Concept explainers

Beasley Ball Bearings paid a

a. Compute the anticipated value of the dividends for the next four years. That is, compute

b. Discount each of these dividends back to present at a discount rate of 15 percent and then sum them.

c. Compute the price of the stock at the end of the fourth year

d. After you have computed

e. Add together the answers in part b and part d to get

f. Use Formula 10-8 to show that it will provide approximately the same answer as part e.

For Formula 10-8, use

g. If current EPS were equal to

h. By what dollar amount is the stock price in part g different from the stock price in part f?

i. In regard to the stock price in part

a.

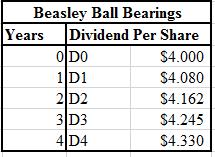

To calculate: The anticipated value of dividends for the next four years to be declared by Beasley Ball Bearings.

Introduction:

Dividends:

It refers to the distribution of profits to the shareholders of the company and can be paid in terms of cash and stock by the company.

Answer to Problem 35P

The calculation for the next four anticipated dividends is shown below:

Explanation of Solution

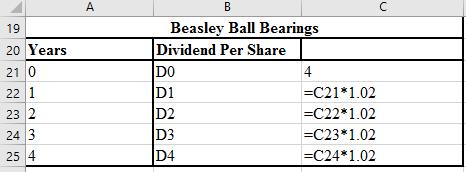

The formulae used for the calculation of the anticipated dividends are shown below:

b.

To calculate: The summation of the present values of the four anticipated dividends discounted at the rate of 15% of Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

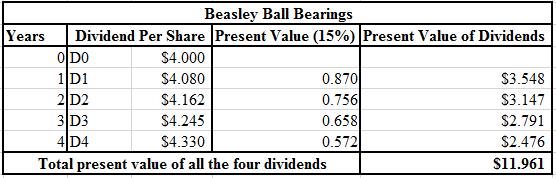

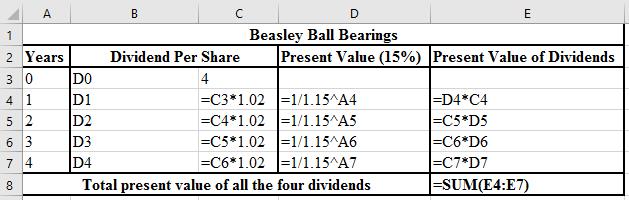

The calculation of the present values of the next four dividends is shown below:

Hence, the sum of the present value of the next four anticipated dividends is $11.961.

Explanation of Solution

The formula used in the calculation of the present values are shown below:

c.

To calculate: The price of the common stock at fourth year (P4), issued by Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock at the end of the fourth year will be $33.977.

Explanation of Solution

Calculation of the stock price:

Working notes:

Calculation of the fifth year expected dividend:

d.

To calculate: The present value of P4 at a discount rate of 15% for Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

The present value of P4 at time zero discounted at 15% will be $19.435.

Explanation of Solution

Calculation of the present value of the stock price in part (c):

e.

To calculate: The current value of the stock.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The current value of the stock is $31.401.

Explanation of Solution

Calculation of the current price of the stock:

f.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $31.385. This price is approximately the same as calculated in the part (e).

Explanation of Solution

Calculation of the stock price by using the formula 10-8:

g.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $35.86.

Explanation of Solution

Calculation of the price of the stock:

Working Notes:

Calculation of firm’s P/E ratio:

h.

To calculate: The difference between the stock price calculated in part (g) and part (f) for Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The dollar amount difference between the stock price in part (g) and part (f) is $4.47.

Explanation of Solution

Calculation of the difference between the stock price in part (g) and part (f):

i.

To calculate: The effect of changing variables on the stock price.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock will increase in the 1st and 3rd parts, whereas it will decrease in the 2nd part.

Explanation of Solution

(1) If D1 increases, then the stock price will go up. The stock price and the amount of dividend are positively related to one another.

(2) If the required rate of return increases the stock price will decrease, exhibiting an inverse relationship.

(3) If the growth rate (g) increases, then the price of the stock will also increase. They exhibit a positive relationship.

Want to see more full solutions like this?

Chapter 10 Solutions

Foundations of Financial Management

- I am looking for help with financial accounting questionarrow_forwardAssume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Keisha Sanders, a divorced single taxpayer and practicing attorney, lives at 9551 Oak Lane in Boise, ID 83709. Her social security number is 412-34-5670 (date of birth 2/27/1979). Her W-2 contained the following information: Wages (box 1) = $ 84,601.55 Federal W/H (box 2) = $ 8,278.51 Social Security wages (box 3) = $ 84,601.55 Social Security W/H (box 4) = $ 5,245.30 Medicare wages (box 5) = $ 84,601.55 Medicare W/H (box 6) = $ 1,226.72 In addition, Keisha made alimony payments totaling $11,100 for the year to her former husband Alex, an unemployed mine worker, whose Social Security number is 412-34-5671. This was in regards to a divorce decree that was completed prior to November 2017 and had not…arrow_forwardTyrone and Akira, who are married, incurred and paid the following amounts of interest during 2024: Home acquisition debt interest Credit card interest Home equity loan interest (used for home improvement) Investment interest expense Mortgage insurance premiums (PMI) Required: $ 10,250 3,100 5,105 8,200 1,000 With 2024 net investment income of $1,025, calculate (a) the amount of their allowable deduction for investment interest expense and, (b) their total deduction for allowable interest. Home acquisition principal and the home equity loan principal combined are less than $750,000. Deduction for investment interest expense Total deduction for allowable interest Amountsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education