Concept explainers

a.

The total product cost and average cost per unit.

a.

Explanation of Solution

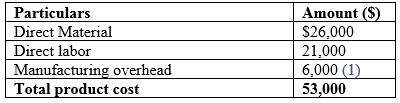

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

Given information:

- The raw material is $26,000.

- The wages for production workers are $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6 years.

- The completed production of Company S is 10,000 units.

The calculation of total product cost for the year 2018 is as follows:

Hence, the total cost of the product for the year 2018 is $53,000.

The calculation average cost per unit for the year 2018 is as follows:

Hence, the average cost per unit for the year 2018 is $5.30.

Working notes:

The calculation of manufacturing

Hence, the manufacturing overheads are $6,000.

(1)

b.

The cost of goods sold that appears in 2018 income statement.

b.

Explanation of Solution

Cost of goods sold

The cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes the indirect expenses.

Given information:

- The total number of units sold by Company S is 8,000 units.

The calculation of total cost of goods sold for the year 2018 is as follows:

Hence, the total cost of goods sold is $41,400.

c.

The cost of ending inventory that appears on 31st December 2018

c.

Explanation of Solution

Inventory:

It is the term for products that are ready for sale and raw materials that are used in the making of the final product.

Given information:

- The total number of units sold by Company S is 8,000 units.

- The completed production of Company S is 10,000 units.

The calculation of ending inventory for the year 2018 is as follows:

Hence, the ending inventory for the year 2018 is $10,600.

d.

The total amount of net income for the year 2018.

d.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as the net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for the raw materials.

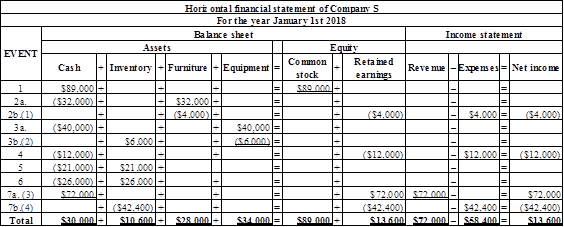

The calculation of net income of the Company S for the year 2018 is as follows:

Table (2)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of the manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

e.

The total amount of net income for the year 2018.

e.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from the business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is 26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

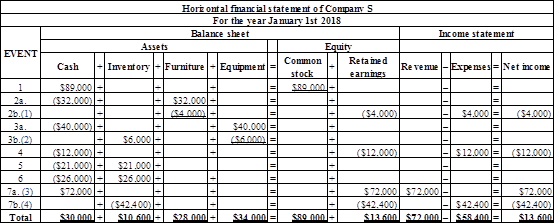

The calculation of

Table (3)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

f.

The total assets that appears on the balance sheet.

f.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000 and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

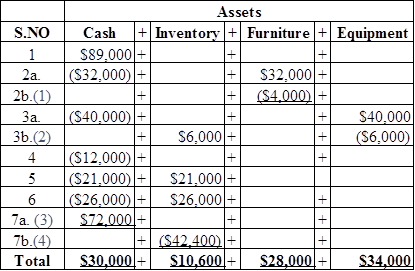

The table showing calculation of assets:

Table (4)

The calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2018 is $102,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

Want to see more full solutions like this?

Chapter 10 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Solve this question and accountingarrow_forwardCustom Pools currently sells420 Economy pools, 580 Standard pools, and 190 Premium pools each year. The firm is considering adding a Luxury pool and expects that, if it does, it can sell 310 of them. However, if the new pool is added, Economy pool sales are expected to decline to 290 units while Standard pool sales are expected to decline to 350. The sales of the Premium model will not be affected. Economy pools sell for an average of $16,200 each. Standard pools are priced at $24,500 and the Premium model sells for $42,000 each. The new Luxury pool will sell for $35,000. What is the value of erosion?arrow_forwardI need help with this solution and general accounting questionarrow_forward

- Naveen Electronics started the year with total assets of $425,000 and total liabilities of $275,000. During the year, the business recorded $580,000 in revenues, $390,000 in expenses, and dividends of $75,000. What is the net income reported by Naveen Electronics for the year?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardSolve step by step .arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,