Loose Leaf for Principles of Taxation for Business and Investment Planning 2019 Edition

22nd Edition

ISBN: 9781260161472

Author: Sally Jones, Shelley C. Rhoades-Catanach

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 3AP

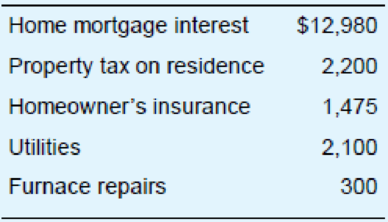

Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the home’s square footage. This year, Colin incurred the following expenses in connection with his home.

Colin purchased the home in 2000 for $225,000. For MACRS

- a. If Colin’s gross business income exceeded his operating expenses by $75,000, compute his net profit for the year.

- b. If Colin’s gross business income exceeded his operating expenses by $1,800, compute his net profit for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting Question need help with this question

Find the turnover and average total assets?

Financial Accounting

Chapter 10 Solutions

Loose Leaf for Principles of Taxation for Business and Investment Planning 2019 Edition

Ch. 10 - Can a sole proprietorship be described as a...Ch. 10 - Mrs. Liu owns a business as a sole proprietor....Ch. 10 - This year, Mr. Pitts sole proprietorship generated...Ch. 10 - This year, Firm Q, a cash basis taxpayer, remitted...Ch. 10 - Prob. 5QPDCh. 10 - Define the tax base for the self-employment tax....Ch. 10 - Prob. 7QPDCh. 10 - Prob. 8QPDCh. 10 - Prob. 9QPDCh. 10 - Prob. 10QPD

Ch. 10 - Prob. 11QPDCh. 10 - Prob. 12QPDCh. 10 - Prob. 13QPDCh. 10 - Prob. 14QPDCh. 10 - Prob. 2APCh. 10 - Colin, a self-employed consultant, uses a room of...Ch. 10 - Prob. 4APCh. 10 - Prob. 5APCh. 10 - Prob. 6APCh. 10 - Prob. 7APCh. 10 - Prob. 9APCh. 10 - Prob. 10APCh. 10 - Jane is a self-employed attorney. This year, her...Ch. 10 - Prob. 12APCh. 10 - Prob. 13APCh. 10 - Amit is a limited partner in Reynolds Partnership....Ch. 10 - Kari is a limited partner in Lizard Partnership....Ch. 10 - Prob. 16APCh. 10 - Prob. 17APCh. 10 - Prob. 18APCh. 10 - Prob. 19APCh. 10 - Prob. 21APCh. 10 - AV Inc. is a member of an LLC. This year, AV...Ch. 10 - Prob. 23APCh. 10 - Prob. 24APCh. 10 - Prob. 25APCh. 10 - For each of the following situations, indicate...Ch. 10 - a. If Video Associates is a partnership, and her...Ch. 10 - Prob. 32APCh. 10 - Prob. 1IRPCh. 10 - Javier is a full-time employee of B Inc. and...Ch. 10 - Mr. and Mrs. Chou file a joint income tax return....Ch. 10 - Travis is a professional writer who maintains his...Ch. 10 - Prob. 5IRPCh. 10 - Prob. 6IRPCh. 10 - Prob. 7IRPCh. 10 - Prob. 8IRPCh. 10 - Prob. 9IRPCh. 10 - Paulas Schedule K-1 from an LLC reported a 12,000...Ch. 10 - Prob. 12IRPCh. 10 - Mr. and Mrs. West are the only shareholders in WW,...Ch. 10 - Prob. 14IRPCh. 10 - Prob. 15IRPCh. 10 - Prob. 16IRPCh. 10 - Prob. 17IRPCh. 10 - Prob. 1RPCh. 10 - Prob. 2RPCh. 10 - Prob. 4RPCh. 10 - Mr. and Mrs. Janus operate a restaurant business...Ch. 10 - Prob. 3TPCCh. 10 - Marla recently inherited 50,000 and is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Correct answer? ? General Accounting questionarrow_forwardIf your estimate is that Galaxy Electronics is going to sell 6,500 units at $25 per piece and each item costs $8, your estimated cost of goods sold in dollars would be: Options-A. $48,500 B. $52,000 C. $65,000 D. None of the abovearrow_forwardCalculate the net income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License