TAXATION OF INDIVIDUALS+BUSINESS ENT.>C

20th Edition

ISBN: 9781307520422

Author: SPILKER

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 46P

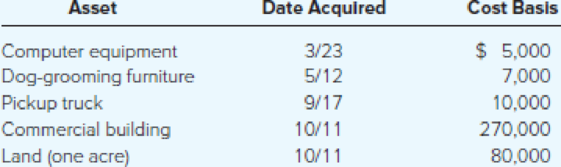

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff’s Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing and elects not to use bonus

- a) What is Poplock’s year 1 depreciation deduction for each asset?

- b) What is Poplock’s year 2 depreciation deduction for each asset?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General accounting question

solve carefully.

If image is blurr or data is unclear then plz comment i will write values or upload a new image.

i will give unhelpful if you will use incorrect data.

Hi expert please give me answer general accounting question

Chapter 10 Solutions

TAXATION OF INDIVIDUALS+BUSINESS ENT.>C

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give correct Answer! If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardAbbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 3% of credit sales will be uncollectible. On January 1, Allowance for Doubtful Accounts had a credit balance of $3,300. During the year, Abbott wrote off accounts receivable totaling $2,100 and made credit sales of $113,000. After the adjusting entry, the December 31 balance in Bad Debt Expense will be .... a. 3300 b. 3390 c. 4590 d. 6690arrow_forwardDo fast answer of this accounting questionsarrow_forward

- Need help with this question solution general accountingarrow_forwardSunshine Blender Company sold 7,000 units in October at a sales price of $40 per unit. The variable cost is $25 per unit. Calculate the total contribution margin. OA. $280,000 OB. $105,000 OC. $87,500 OD. $175,000arrow_forwardI want to correct answer general accounting questionarrow_forward

- Five I + Beginning Work-in-Process Inventory Cost of Goods Manufactured Cost of Goods Sold Direct Labor Direct Materials Used Ending Work-in-Process Inventory Finished Goods Inventory 4 of 35 > manufactured. Use the followin Process Inventory, $32,800; an Total Manufacturing Costs Incurred during Period Total Manufacturing Costs to Account Forarrow_forwardDon't use ai given answer accounting questionsarrow_forwardRequirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: Period cost Product cost a. Depreciation on plant equipment Depreciation on salespersons' automobiles Insurance on plant building Marketing manager's salary Direct materials used Manufacturing overhead g. Electricity bill for human resources office h. Production employee wagesarrow_forward

- I want to correct answer general accounting questionarrow_forwardTungsten, Inc. manufactures both normal and premium tube lights. The company allocates manufacturing over machine hours as the allocation base. Estimated overhead costs for the year are $108,000. Additional estimated information is given below. Machine hours (MHr) Direct materials Normal 23,000 $60,000 Premium 31,000 $480,000 Calculate the predetermined overhead allocation rate. (Round your answer to the nearest cent.) OA. $4.70 per direct labor hour OB. $3.48 per machine hour OC. $2.00 per machine hour OD. $0.20 per direct labor hourarrow_forward< Factory Utilities Indirect Materials Used $1,300 34,500 Direct Materials Used 301,000 Property Taxes on Factory Building 5,100 Sales Commissions 82,000 Indirect Labor Incurred 25,000 Direct Labor Incurred 150,000 Depreciation on Factory Equipment 6,300 What is the total manufacturing overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License