Concept explainers

Beasley Ball Bearings paid a

a. Compute the anticipated value of the dividends for the next four years. That is, compute

b. Discount each of these dividends back to present at a discount rate of 15 percent and then sum them.

c. Compute the price of the stock at the end of the fourth year

d. After you have computed

e. Add together the answers in part b and part d to get

f. Use Formula 10-8 to show that it will provide approximately the same answer as part e.

For Formula 10-8, use

g. If current EPS were equal to

h. By what dollar amount is the stock price in part g different from the stock price in part f?

i. In regard to the stock price in part

a.

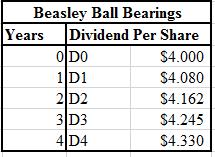

To calculate: The anticipated value of dividends for the next four years to be declared by Beasley Ball Bearings.

Introduction:

Dividends:

It refers to the distribution of profits to the shareholders of the company and can be paid in terms of cash and stock by the company.

Answer to Problem 35P

The calculation for the next four anticipated dividends is shown below:

Explanation of Solution

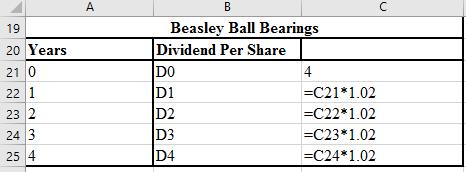

The formulae used for the calculation of the anticipated dividends are shown below:

b.

To calculate: The summation of the present values of the four anticipated dividends discounted at the rate of 15% of Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

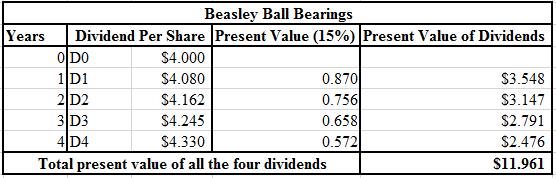

The calculation of the present values of the next four dividends is shown below:

Hence, the sum of the present value of the next four anticipated dividends is $11.961.

Explanation of Solution

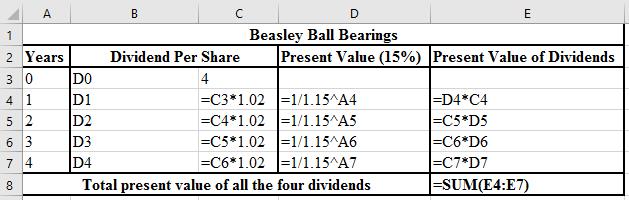

The formula used in the calculation of the present values are shown below:

c.

To calculate: The price of the common stock at fourth year (P4), issued by Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock at the end of the fourth year will be $33.977.

Explanation of Solution

Calculation of the stock price:

Working notes:

Calculation of the fifth year expected dividend:

d.

To calculate: The present value of P4 at a discount rate of 15% for Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

The present value of P4 at time zero discounted at 15% will be $19.435.

Explanation of Solution

Calculation of the present value of the stock price in part (c):

e.

To calculate: The current value of the stock.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The current value of the stock is $31.401.

Explanation of Solution

Calculation of the current price of the stock:

f.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $31.385. This price is approximately the same as calculated in the part (e).

Explanation of Solution

Calculation of the stock price by using the formula 10-8:

g.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $35.86.

Explanation of Solution

Calculation of the price of the stock:

Working Notes:

Calculation of firm’s P/E ratio:

h.

To calculate: The difference between the stock price calculated in part (g) and part (f) for Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The dollar amount difference between the stock price in part (g) and part (f) is $4.47.

Explanation of Solution

Calculation of the difference between the stock price in part (g) and part (f):

i.

To calculate: The effect of changing variables on the stock price.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock will increase in the 1st and 3rd parts, whereas it will decrease in the 2nd part.

Explanation of Solution

(1) If D1 increases, then the stock price will go up. The stock price and the amount of dividend are positively related to one another.

(2) If the required rate of return increases the stock price will decrease, exhibiting an inverse relationship.

(3) If the growth rate (g) increases, then the price of the stock will also increase. They exhibit a positive relationship.

Want to see more full solutions like this?

Chapter 10 Solutions

BUS 225 DAYONE LL

- Don't used Ai solution and don't used hand raitingarrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death,…arrow_forwardCould you please help explain what is the research assumptions, research limitations, research delimitations and their intent? How the research assumptions, research limitations can shape the study design and scope? How the research delimitations could help focus the study and ensure its feasibility? What are the relationship between biblical principles and research concepts such as reliability and validity?arrow_forward

- What is the concept of the working poor ? Introduction form. Explain.arrow_forwardWhat is the most misunderstanding of the working poor? Explain.arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $240,000 saved, and he expects to earn 8% annually on his savings. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 4.00% Savings $240,000 Rate of return 8.00% Calculate value of…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now…arrow_forwardYou are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. Bond valuation Years to maturity 10 Par value of bond $1,000.00 Coupon rate 11.00% Frequency interest paid per year 2 Effective annual rate 8.78% Calculation of periodic rate: Formulas Nominal annual rate #N/A Periodic rate #N/A Calculation of bond price: Formulas Number of periods #N/A Interest rate per period 0.00% Coupon payment per period #N/A Par value of bond $1,000.00 Price of bond #N/Aarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education