Concept explainers

Problem 1O-2A

Depreciation methods

P1

A machine costing $257,500 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units: 220,000 in 1st year, 124,600 in 2nd year, 121,800 in 3rd year, 15,200 in 4th year. The total number of units produced by the end of year 4 exceeds the original estimate-this difference was not predicted. (The machine must not be

Required

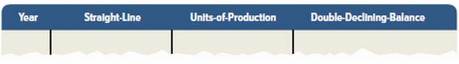

Prepare a table with the following column headings and compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

Check Year 4 units-of-production depreciation. $4,300; DDB depreciation, $12,187

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Fundamental Accounting Principles -Hardcover

- Determine the prepaid rent value for builla Enterprises as this is the onearrow_forwardNeed general account solutionsarrow_forwardNurix, Inc. is a business consulting firm. During the month of February, Nurix earned $55,200 of revenues by providing services to 46 clients. Operating costs for February were $8,500 and non-operating costs were $5,500. What is the unit cost per service? (Round your answer to the nearest cent.) OA. $184.78 OB. $304.35 OC. $1,200.00 OD. $119.57arrow_forward

- Give correct Answer! If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardAbbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 3% of credit sales will be uncollectible. On January 1, Allowance for Doubtful Accounts had a credit balance of $3,300. During the year, Abbott wrote off accounts receivable totaling $2,100 and made credit sales of $113,000. After the adjusting entry, the December 31 balance in Bad Debt Expense will be .... a. 3300 b. 3390 c. 4590 d. 6690arrow_forwardDo fast answer of this accounting questionsarrow_forward

- Need help with this question solution general accountingarrow_forwardSunshine Blender Company sold 7,000 units in October at a sales price of $40 per unit. The variable cost is $25 per unit. Calculate the total contribution margin. OA. $280,000 OB. $105,000 OC. $87,500 OD. $175,000arrow_forwardI want to correct answer general accounting questionarrow_forward

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning