a.

Classify the items that will come under the product cost and calculate the amount of cost of goods sold for the year 2017 income statement.

a.

Answer to Problem 2ATC

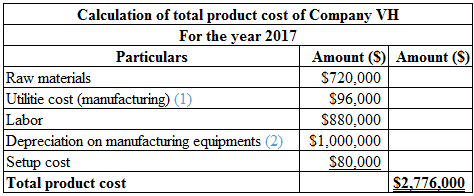

The items that will be classified under the product cost are as follows:

Table (1)

Hence, the total product cost of Company VH is $2,776,000.

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

Explanation of Solution

The cost of goods sold:

The cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $96,000.

(1)

Calculate the

Hence, the depreciation cost is $1,000,000.

(2)

Calculate the cost per unit as follows:

Hence, the cost per unit is $40.

(3)

Classify the items that will come under the upstream cost and calculate the amount of upstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

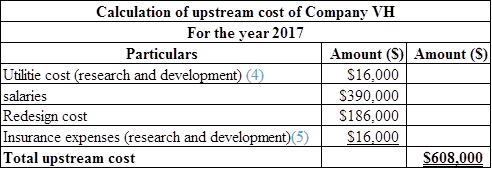

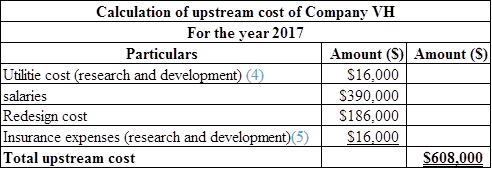

The items that will be classified under the upstream cost are as follows:

Table (2)

Hence, the total upstream expenses are $608,000.

Explanation of Solution

Upstream cost:

This cost is incurred before starting the manufacturing process. For example: research and development, and product design.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $16,000

(4)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on research and development as follows:

Hence, the insurance expenses on research and development is $16,000.

(5)

Note:

The accrued engineer’s salary $10,000 comes under the upstream cost but it is not considered for calculating the upstream cost because it is previous year’s cost.

Classify the items that will come under the downstream cost and calculate the amount of downstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

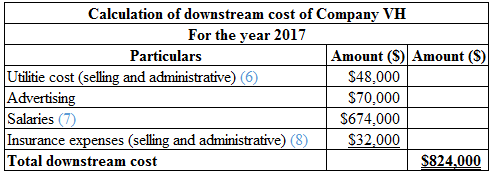

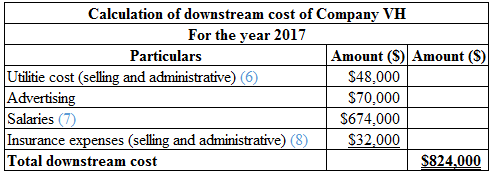

The items that will be classified under the downstream cost are as follows:

Table (3)

Hence, the total downstream expenses are $824,000.

Explanation of Solution

Downstream:

This cost is incurred after starting the manufacturing process. For example: marketing, distribution, and customer service.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for selling and administrative as follows:

Hence, the utility cost for selling and administrative cost is $48,000.

(6)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the total salary as follows:

Hence, the total salary is $674,000.

(7)

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on selling and administrative as follows:

Hence, the insurance expenses on selling and administrative is $32,000.

(8)

b.

Prepare the income statement.

b.

Answer to Problem 2ATC

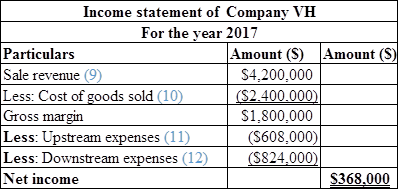

The calculation of the income statement is as follows:

Table (4

Hence, the net income of Company VH is $368,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue as follows:

Hence, the revenue is $4,200,000.

(9)

Calculate the cost of goods sold as follows:

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

(10)

Calculate the upstream expenses as follows:

Table (5)

Hence, the total upstream expenses are $608,000.

(11)

Calculate the downstream expenses as follows:

Table (6)

Hence, the total downstream expenses are $824,000.

(12)

Want to see more full solutions like this?

Chapter 10 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Donovan Manufacturing has an overhead application rate of 145% and allocates overhead based on direct material cost. During the current period, direct labor cost is$63,500 and direct materials used cost is $82,000. Determine the amount of overhead Donovan Manufacturing should record in the current period. Solutionarrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardDuring June, the production department of a process operations system completed and transferred to finished goods a total of 82,000 units of product. At the end of May, 18,000 additional units were in process in the production department and were 70% complete with respect to materials. The beginning inventory included a materials cost of $92,400 and the production department incurred a direct materials cost of $276,800 during June. Compute the direct materials cost per equivalent unit for the department using the weighted-average method.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning