a.

Prepare an amortization table.

a.

Explanation of Solution

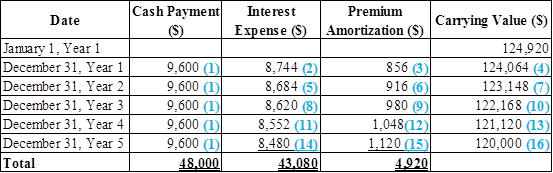

Amortization Schedule:

A schedule that gives the detail about each loan payment and shows the allocation of principal and interest over the life of the note, or bond is called amortization schedule.

Amortization table is prepared as follows:

Figure (1)

Working notes:

Calculate the cash payment from Year 1 to Year 5:

Calculate the interest Expense as on December 31, Year 1:

Calculate the premium amortization as on December 31, Year 1:

Calculate the carrying

Calculate the interest Expense as on December 31, Year 2:

Calculate the premium amortization as on December 31, Year 2:

Calculate the carrying value of bond as on December 31, Year 2:

Calculate the interest Expense as on December 31, Year 3:

Calculate the premium amortization as on December 31, Year 3:

Calculate the carrying value of bond as on December 31, Year 3:

Calculate the interest Expense as on December 31, Year 4:

Calculate the premium amortization as on December 31, Year 4:

Calculate the carrying value of bond as on December 31, Year 4:

Calculate the interest Expense as on December 31, Year 5:

Note: $8,478.4 rounded to $10,597.

Calculate the premium amortization as on December 31, Year 5:

Calculate the carrying value of bond as on December 31, Year 5:

b.

State the item that would appear on the

b.

Explanation of Solution

Balance sheet:

Balance is the financial statement that reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and

- The item that would appear on the Balance sheet of Year 3 is the carrying value of bond liability. The premium amount is included while, reporting the carrying value ($122,168).

- The face value of the bond and the premium received on bond is disclosed in the notes to the financial statements. Alternatively, the face value plus the premium could be shown in the following way:

| Particulars | Amount ($) |

| Bond liability | 120,000 |

| Add: Bond Premium (17) | 2,168 |

| Carrying value | 122,168 |

Table (2)

Working note:

Calculate the total premium on bond:

c.

State the item that would appear on the income statement of Year 3.

c.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

The statement of income will report interest expense of $8,620.

d.

State the item that would appear on the statement of

d.

Explanation of Solution

Statement of cash flows:

Statement of cash flows is one among the financial statement of a Company statement that

Shows aggregate data of all

The cash flow statement will report

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamental Financial Accounting Concepts

- Please help me solve this general accounting problem with the correct financial process.arrow_forwardThe installment method of revenue recognition is primarily used for_. (a) Service contracts (b) Sales with extended payment terms (c) Construction projects (d) Consignment sales MCQarrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- I need help with this financial accounting question using accurate methods and procedures.arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education