1 to 7.

Prepare payroll register for Company A from the information given.

1 to 7.

Explanation of Solution

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withheld from employees’ gross pay to deduct taxes such as federal income tax, state income tax, social security tax, and Medicare tax are called payroll withholding deduction.

Payroll register: A schedule which is maintained by the company to record the earnings, earnings withholdings, and net pay of each employee is referred to as payroll register.

The purpose of payroll register is used to record the following:

- Earnings of each employee.

- Taxes (Social security tax, Medicare tax, and federal income tax) and other withholdings (health insurance, and other) of each employee.

- Net pay of each employee.

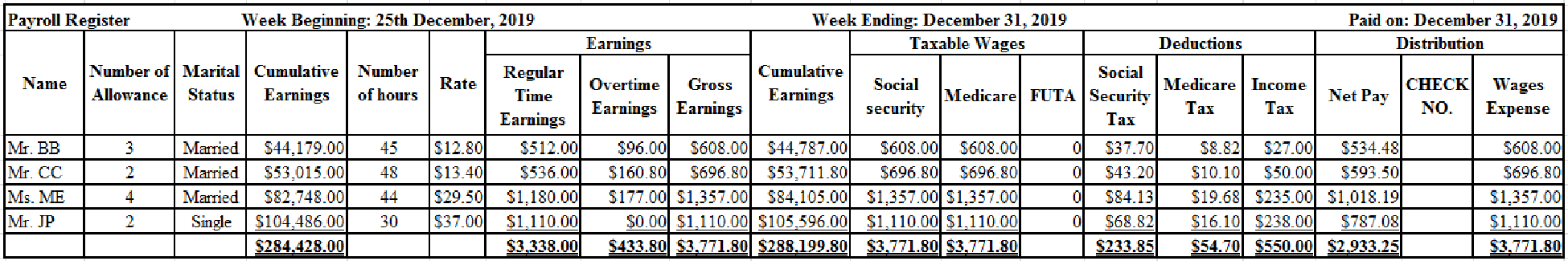

Prepare payroll register for Company A as below:

Table (1)

Working notes:

Calculate regular time earnings for Mr. BB.

Calculate regular time earnings for Mr. CC.

Calculate regular time earnings for Ms. ME.

Calculate regular time earnings for Mr. JP.

Calculate overtime earnings for Mr. BB.

Calculate overtime earnings for Mr. CC.

Calculate overtime earnings for Ms. ME.

Calculate social security tax for Mr. BB.

Calculate social security tax for Mr. CC.

Calculate social security tax for Ms. ME.

Calculate social security tax for Mr. JP.

Calculate Medicare tax for Mr. BB.

Calculate Medicare tax for Mr. CC.

Calculate Medicare tax for Ms. ME.

Calculate Medicare tax for Mr. JP.

Calculate the amount of Federal income tax for Mr. BB.

Mr. BB is married, claims three withholding allowances, and earned weekly salary of $608.00. Hence, by using withholding table (Refer figure 10.2B) his Federal income tax amount would be $27.

Calculate the amount of Federal income tax for Mr. CC.

Mr. CC is married, claims two withholding allowances, and earned weekly salary of $696.80. Hence, by using withholding table (Refer figure 10.2B) his Federal income tax amount would be $50.

Notes:

- Gross earnings are calculated by using the following formula:

- Net pay is calculated by using the following formula:

8.

Journalize the entry to record the payroll on December 31, 2019.

8.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare general journal entry to record the payroll on December 31, 2019.

| General Journal | Page 18 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Wages Expense | 3,771.80 | |||||

| December | 31 | Social Security Taxes Payable | 233.85 | ||||

| Medicare Taxes Payable | 54.70 | ||||||

| Employees Income Taxes Payable | 550.00 | ||||||

| Wages Payable | 2,933.25 | ||||||

| (To record wages expense and payroll withholdings) | |||||||

Table (2)

- Wages expense is an expense and it decreases equity value. So, debit it by $3,771.80.

- Social security taxes payable is a liability and it is increased. So, credit it by $233.85.

- Medicare taxes payable is a liability and it is increased. So, credit it by $54.70.

- Employee income taxes payable is a liability and it is increased. So, credit it by $550.00.

- Wages payable is a liability and it is increased. So, credit it by $2,933.25.

9.

Journalize the entry to record the payment of weekly payroll on July 3, 2019.

9.

Explanation of Solution

Prepare general journal entry to record payment of weekly payroll on December 31, 2019.

| General Journal | Page 18 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Wages Payable | 2,933.25 | |||||

| December | 31 | Cash | 2,933.25 | ||||

| (To record the payment of weekly payroll) | |||||||

Table (3)

- Wages payable is a liability and it is decreased. So, debit it by $2,933.25.

- Cash is an asset and it is decreased. So, credit it by $2,933.25.

Analyze: The difference between cash paid and wages expense for the same payroll period is $838.55

Want to see more full solutions like this?

Chapter 10 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

- I need help Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardWhich account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalhelparrow_forwardAccounting solution with right answerarrow_forward

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning