a.

Prepare an amortization table.

a.

Explanation of Solution

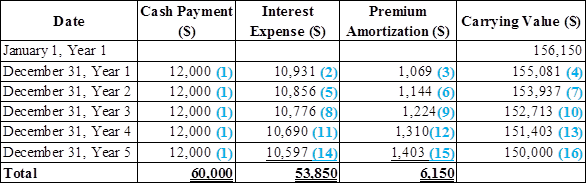

Amortization Schedule:

A schedule that gives the detail about each loan payment and shows the allocation of principal and interest over the life of the note, or bond is called amortization schedule.

Amortization table is prepared as follows:

Figure (1)

Note: Year 1 considered as 2016, Year 2 considered as 2017, Year 3 considered as 2018, Year 4 considered as 2019, and Year 5 considered as 2020.

Working notes:

Calculate the cash payment from Year 2016 to Year 2020:

Calculate the interest Expense as on December 31, Year 2016:

Calculate the premium amortization as on December 31, Year 1:

Calculate the carrying

Calculate the interest Expense as on December 31, Year 2:

Calculate the premium amortization as on December 31, Year 2:

Calculate the carrying value of bond as on December 31, Year 2:

Calculate the interest Expense as on December 31, Year 3:

Calculate the premium amortization as on December 31, Year 3:

Calculate the carrying value of bond as on December 31, Year 3:

Calculate the interest Expense as on December 31, Year 4:

Calculate the premium amortization as on December 31, Year 4:

Calculate the carrying value of bond as on December 31, Year 4:

Calculate the interest Expense as on December 31, Year 5:

Note: $10,598.21 rounded to $10,597.

Calculate the premium amortization as on December 31, Year 5:

Calculate the carrying value of bond as on December 31, Year 5:

b.

State the item that would appear on the

b.

Explanation of Solution

Balance sheet:

Balance is the financial statement that reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and

- The item that would appear on the Balance sheet of Year 2019 is the carrying value of bond liability. The premium amount is included while, reporting the carrying value ($151,403).

- The face value of the bond and the premium received on bond is disclosed in the notes to the financial statements. Alternatively, the face value plus the premium could be shown in the following way:

| Particulars | Amount ($) |

| Bond liability | 150,000 |

| Add: Bond Premium (17) | 1,403 |

| Carrying value | 151,403 |

Table (2)

Working note:

Calculate the total premium on bond:

c.

State the item that would appear on the income statement of Year 2019.

c.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

The statement of income will report interest expense of $10,690.

d.

State the item that would appear on the statement of

d.

Explanation of Solution

Statement of cash flows:

Statement of cash flows is one among the financial statement of a Company statement that

Shows aggregate data of all

The cash flow statement will report

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamental Financial Accounting Concepts, 9th Edition

- Crane Furniture purchased a delivery van with a $51000 list price, but Parisa negotiated with the dealer to bring the price down to $46900. Crane also paid $2700 sales tax and annual insurance on the van for $1500. What will Crane record as the cost of the van? ○ $49600 ○ $53700 ○ $51100 ○ $46900arrow_forwardThe balance sheet of Armani Systems at December 31 showed assets of $75,000 and shareholders equity of $45,000. What were the liabilities at December 31? a. $40,000 b. $30,000arrow_forward4 PTSarrow_forward

- Equipment with a cost of $501400 has an estimated salvage value of $47000 and an estimated life of 4 years or 9400 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used for 2350 hours? $137100 $129700 $113600 ○ $125350arrow_forwardViola enterprises purchased an item for inventory that cost $25 pet unit and was priced to sell at $40.arrow_forwardBlossom Wholesale Motor Company purchases land for $120000 cash. Blossom assumes $4500 in property taxes due on the land. The title and attorney fees totaled $1500. Blossom has the land graded for $3400. They paid $15000 for paving of a parking lot. What amount does Blossom record as the cost for the land? ○ $120000 ○ $129400 $124900 ○ $144400arrow_forward

- Solve with explanation and accounting questionarrow_forwardCarla Vista Motor Corporation bought equipment on January 1, 2025. The equipment cost $440000 and had an expected salvage value of $70000. The life of the equipment was estimated to be 4 years. The depreciable cost of the equipment is $70000. $440000. $92500. $370000.arrow_forwardOn January 1, a machine with a useful life of five years and a salvage value of $30000 was purchased for $220000. What is the depreciation expense for year 2 under straight-line depreciation? ○ $132000 ○ $38000 $32000 ○ $114000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education