Prob. 20ECh. 10 - Prob. 21ECh. 10 - Prob. 1PCh. 10 - Prob. 2PCh. 10 - Prob. 3PCh. 10 - At December 31, 2015, certain accounts included in...Ch. 10 - Prob. 5PCh. 10 - Prob. 6PCh. 10 - Prob. 7PCh. 10 - Prob. 8PCh. 10 - Prob. 9PCh. 10 - Prob. 10PCh. 10 - Prob. 11PCh. 10 - Prob. 1CCh. 10 - Prob. 2CCh. 10 - Cost Issues Deskin Company purchased a new machine...Ch. 10 - Prob. 4CCh. 10 - Prob. 5CCh. 10 - Prob. 6CCh. 10 - Prob. 7CCh. 10 - Prob. 9CCh. 10 - Prob. 10CCh. 10 - Prob. 11C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License