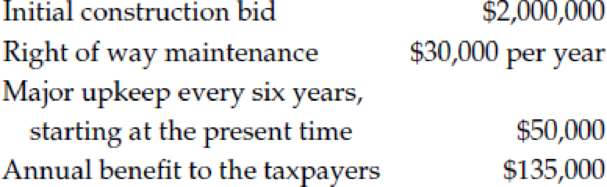

The Adams Construction Company is bidding on a project to install a large flood drainage culvert from Dandridge to a distant lake. If they bid $2,000,000 for the job, what is the benefit-cost ratio in view of the following data? The MARR is 6% per year, and the project’s life is 30 years.

Calculate the benefit cost ratio.

Explanation of Solution

Time period is denoted by n and interest rate (MARR) is denoted by i. Benefit cost ratio (BC) can be calculated as follows.

Benefit cost ratio is 0.72. Since the benefit cost ratio is less than 1, it is not acceptable 1. To make the acceptable project, the bid price need to decrease. The new maximum bid amount to accept the project (B) can be calculated as follows.

Maximum amount bid is $1,306,198.

Want to see more full solutions like this?

Chapter 10 Solutions

Engineering Economy (16th Edition) - Standalone book

- B G C D E H M K Armchair For puzzles 96 and 97, use the first phylogenetic tree on the following page (Figure 2). 96) Who is the most recent common ancestor of species A and species G? 97) Who is the most recent common ancestor of species D, E, and F?arrow_forwardNot use ai pleasearrow_forwardNot use ai pleasearrow_forward

- Stealth bank has deposits of $700 million. It holds reserves of $20 million and has purchased government bonds worth $350 million. The banks loans, if sold at current market value, would be worth $600 million. What is the total value of Stealth bank's assets? I believe my calculation of 1.3 billion may be incorrect May I have my work checked pleasearrow_forwardThe following graph shows the downward-sloping demand curve for Oiram-46, a monopolist producing unique magic hats. The graph also shows Oiram-46's marginal revenue curve and its average total cost curve. On the following graph, use the orange point (square symbol) to indicate the profit-maximizing quantity. Use the blue point (circle symbol) to indicate the profit-maximizing price. Use the purple point (diamond symbol) to indicate the average total cost. Use the tan rectangle (dash symbol) to show Oiram-46's total revenue and the grey rectangle (star symbol) to show its total cost. PRICE (Dollars per magic hat) 2 0 20 Marginal Cost 18 ATC 16 Profit-Maximizing Quantity 14 12 Profit-Maximizing Price MC 8 Demand 02 4 6 8 10 12 14 16 18 20 QUANTITY (Magic hats per week) Based on the graph, Oiram-46's profit is equal to 5 TOTAL SCORE: 1/4 Average Total Cost Total Revenue Total Cost Grade Step 2 (to complete this step and unlock the next step)arrow_forwardExplain information regarding the effective interest rates being charged and how much higher the rent-to-own stores’ cash price exceeded the price of the identical item at a reputable retail outlet.arrow_forward

- How can Rent-to-own industries avoid the restrictions on interest rates? Explain.arrow_forwardExplain why rent-to-own operations are so attractive to so many people compared to saving the money to buy the desired item or going to a thrift store to acquire the item?arrow_forwardExplain the business practices of the rent-to-own industry.arrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning