Concept explainers

The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer.

Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $775.

2 J. Hammond, the owner, invested an additional $3,500 in the business.

4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,930; terms 2/10, n/30; dated January 2.

4 Received check from Vega Appliance for $980 in payment of $1,000 invoice less discount.

4 Sold merchandise on account to L. Paul, invoice no. 6483, $850.

6 Received check from Petty, Inc., $637, in payment of $650 invoice less discount.

7 Issued Ck. No. 6982, $588, to Fischer and Son, in payment of invoice no. C1272 for $600 less discount.

7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days.

7 Sold merchandise on account to Ellison and Clay, invoice no. 6484, $787.

9 Issued credit memo no. 43 to L. Paul, $54, for merchandise returned.

11 Cash sales for January 1 through January 10, $4,863.20.

11 Issued Ck. No. 6983, $2,871.40, to Valencia and Company, in payment of $2,930 invoice less discount.

14 Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,050.

Jan. 18 Bought merchandise on account from Costa Products, invoice no. 7281D, $4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $147 (total $5,001).

21 Issued Ck. No. 6984, $194, to M. Miller for miscellaneous expenses not recorded previously.

21 Cash sales for January 11 through January 20, $4,591.

23 Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4.

23 Received credit memo no. 163, $376, from Costa Products for merchandise returned.

29 Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,835.

31 Cash sales for January 21 through January 31, $4,428.

31 Issued Ck. No. 6986, $53, to M. Miller for miscellaneous expenses not recorded previously.

31 Recorded payroll entry from the payroll register: total salaries, $6,200; employees’ federal income tax withheld, $872; FICA Social Security tax withheld, $384.40, FICA Medicare tax withheld, $89.90.

31 Recorded the payroll taxes: Social Security tax, $384.40, FICA Medicare tax, $89.90; state

31 Issued Ck. No. 6987, $4,853.70, for salaries for the month.

31 J. Hammond, the owner, withdrew $1,000 for personal use, Ck. No. 6988.

Required

- 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used.

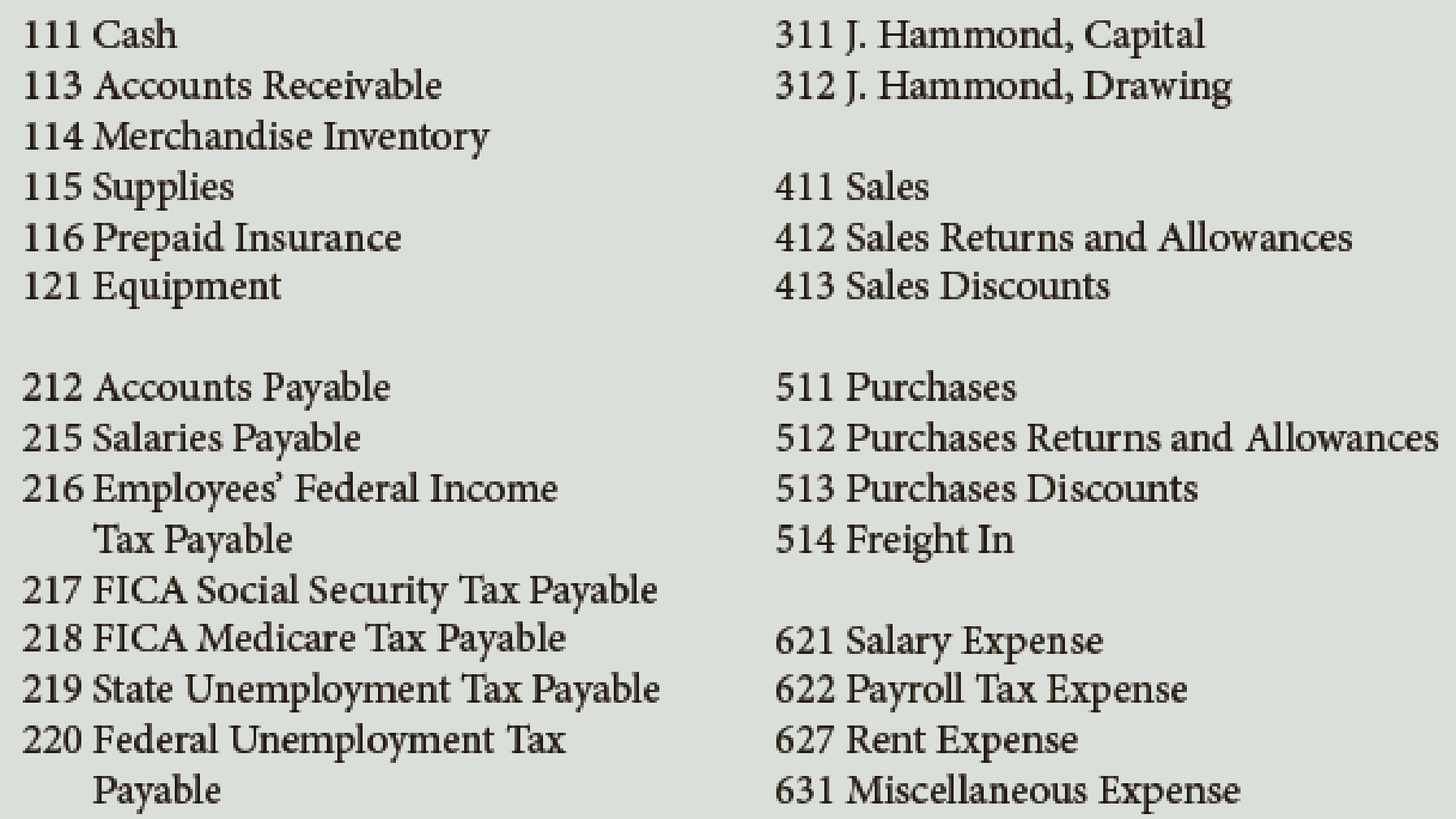

The chart of accounts is as follows:

- 2.

Post daily all entries involving customer accounts to theaccounts receivable ledger. - 3. Post daily all entries involving creditor accounts to the accounts payable ledger.

- 4. Post daily the general

journal entries to the general ledger. Write the owner’s name in the Capital and Drawing accounts. - 5. Prepare a

trial balance . - 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

1.

Journalize the transactions in the general journal using the periodic inventory method.

Explanation of Solution

General journal is a record of financial transaction. The transactions are recorded in the journal prior to posting them to the accounts in the general ledger.

Periodic inventory system: The method or system of recording the transactions related to inventory occasionally or periodically are referred to as periodic inventory system.

Journalize the transactions in the general journal.

GENERAL JOURNAL PAGE 1

| Date | Description | Post Ref. | Debit ($) | Credit ($) | |||

| 20-- | |||||||

| Jan | 2 | Rent Expense | 627 | 775 | |||

| Cash | 111 | 775 | |||||

| (Record the paid month rent, Ck.No.6981) | |||||||

| 2 | Cash | 111 | 3,500 | ||||

| Mr. H, Capital | 311 | 3,500 | |||||

| (Record the additional capital invested by the owner) | |||||||

| 4 | Purchases | 511 | 2,930 | ||||

| Accounts Payable, V Company | 212/ | 2,930 | |||||

| (Purchased merchandise from V Company, invoice no.A691,invoice dated January 2,terms 2/10, n/30) | |||||||

| 4 | Cash | 111 | 980 | ||||

| Sales Discount | 413 | 20 | |||||

| Accounts Receivable | 113/ | 1,000 | |||||

| (Payment of invoice less discount) | |||||||

| 4 | Accounts Receivable Mr. P | 113/ | 850 | ||||

| Sales | 411 | 850 | |||||

| (Record the sale of merchandise to Mr. P, invoice no.6483) | |||||||

| 6 | Cash | 111 | 637 | ||||

| Sales Discount | 413 | 13 | |||||

| Accounts Receivable, Petty, Inc. | 113/ | 650 | |||||

| (Record the payment of invoice less discount) | |||||||

| 7 | Accounts Payable, F Company | 212/ | 600 | ||||

| Purchase Discount | 513 | 12 | |||||

| Cash | 111 | 588 | |||||

| (Record the paid invoice no.C1272, Ck.No.6982) | |||||||

GENERAL JOURNAL PAGE 2

| 7 | Supplies | 115 | 108 | |||

| Accounts Payable, D Company | 212 | 108 | ||||

| (Record the office supply, Invoice no. 1906B,term net 30) | ||||||

| 7 | Accounts Receivable, Mr. E & C | 113/ | 787 | |||

| sales | 411 | 787 | ||||

| (Record the sale of merchandise to Mr. E & C invoice no.6484) | ||||||

| 9 | Sales Return and Allowance | 412 | 54 | |||

| Accounts Receivable, Mr. P | 113/ | 54 | ||||

| (Record the issued credit memo no.43) | ||||||

| 11 | Cash | 111 | 4,863.20 | |||

| Sales | 411 | 4,863.20 | ||||

| (Record the cash sales, January 1-10) | ||||||

| 11 | Accounts Payable, V Company | 212/ | 2,930 | |||

| Cash | 111 | 2,871.40 | ||||

| Purchase Discount | 513 | 58.6 | ||||

| (Record the invoice paid n.A691 less discount, Ck. No. 6983) | ||||||

| 14 | Accounts Receivable, V Company | 113/ | 2,050 | |||

| Sales | 411 | 2,050 | ||||

| (Record the sale of merchandise to V Company, invoice no. 6485) | ||||||

| 18 | Purchases | 511 | 4,854 | |||

| Freight In | 514 | 147 | ||||

| Accounts Payable, Mr. C | 212/ | 5,001 | ||||

| (Record the purchase of merchandise from C Company, invoice dated January 16) | ||||||

| 21 | Miscellaneous Expense | 631 | 194 | |||

| Cash | 111 | 194 | ||||

| (Record the cash paid to Mr. M,Ck.No.6985) | ||||||

| 21 | Cash | 111 | 4,591 | |||

| Sales | 411 | 4,591 | ||||

| (Record the cash sales, January 11-20) | ||||||

| 23 | Freight In | 514 | 96 | |||

| Cash | 111 | 96 | ||||

| (Record the freight charge, Ck. No. 6985) | ||||||

GENERAL JOURNAL PAGE 3

| 23 | Accounts Payable, C Company | 212/ | 376 | |||

| Purchase Return and Allowance | 512 | 376 | ||||

| (Record return on merchandise credit memo.163) | ||||||

| 29 | Accounts Payable, B Company | 113/ | 1,835 | |||

| Sales | 411 | 1,835 | ||||

| (Record the sale of merchandise to B Company invoive no.6486) | ||||||

| 31 | Cash | 111 | 4,428 | |||

| Sales | 411 | 4,428 | ||||

| (Record cash sales on january21-31) | ||||||

| 31 | Miscellaneous Expenses | 631 | 53 | |||

| Cash | 111 | 53 | ||||

| (Paid to Mr. M CK.NO.6986) | ||||||

| 31 | Salary Expenses | 621 | 6,200 | |||

| Employees' Federal Income Tax Payable | 216 | 872 | ||||

| FICA Social Security Tax Payable | 217 | 384.4 | ||||

| FICA Medicare Tax Payable | 218 | 89.9 | ||||

| Salaries Payable | 215 | 4,854 | ||||

| (Record the salaries for the month) | ||||||

| 31 | Payroll Tax Expense | 622 | 846.3 | |||

| FICA Social Security Tax Payable | 217 | 384.4 | ||||

| FICA Medicare Tax Payable | 218 | 89.9 | ||||

| State Unemployment Tax Payable | 219 334.80 | 334.8 | ||||

| Federal Unemployment Tax Payable | 220 | 220 | ||||

| (Record the employer’s share of FICA taxes and employer's state and federal unemployment taxes for the month) | ||||||

| 31 | Salaries Payable | 215 | 4,853.70 | |||

| Cash | 111 | 4,853.70 | ||||

| (Record the payroll, Ck.No.6987) | ||||||

| 31 | Mr. H, Drawing | 312 | 1,000 | |||

| Cash | 111 | 1,000 | ||||

| (Record the withdrawal for personal use,Ck.No.6988) | ||||||

Table (1)

2.

Record the entries from customer accounts to the accounts receivable ledger.

Explanation of Solution

Account receivable: The amount of money to be received by a company for the sale of goods and services to the customers is referred to as account receivable.

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Entries from customer accounts to the accounts receivable ledger:

| Accounts receivable ledger | ||||||

| Name: B company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 29 | 3 | 1,835 | 1,835 | ||

| Name: E and C company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 7 | 2 | 787 | 787 | ||

| Name: L company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 4 | 1 | 850 | 850 | ||

| 9 | 2 | 54 | 796 | |||

| Name: P company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 1 | Balance | 650 | |||

| 6 | 1 | 650 | 0 | |||

| Name: V company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 1 | Balance | 1,000 | |||

| 4 | 1 | 1,000 | 0 | |||

| 14 | 2 | 2,050 | 2,050 | |||

Table (2)

3.

Record the entries from customer accounts to the accounts payable ledger.

Explanation of Solution

Account payable: The amount of money to be paid by a company for the purchase of goods and services from the seller is referred to as account payable.

Entries from customer accounts to the accounts payable ledger:

| Accounts payable ledger | ||||||

| Name: C company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 18 | 2 | 5,001 | 5,001 | ||

| 23 | 3 | 376 | 4,625 | |||

| Name: D company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 7 | 1 | 108 | 108 | ||

| Name: F and sons | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 1 | Balance | 600 | |||

| 7 | 1 | 600 | 0 | |||

| Name: V company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| Jan | 4 | 1 | 2,930 | 2,930 | ||

| 11 | 2 | 2,930 | 0 | |||

Table (3)

4.

Record the journal entries to the general ledger.

Explanation of Solution

General ledger: General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements.

Journal entries to the general ledger:

| Account: Cash | Account No:111 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 8,740 | |||||

| 2 | 1 | 775 | 7,965 | |||||

| 2 | 1 | 3,500 | 11,465 | |||||

| 4 | 1 | 980 | 12,445 | |||||

| 6 | 1 | 637 | 13,082 | |||||

| 7 | 1 | 588 | 12,494 | |||||

| 11 | 2 | 4,863.2 | 17,357.2 | |||||

| 11 | 2 | 2,871.4 | 14,485.8 | |||||

| 21 | 2 | 194 | 14,291.8 | |||||

| 21 | 2 | 4,591 | 18,882.8 | |||||

| 23 | 2 | 96 | 18,786.8 | |||||

| 31 | 3 | 4,428 | 23,214.8 | |||||

| 31 | 3 | 53 | 23,161.8 | |||||

| 31 | 3 | 4,853.7 | 18,308 | |||||

| 31 | 3 | 1,000 | 17,308.1 | |||||

| Account: Accounts receivable | Account No:113 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 1,650 | |||||

| 4 | 1 | 1,000 | 650 | |||||

| 4 | 1 | 850.00 | 1,500 | |||||

| 6 | 1 | 650.00 | 850 | |||||

| 7 | 2 | 787 | 1,637 | |||||

| 9 | 2 | 54 | 1,583 | |||||

| 14 | 2 | 2,050 | 3,633 | |||||

| 29 | 3 | 1,835 | 5,468 | |||||

| Account: Merchandise inventory | Account No:114 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 20,584 | |||||

| Account: Suppliers | Account No:115 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 592 | |||||

| 7 | Purchase | 1 | 108 | 700 | ||||

| Account: Prepaid insurance | Account No:116 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 390 | |||||

| Account: Equipment | Account No:121 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 3,644 | |||||

| Account: Accounts payable | Account No:212 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | Balance | 600 | |||||

| 4 | 1 | 2,930 | 3,530 | |||||

| 7 | 1 | 600 | 2,930 | |||||

| 7 | 1 | 108 | 3,038 | |||||

| 11 | 2 | 2,930 | 108 | |||||

| 18 | 2 | 5,001 | 5,109 | |||||

| 23 | 3 | 376 | 4,733 | |||||

| Account: Salaries payable | Account No:215 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 4,853.70 | 4,853.70 | ||||

| 31 | 3 | 4,853.70 | ||||||

| Account: Employees federal income tax payable | Account No:216 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 872 | 872 | ||||

| Account: FICA social security tax payable | Account No:217 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 384.4 | 384.4 | ||||

| 31 | 3 | 384.4 | 768.8 | |||||

| Account: FICA Medicare payable | Account No:218 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 89.9 | 89.9 | ||||

| 31 | 3 | 89.9 | 179.8 | |||||

| Account: State unemployment tax payable | Account No:219 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 334.8 | 334.8 | ||||

| Account: Federal unemployment tax payable | Account No:220 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 37.2 | 37.2 | ||||

| Account: Mr. H Capital | Account No:311 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 1 | 35,000 | ||||||

| 2 | 1 | 3,500 | 38,500 | |||||

| Account: Mr. H Drawing | Account No:312 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 1,000 | 1,000 | ||||

| Account: Sales | Account No:411 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 4 | 1 | 850 | 850 | ||||

| 7 | 2 | 787 | 1,637 | |||||

| 11 | 2 | 4,863.0 | 6,500.2 | |||||

| 14 | 2 | 2,050 | 8,550.2 | |||||

| 21 | 2 | 4,591 | 13,141.2 | |||||

| 29 | 3 | 1,835 | 14,976.2 | |||||

| 31 | 3 | 4,428 | 19,404.2 | |||||

| Account: Sales return and allowance | Account No:412 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 9 | 2 | 54 | 54 | ||||

| Account: Sales discounts | Account No:413 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 4 | 1 | 20 | 20 | ||||

| 6 | 1 | 13 | 33 | |||||

| Account: Purchases | Account No:511 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 4 | 1 | 2,930 | 2,930 | ||||

| 18 | 2 | 4,854 | 7,784 | |||||

| Account: Purchases returns and allowances | Account No:512 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 23 | 3 | 376 | 376 | ||||

| Account: Purchase discounts | Account No:513 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 7 | 1 | 12 | 12 | ||||

| 11 | 2 | 58.6 | 58.6 | |||||

| Account: Freight in | Account No:514 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 18 | 2 | 147 | 147 | ||||

| 23 | 2 | 96 | 243 | |||||

| Account: Salary expense | Account No:621 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 6,200 | 6,200 | ||||

| Account: Payroll tax expense | Account No:622 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 31 | 3 | 846.3 | 846.3 | ||||

| Account: Rent expense | Account No:627 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 2 | 1 | 775 | 775 | ||||

| Account: Miscellaneous expense | Account No:631 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| Jan | 21 | 2 | 194 | 194 | ||||

| 31 | 3 | 53 | 247 | |||||

Table (4)

5.

Prepare a trial balance of H Company.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the ledger postings and helps preparing the final accounts.

Prepare a trial balance.

| H company | |||||

| Trail balance | |||||

| January 31, 20__ | |||||

| Account name | Debit ($) | Credit($) | |||

| Cash | 17,308.10 | ||||

| Accounts receivable | 5,468 | ||||

| Merchandise inventory | 20,584 | ||||

| Supplies | 700 | ||||

| Prepaid insurance | 390 | ||||

| Equipment | 3,644 | ||||

| Accounts payable | 4,733 | ||||

| Employee's federal income tax payable | 872 | ||||

| FICA social security tax payable | 768.8 | ||||

| FICA Medicare tax payable | 179.8 | ||||

| State unemployment tax payable | 334.8 | ||||

| Federal unemployment tax payable | 37.2 | ||||

| Mr. J capital | 38,500 | ||||

| Mr. J drawings | 1,000 | ||||

| Sales | 19,404.2 | ||||

| Sales returns and allowances | 54 | ||||

| Sales discounts | 33 | ||||

| Purchases | 7,784 | ||||

| Purchases returns and allowances | 376 | ||||

| Purchases discounts | 70.6 | ||||

| Freight in | 243 | ||||

| Salary expense | 6,200 | ||||

| Payroll tax expense | 846.3 | ||||

| Rent expense | 775 | ||||

| Miscellaneous expense | 247 | ||||

| 65,276.40 | 65,276.40 | ||||

Table (5)

6.

Prepare a schedule of accounts receivable and accounts payable.

Explanation of Solution

Schedule of accounts receivable:

| H company | |

| Schedule of Accounts Receivable | |

| January 31, 20__ | |

| Particulars | Amount($) |

| B company | 1,835 |

| E and C company | 787 |

| L company | 796 |

| V company | 2,050 |

| Total accounts receivable | $5,468 |

Table (6)

Schedule of accounts payable

| H company | |

| Schedule of Accounts Payable | |

| January 31, 20__ | |

| Particulars | Amount($) |

| C company | 4,625 |

| D company | 108 |

| Total accounts payable | $4,733 |

Table (7)

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Macroeconomics

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

- What is the expected dividend next year of this financial accounting question?arrow_forwardSituational(Accidental) vs Predatory Fraud The two main categories of fraudsters are predatory and situational (accidental). Distinguish between these two categories of scammers. Analyze the different instruments and methods that criminals frequently use to transfer funds related to money flow concealment. Make sure to reply to a minimum of one post made by your peers.arrow_forwardneed correct answer this general accountingarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning