Concept explainers

Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks.

The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division.

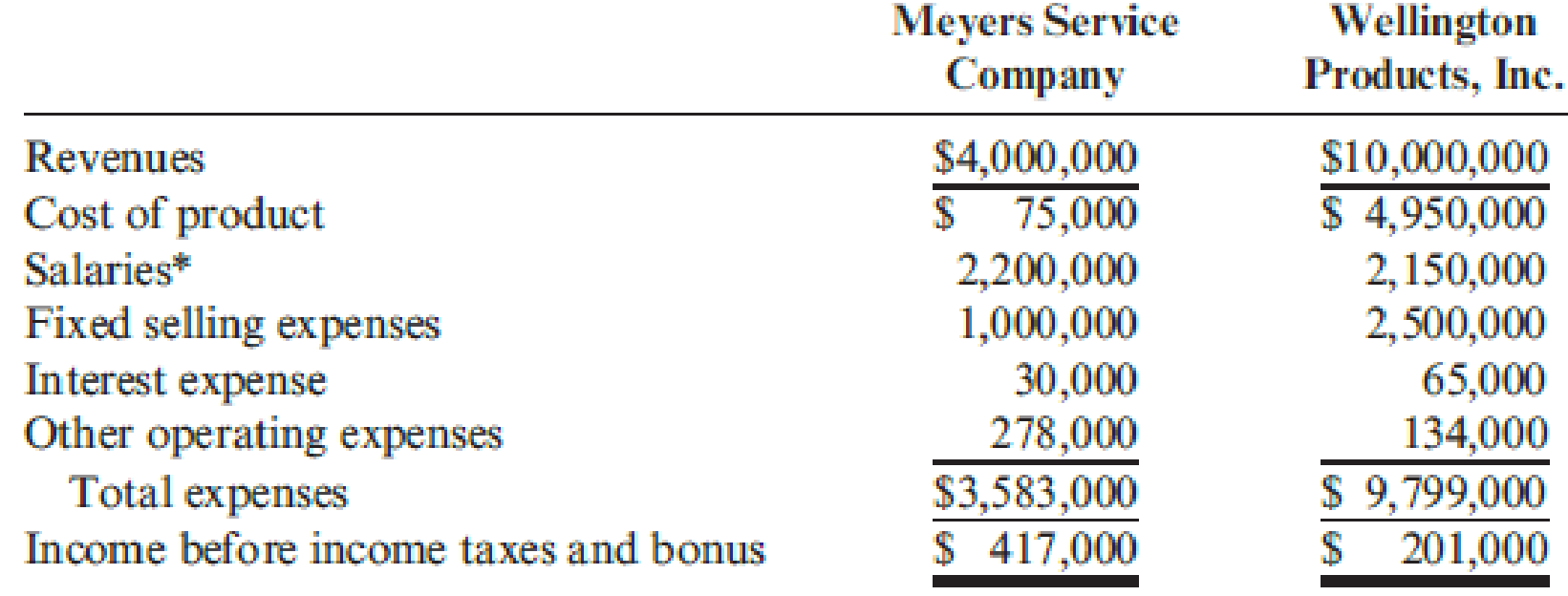

Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1:

Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1

*Each division has $1,000,000 of management salary expense that is eligible for the bonus pool.

Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion.

Required:

- 1. Determine the 20x1 bonus pool available for the management team at:

- a. Meyers Service Company

- b. Wellington Products, Inc.

- 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at:

- a. Meyers Service Company

- b. Wellington Products, Inc.

- 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems.

- a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans.

- b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.

Trending nowThis is a popular solution!

Chapter 10 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- D-Mart reported a net income of $19,500 for the previous year. At the beginning of the year, the company had $300,000 in assets. By the end of the year, assets had increased by $100,000. Calculate the return on assets. Help mearrow_forwardNonearrow_forwardPlease help me this question general accountingarrow_forward

- Provide answer general accountingarrow_forwardDon't Use Aiarrow_forward%17 .46 Vo i ཁ། B 7:-0 ÓrangeHost Having problems viewing this email? View email online Dear Awab Hameed (Printer), This is a notification that your service has now been suspended. The details of this suspension are below: Product/Service: Micro Domain: awabmohammed.com Amount: $23.40 Due Date: Thursday, January 16th, 2025 Suspension Reason: Overdue on Payment Please contact us as soon as possible to get your service reactivated. OrangeHost @ ||| ୦arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning