McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

1st Edition

ISBN: 9781259918391

Author: Professor, Brian C. Spilker

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 46P

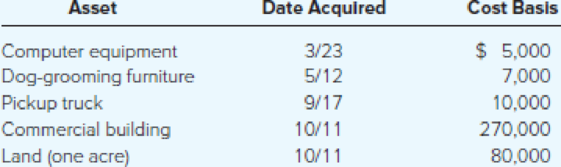

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff’s Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing and elects not to use bonus

- a) What is Poplock’s year 1 depreciation deduction for each asset?

- b) What is Poplock’s year 2 depreciation deduction for each asset?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give me true answer this financial accounting question

Please provide answer

generaal account answer wanted

Chapter 10 Solutions

McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Yom Electronics has an accounts receivable turnover for the year of 8.2. Net sales for the period are $120,000. What is the number of days' sales in receivables? accurate answerarrow_forwardCalculate the sales volume variancearrow_forwardWhat is the budgeted manufacturing fixed overhead rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License